In a recent conversation, Mr. T, a long-time investor living in Thu Duc City, Ho Chi Minh City, shared: “If I had the financial means, I would still want to buy land.” Despite the current challenges in offloading his assets, Mr. T remains optimistic about the potential for future gains.

Mr. T has a track record of successful real estate investments. Up to this point, his cash flow may have slowed down, but he now owns a considerable number of properties. According to Mr. T, this is the phase where one can easily acquire undervalued assets, presenting an opportunity to sell them at a profit in the future. While the market may not experience the same feverish pitch as before, real estate prices are expected to continue their upward trajectory. Hence, investors with ready cash are at a significant advantage.

“There are some land plots and houses available at attractive prices, but my limited liquidity prevents me from seizing these opportunities,” Mr. T admitted. “Recently, a landowner advertised a plot of land near a major road at a discounted price, slashing more than VND 500 million from the purchase price at the end of 2021. Unfortunately, I didn’t have the funds to act on it promptly, and the plot was snapped up within a week.”

According to this seasoned investor, the southern real estate market’s subdued performance can be partly attributed to long-time investors being unable to offload their existing holdings, resulting in a lack of reinvestment capital. Interestingly, the recent trend of ‘panic buying’ is primarily driven by these same experienced investors. This indicates their propensity for forward-thinking and their ability to recognize future opportunities. They quietly accumulate assets when the chance arises.

Currently, investors are focusing on land plots with completed legal procedures, priced around 20% lower than in 2022. While the number of distressed sales has decreased, seasoned investors remain adept at identifying lucrative investment opportunities.

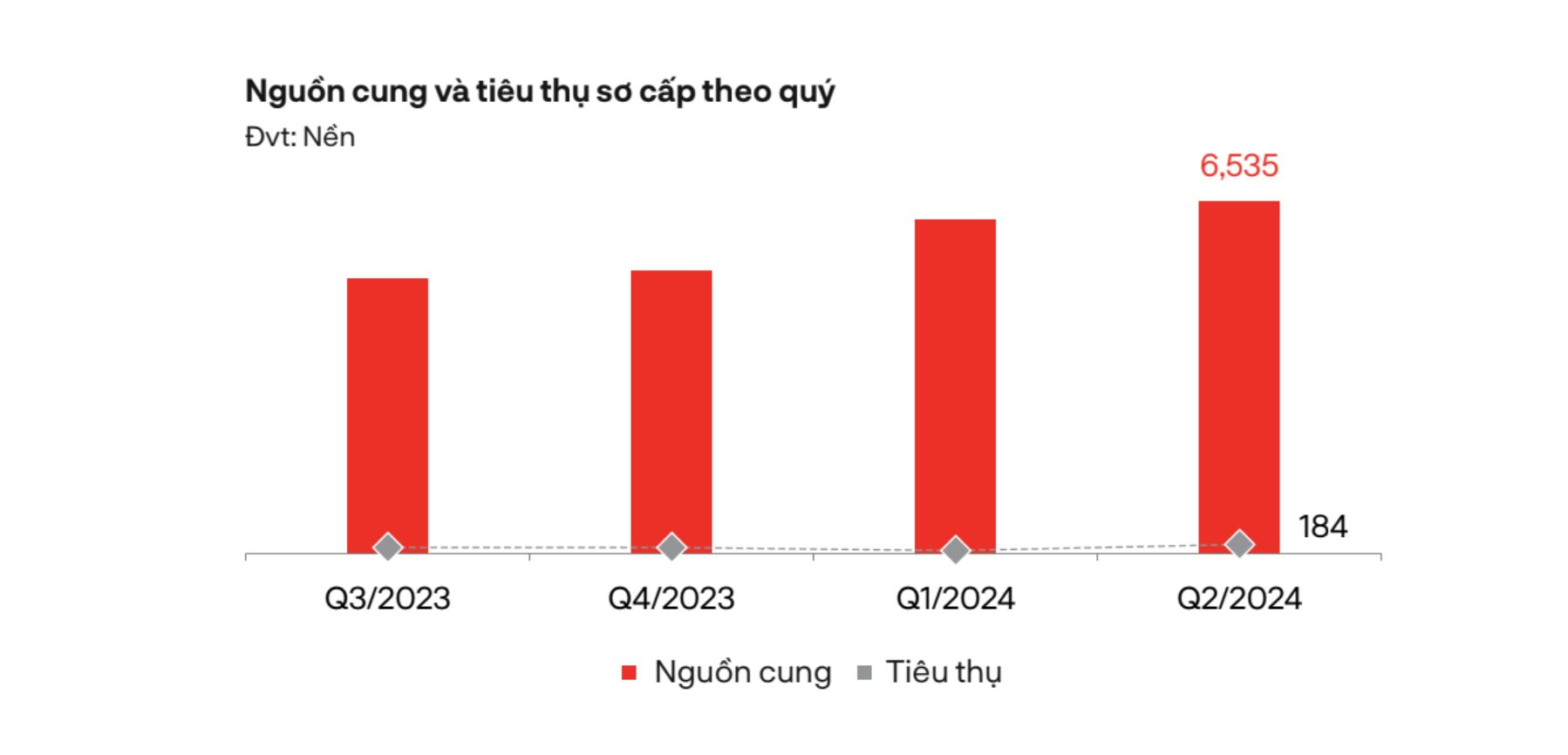

There are positive signs of recovery in the southern land market. Demand has improved significantly in both the primary and secondary markets. According to DKRA Group data, secondary land prices in the second quarter of 2024 edged slightly higher (by approximately 1-2%). The market recorded notable improvements in liquidity compared to the same period last year, with transactions concentrated on projects with completed infrastructure and legal documentation, offering convenient access to central areas.

Land consumption rate in the South showed signs of increase in Q2 2024. Source: DKRA Group

According to brokers, many homeowners and landowners have noticed the market’s upward trend and have chosen to postpone their sales, anticipating further price increases. This reflects improved confidence on both the buying and selling sides. In 2023, numerous investors faced pressure to offload parts of their investment portfolios, but now they are adopting a more patient stance.

While there are predictions that the land market, and the real estate market in general, is unlikely to experience the same frenzied activity as in previous years, investors’ willingness to hold onto their assets indicates a positive shift after a prolonged period of volatility. For now, the scarcity of new supply entering the market further fuels investors’ expectations of future real estate price appreciation.

The Dragon Group Unveils Plans for a Thriving Urban Development Project in Thai Binh, Valued at Over VND 1.4 Trillion.

The Thai Binh Province Planning and Investment Department confirms that Dragon Group is the sole enterprise registered to undertake a housing development project in the planned lot, coded A4, in Vu Phuc Ward, Thai Binh City, Thai Binh Province.