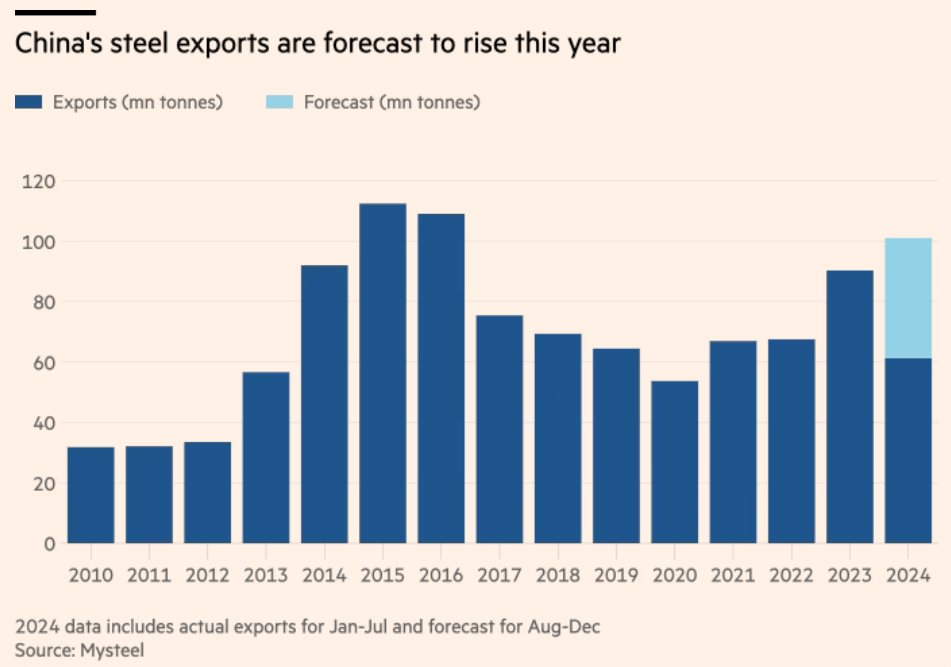

According to the Financial Times (FT), China’s steel exports are expected to hit an eight-year high in 2024, flooding the global market with cheap supply and threatening to spark trade tensions worldwide.

Shanghai-based consulting firm MySteel estimates that exports from China, the world’s largest steel producer, will reach 100 million tons in 2024, the highest since 2016.

Vivian Yang, editor-in-chief of MySteel, stated, “Steel exports have reached a historical high this year.” She predicts total steel exports to amount to 100-101 million tons for the full year, the third-highest on record.

Declining domestic demand in China, which accounts for over 50% of global steel output, has prompted manufacturers to export more of their produce, mainly to Southeast Asian countries and increasingly to Europe.

Ian Roper, a commodity strategist at Astris Advisory Japan, a consulting firm, commented, “Chinese steel has flooded the world and pushed prices down.” This explains the rising number of trade disputes, leading to countries imposing higher tariffs on Chinese steel, which already faces duties in some nations.

Several emerging market economies, such as Mexico and Brazil, have raised tariffs this year, while others like Vietnam and Turkey have initiated new investigations.

The US has tripled tariffs on Chinese steel this year, while in May, the EU launched an anti-dumping investigation into China’s tinplate steel products. Canada announced new steel tariffs last week.

Forecasted increase in China’s steel exports in 2024.

On August 29, the China Iron and Steel Association, representing the country’s large state-owned mills, called on steelmakers to end their “fierce competition” and accused them of relying on a ‘price war’ to gain market share.

China’s steel price index dropped to a near eight-year low as of August 16. In Europe, spot prices for hot-rolled coil steel have fallen by nearly a fifth since the start of the year.

China’s economic and construction slowdown has significantly weakened domestic demand, while steelmakers have been slow to curb production, leading to a supply glut.

Reflecting Beijing’s concern over this issue, the Ministry of Industry and Information Technology announced a halt to approvals for new steel plants.

Daniel Hynes, a senior commodity strategist at ANZ Research, the research division of one of Australia’s largest banks, noted that Chinese steelmakers, who typically export 7-10% of their total output, have benefited this year from relatively strong demand in Europe and other parts of Asia.

“Particularly at this point in time when we’re seeing producers in some regions, such as Europe, facing higher energy costs . . . that’s opened up opportunities for Chinese steelmakers,” Hynes said.

Baowu Steel Group, the world’s largest steelmaker, warned in August that the steel industry is facing a long and cold winter, potentially worse than previous steel crises in 2008 and 2015.

Official data shows that Chinese steelmakers are deep in the red, with cumulative losses of 2.8 billion CNY (USD 390 million) in the first seven months of this year. According to MySteel, only 1% of Chinese steel mills are profitable.

Reference: FT

7 reasons that make predicting the global steel industry outlook in 2024 challenging

In the context of global inflation and economic recession, the ‘giant’ mining company BHP is still uncertain about the prospects of the steel industry due to the influence of China – the world’s largest steel producer.