|

Saigontel’s Business Results Before and After the 2024 Semi-Annual Review

Unit: Billion VND

Source: VietstockFinance

|

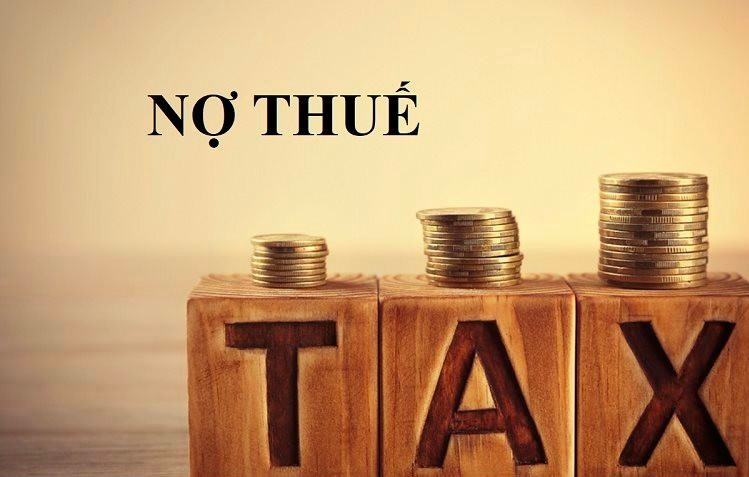

Increased provision for investment reserves was the main reason

Comparing the reports before and after the review, the notable change came from a 13% increase in financial expenses to over VND 44.8 billion, which SGT explained was due to additional provisions for investment reserves as required. In fact, SGT has recorded over VND 5 billion in provisions for securities devaluation and investment losses.

Source: 2024 Semi-Annual Reviewed Consolidated Financial Statements of SGT

|

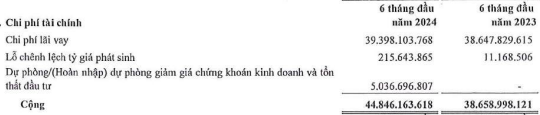

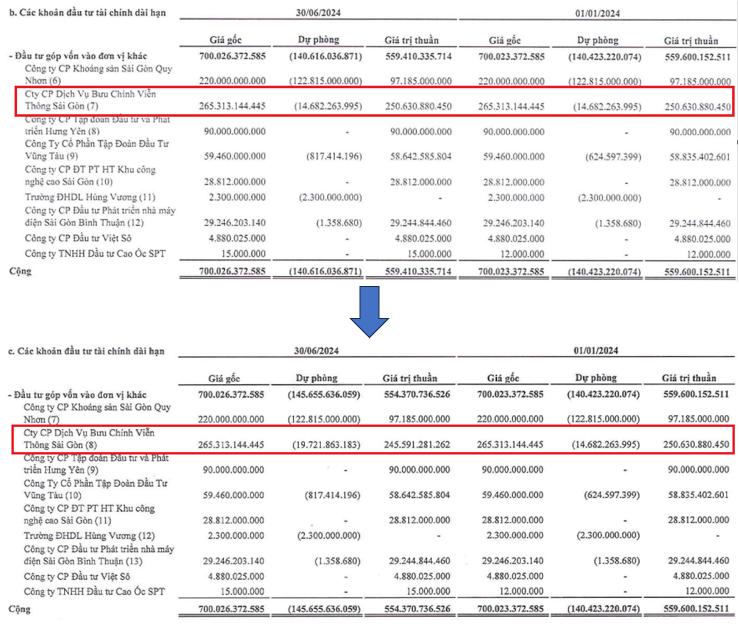

On the post-reviewed balance sheet, the long-term financial investment reserve increased by over VND 5 billion, almost identical to the above changes. This additional reserve is for investment in contributing capital to Saigon Postal Service and Telecommunications Joint Stock Company (SPT), increasing from nearly VND 14.7 billion to over VND 19.7 billion.

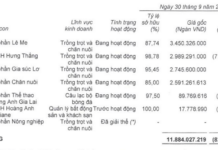

Source: 2024 Semi-Annual Reviewed and Unreviewed Consolidated Financial Statements of SGT

|

According to the Company’s explanation, the provision for losses on investments in SPT, with an investment value equivalent to 13.29% of SPT‘s charter capital, is based on SPT‘s audited financial statements for the fiscal year ended December 31, 2022. The basis for SPT‘s owner’s equity value used by the Company to estimate the reserve includes the potential impact of the auditor’s qualifications for SPT‘s financial statements.

There’s still a lot to do in the second half

The action of increasing the provision for reserves caused SGT‘s net profit to decrease by 2% compared to the same period last year, resulting in a 27% decrease.

In the first six months of 2024, commercial and service activities remained the main contributors to SGT‘s operating profit, along with profits from real estate, land, office, and workshop leasing activities. In terms of geography, the province of Bac Ninh made the largest contribution, followed by Ho Chi Minh City, Hanoi, Long An, Thai Nguyen, and Da Nang.

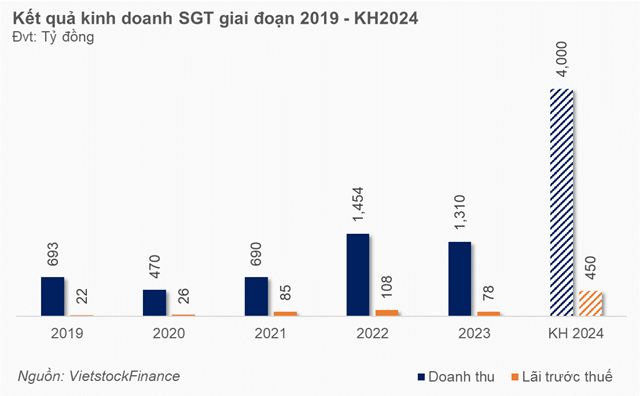

In 2024, SGT set a plan to achieve VND 4,000 billion in revenue and VND 450 billion in pre-tax profit, three and six times higher than the actual figures in 2023, respectively. SGT‘s focus remains on industrial real estate, urban real estate, and telecommunications, gasoline, and oil services. If successful, SGT will achieve its highest business results in history, according to statistical data from 2005.

Thus, SGT has only achieved 9% of its revenue plan and 5% of its profit plan, despite being halfway through the year. It is clear that the remaining tasks for the second half are enormous for SGT.

Recall that at the 2024 Annual General Meeting of Shareholders held in April 2024, Chairman of the Board of Directors, Dang Thanh Tam, shared: “Saigontel sets realistic plans instead of aiming too high and falling short”.

“Saigontel’s Profit Plunge: Unveiling the 28% Drop in Review”

After the review, Saigontel’s financial costs increased by VND 5 billion due to additional provision adjustments. Along with changes in some other indicators, the company’s post-inspection profit after tax decreased by 28%, to over VND 13 billion.