New customers who open an account will have the chance to receive an E-voucher for phone top-ups worth up to 500,000 VND when they make a minimum of 10 transactions receiving money via QR Code from 03 different payment accounts, with each transaction valued at 100,000 VND or more, while maintaining a minimum average account balance of 1 million VND in the month of account opening.

SHB will send the E-voucher to eligible customers before the 10th of the following month. Each customer will receive 01 offer during the promotion period and can check and use the evoucher in the “Top-up phone” section of the SHB Mobile app.

In recent years, the trend of cashless payments and transactions via mobile banking apps and QR code scanning has gained popularity. With just one scan, customers can complete a payment transaction in a few seconds without having to enter the recipient’s account number, thus saving time and reducing the risk of errors and mistakes during the transaction. According to the Payment Department of the State Bank of Vietnam, as of mid-2024, QR code payment transactions increased by 104.23% in volume and 99.57% in value compared to the same period in 2023.

A representative from SHB shared that thanks to its simplicity, convenience, and ease of use, this transaction method is not only popular in supermarkets, restaurants, fashion shops, but also becoming familiar in traditional markets, parking lots, and even street vendors. Elderly people, who are used to cash transactions, are also gradually shifting to this form of payment.

“QR code scanning for payments is a growing trend that enhances the daily online transaction experience. We hope that SHB‘s promotional program will encourage customers to use this convenient payment method, not only to ‘scan’ for payments but also to ‘scan’ for gifts,” emphasized the SHB representative.

From now until the end of 2024, SHB is also launching the “Online Transactions – Abundant Privileges” program to express gratitude to customers who have been using SHB’s payment account and mobile banking services.

Specifically, SHB will offer 5,000 E-vouchers for phone top-ups on the Mobile Banking app worth 30,000 VND each to customers who opened an account in 2024 but have not actively used it in the last 03 months. Each customer will be entitled to 01 offer during the promotion period.

With its continuous focus on technology research, application, and innovation in feature development and new services, SHB Mobile aims to become a diverse ecosystem that allows users to easily make QR code payments, pay bills (electricity, water, internet…), book train/bus tickets, save money online, apply for loans, and more, anytime, anywhere. Customers can download the SHB Mobile app on App Store (for iOS) or Google Play (for Android) and enjoy these superior features at zero cost.

As of July 31, 2024, SHB recorded millions of customers using the SHB Mobile app. The average non-term deposit balance (CASA) as of the end of July 2024 increased by 43% compared to the end of 2023.

Moving forward, SHB will continue to develop features and solutions to enhance the user experience on SHB Mobile in a faster, smoother, and more seamless manner.

For more information on special offers, customers can contact the 24/7 Customer Service Center at *6688 or visit any SHB branch or transaction office nationwide.

SERVICES

“Unverified Bank Accounts to Become Inactive for Online Transactions from 1st January 2025”

As of January 1st, 2025, bank account holders will be required to verify their accounts before being able to transact online. This extra layer of security is designed to protect your personal information and finances, ensuring that only the rightful account owners can access and manage their funds online.

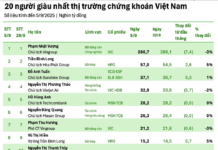

The Rise of Southeast Asia and the Mark of Vietnamese Banks

As of 2023, 34 banks are featured on the Fortune list of the top 200 largest companies in Southeast Asia, with 12 of these prestigious financial institutions hailing from Vietnam. This significant presence underscores the remarkable growth and prominence of Vietnam’s financial market within the regional landscape.

“SHB: Innovating the Banking Experience with Outstanding Products and Services”

SHB’s suite of innovative services and solutions has garnered acclaim and recognition at prestigious domestic and international awards.

“SHB Honored by ABF as the Bank with the Best Initiative for SMEs”

SHB has been recognized by experts as the leading financial institution for its continuous efforts and innovations in providing both financial and non-financial solutions to businesses. With a strong commitment to making a social impact and fostering collaboration with SMEs, SHB has earned the reputation of being the bank with the best financial initiatives.