Retail businesses are evolving their strategies in 2024, moving away from the price wars of the previous year. This shift in focus aims to find new avenues for development in a seemingly saturated distribution landscape.

MWG’s Strategy: ‘Less is More’ as They Venture into Indonesia

In 2024, Mobile World Investment Corporation (MWG) has been consistently restructuring its approach with a new “less is more” philosophy, marking a departure from their “Cheap Beyond Belief” campaign in 2023.

Consequently, MWG has closed down hundreds of inefficient stores, reduced their workforce, and yet witnessed an increase in revenue.

From January 1, 2023, to March 31, 2024, MWG decreased its employee count by 13,447, going from 74,008 to 60,561.

In the second quarter of 2024 alone, the company shut down 116 Dien May Xanh and The Gioi Di Dong stores. Comparing the numbers from the end of June 2024 to the same period in 2023, these two chains have closed 330 stores.

Apart from this strategic shift, MWG is also expanding into new markets. After their unsuccessful attempt in Cambodia, they are now setting their sights on Indonesia with a new consumer electronics retail chain.

Their new chain, Erablue, which started with 38 stores in late 2023, has grown to 59 stores by the end of May 2024, a 55.3% increase, and there are plans for further expansion.

Erablue store, MWG’s venture in Indonesia

MWG’s unique approach in Indonesia involves opening electronics stores outside of supermarkets, similar to the small-scale Dien May Xanh stores in Vietnam (under 300m2). EraBlue stores are outperforming their Vietnamese counterparts, with smaller stores generating approximately over $160,000 in revenue and the smallest stores bringing in over $100,000.

MWG is also replicating its successful service model from Vietnam in Indonesia. While local retailers take 7-10 days to complete deliveries and installations, EraBlue completes these within the same day, attracting customers.

In parallel, MWG is continuously revamping its Bach Hoa Xanh chain, aiming to reach a break-even point by the end of 2024. This year, the company will open new stores selectively, focusing on efficiency; continue to grow old stores’ revenue by enhancing quality, safety, and stability of fresh food products, and exploring opportunities to boost FMCG sales; and optimize costs, especially in warehousing and logistics, to ensure profitability at the company level.

Despite Bach Hoa Xanh and Erablue chains still incurring losses, MWG views these as long-term growth strategies, expecting them to become the main drivers of growth once the Dien May Xanh and The Gioi Di Dong chains reach saturation.

FPT Retail’s Focus on Long Chau Chain

Similarly, FPT Digital Retail Joint Stock Company (FPT Retail) is shifting its competitive strategy towards product quality and enhanced customer experience, including post-sales services.

In 2024, FPT Retail will evaluate the performance of each FPT Shop and close underperforming stores to concentrate on improving the efficiency of existing ones.

Alongside diversifying FPT Shop’s product range with household appliances, TVs, air conditioners, and FPT-branded SIM cards, FPT Retail is also venturing into pharmaceuticals, aiming to build an integrated healthcare ecosystem following the success of the Long Chau pharmacy chain.

FPT Retail’s vision for Long Chau: An integrated healthcare ecosystem

Long Chau, with a market scale of $7 billion and double-digit annual growth, is now expanding into the vaccination service market, which has a potential scale of $1-3 billion.

In the third or fourth quarter of 2024, FPT Retail plans to launch the Long Chau 247 health monitoring app for customers with chronic illnesses, alerting them to potential health issues.

Additionally, Long Chau is preparing to introduce a medicine guarantee service this year, where customers with insurance can purchase medicine using their insurance cards without any out-of-pocket expenses. Ultimately, Long Chau aims to provide diagnosis and treatment services, completing the closed healthcare ecosystem.

Petrosetco’s Product Expansion

Meanwhile, Petrosetco, a leading oil and gas service company, anticipates an improvement in distribution margins in 2024 as price dumping has been curbed. To reduce reliance on a few brands, Petrosetco plans to expand its product portfolio by partnering with high-growth potential companies in the Vietnamese market. They are also restructuring their product portfolio, focusing on core, profitable products.

“Walking the Talk”, Nguyen Duc Tai Shuts Down Nearly 100 An Khang Pharmacies in July, Focusing on Expanding Bach Hoa Xanh and Indonesia Markets

The first seven months of The Gioi Di Dong’s fiscal year witnessed remarkable performance, with revenues surpassing 76.5 trillion VND, marking an impressive 61% achievement of their annual target.

“Breaking News: Nguyen Duc Tai Delights The Gioi Di Dong Shareholders as Market Capitalization Surpasses VND 100,000 Billion Mark: July Revenue Surges, and 2025 Outlook Remains Positive”

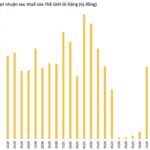

Reviewing the first half of the year, The Gioi Di Dong (Mobile World) – one of the leading retailers in Vietnam – reported impressive financial results with revenue reaching VND 65,621 billion and after-tax profit reaching VND 2,075 billion, up 16% and a staggering 5,200% year-on-year, respectively.