Sustainable development in the banking sector is a critical topic in the growth strategy of every nation, requiring banks to focus not only on short-term profits but also on environmental, social, and governance (ESG) factors. This is a challenging equation as, typically, business growth comes with environmental and social impacts. However, because of these challenges, pioneers are needed to show that it is difficult but not impossible.

Among the banks currently implementing ESG in the market, ACB is often mentioned as a practical example as they have been acting on all three aspects of ESG for over a decade. ACB’s sustainable development orientation is integrated into all its activities, and the bigger goal is not just to apply this within the bank but also to encourage relevant parties to practice ESG, replicating this model to more individuals and organizations in Vietnam.

This orientation comes from the bank’s leaders, especially the Chairman of the Board of Directors, Tran Hung Huy. The ACB Chairman once shared, “At ACB, we strongly believe that every product, service, or initiative we create today will leave a certain value and serve as a foundation for future development.”

ACB’s commitment to sustainable development also receives strong support from its shareholders. At the 2024 Annual General Meeting of Shareholders, Mr. Tran Hung Huy stated that ACB would balance growth and sustainable development, continuing to maintain its position as one of the Top 3 private banks in terms of market share and profitability. Therefore, ACB always proactively contributes to the long-term development of the economy and society.

In its sustainable development strategy, the bank’s social responsibility activities are of utmost importance. When banks fulfill their social responsibilities and positively contribute to the national budget, they create sustainable value for the community and build trust with their customers. This also helps banks maintain and expand their business operations in the future.

Moreover, when banks operate efficiently and profitably, they not only pay higher taxes but also stimulate other business activities, creating more jobs and increasing workers’ income. This contributes to increasing state budget revenues, thereby providing the government with additional resources to invest in critical areas such as healthcare, education, and infrastructure.

Recently, ACB was one of the prominent banks on the PRIVATE 100 list, which honors the top 100 private enterprises with the highest budget contributions in Vietnam. Specifically, ACB ranked in the Top 3 private banks and the Top 10 in the PRIVATE 100 list, with a contribution of VND 5,214 billion to the State Budget (including taxes and fees) in 2023.

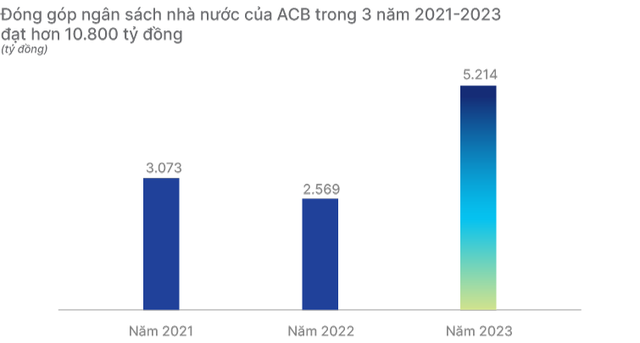

Notably, 2023 was not the first time ACB made it to the list of enterprises with the highest budget contributions. In the last three years (2021-2023), ACB has contributed over VND 10,800 billion to the State Budget. The budget contribution has also been consistently increasing, doubling in 2023 compared to 2022 and up nearly 70% from 2021.

Within its financial capacity, ACB has continuously promoted educational sponsorship, built charity houses, improved physical infrastructure for schools, and supported policy beneficiaries. In 2023, ACB allocated a budget of over VND 10.9 billion for community social activities, including environmental protection and nature conservation, sponsoring 890 scholarships and gifts for educational activities, building charity houses and improving school infrastructure, etc.

As seen, ACB’s budget contributions and social activities tend to increase year after year. To achieve this, the bank must have a solid financial foundation. That is also what ACB always emphasizes: balancing growth and sustainable development. ACB is also one of the few banks that demonstrate flexibility and efficiency in its operating strategy, leading to healthy business performance.

In the first half of 2024, ACB impressed with a credit growth rate of 12.8%, more than twice the industry average. Among banks with a high retail loan ratio, ACB was an exception, showing positive growth despite decreased demand for consumer and business production loans in the past. A closer look reveals that ACB balanced credit growth in both the individual and corporate segments, with a 13% increase in the first half of the year.

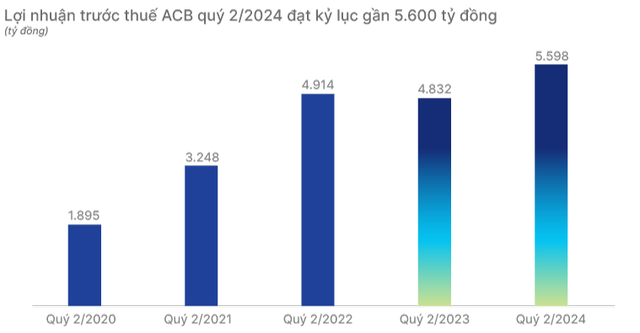

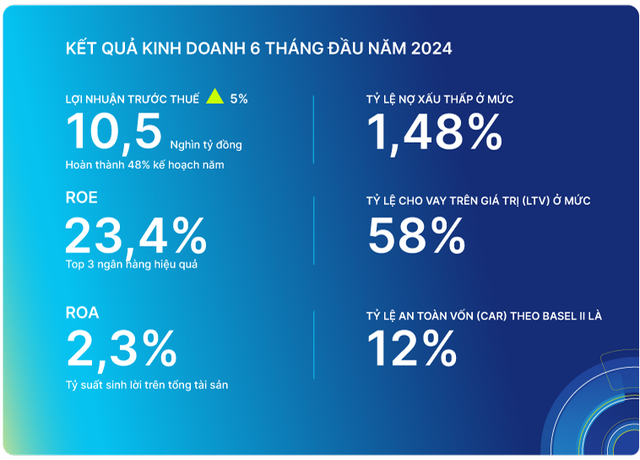

According to statistics, ACB ranked third in profit among private banks in the first half of 2024. Specifically, the bank’s pre-tax profit in the first half reached nearly VND 10,500 billion, up 5% over the same period last year and completing 48% of the full-year plan.

The main business segments, such as net interest income and service activities, saw remarkable profits, growing by 11% and 13%, respectively, compared to the same period. The return on equity (ROE) reached 23.4%, and the return on assets (ROA) was 2.3%, both among the market’s top performers.

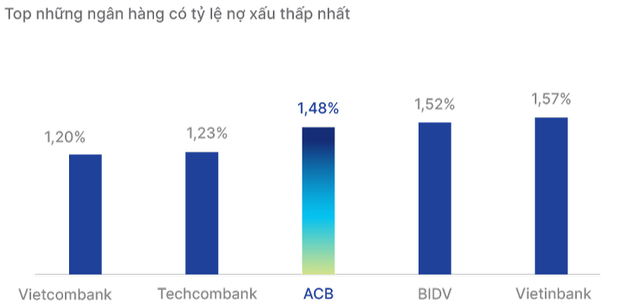

In terms of asset quality, ACB continued to lead the industry with a low non-performing loan ratio of 1.48%. The loan-to-value (LTV) ratio was 58%, and 98% of the loans were secured. ACB’s cautious lending approach, selective lending, and robust risk management have helped the bank maintain a healthy balance sheet for many consecutive years.

The bank also met the regulatory requirements for operational safety ratios. The loan-to-deposit ratio was 82.2% (compared to a maximum requirement of 85%), and the short-term capital for medium and long-term loans was 17.6% (compared to a maximum requirement of 30%). The capital adequacy ratio (CAR) under Basel II was 12%, well above the minimum requirement of 8%.

In 2023, ACB received a BB- rating from Fitch Ratings and maintained a Ba3 rating from Moody’s based on asset quality, profitability, and risk management capabilities. Fitch assessed ACB to have a good loan portfolio and a stable credit profile focusing on retail lending. Moody’s also highly appreciated ACB’s financial strength, profitability, capital adequacy ratio, and capital adequacy ratio Tier 1, which exceeded the minimum requirements set by the State Bank of Vietnam.

With these achievements, ACB is increasingly recognized as one of Vietnam’s most reputable banks by shareholders, customers, and employees. Being in the top 10 private enterprises contributing the most to the state budget in 2023, as announced by CAFEF, is not only a testament to ACB’s business capabilities but also a demonstration of its social responsibility over the years.

In addition, ACB has won numerous awards at home and abroad, showing the positive impact of ESG on customers, partners, and employees and affirming the efforts in “Using ACB’s ESG model as a foundation to encourage relevant parties to practice ESG and replicate this model to more individuals and organizations in Vietnam,” as mentioned in the 2022 ESG Report.

On August 2, ACB was named for the third consecutive time in the Top 50 Corporate Sustainability Awards (CSA) in two categories: Outstanding CSR Activities (Social criteria) and Excellent Corporate Governance (Governance criteria).

In terms of ACB’s responsibility to its employees, the bank has built a Work-Live-Learn model to create a comprehensive working environment, helping employees work efficiently, live healthily, and continuously learn. As a result, the bank not only attracts but also retains talented personnel from different generations, ensuring the continuity of values for long-term sustainable development.

In the HR Asia Awards 2024 program in August, ACB won the “Best Companies To Work For In Asia 2024” award for the sixth consecutive year. HR Asia, one of Asia’s most prestigious human resources magazines, recognizes ACB’s continuous progress in building a positive corporate culture, providing numerous opportunities for personal development, and maintaining high standards of management and employee benefits. Enterprises like ACB are contributing to building and developing a better working environment in the market.

ACB stated that, in the future, the bank would remain committed to sustainable development, continuously improving service quality, and creating more value for stakeholders. Despite the challenges in implementing ESG, ACB always strives to be a pioneer and proudly contributes to the country’s overall sustainable development.

The Green Evolution: Unveiling Sacombank’s ESG Strategy

Sacombank’s leadership has shared their vision for the bank’s future. Alongside their short-term goal of completing the restructuring plan and regaining their position as a top player in the market by 2025, they have their sights set on long-term sustainable development following the ESG model.

The Retail Giant: Generating $170 Million in Annual Tax Revenue

Masan Group is proud to be one of the largest taxpayers in the provinces where its factories operate, but its contribution to the community goes beyond that. The company provides employment opportunities for thousands of people, improving their livelihoods and positively impacting their lives. Additionally, Masan Group is committed to community development, allocating a portion of its profits to initiatives that make a lasting difference in the areas it serves.

“CapitaLand Development Launches ‘Steps of Love’ Campaign in Hanoi”

On August 27, 2024, CapitaLand Development (CLD) proudly launched its second annual “Steps of Love” campaign in Hanoi, in collaboration with the CapitaLand Hope Foundation (CHF) and Blue Dragon Children’s Organization. This initiative aims to unite the community in supporting underprivileged children and youth in Vietnam.

The Green Business Award: PNJ’s Consecutive Wins

PNJ has once again proven its mettle by being awarded the “Ho Chi Minh City Green Enterprise 2024” title by the People’s Committee of Ho Chi Minh City. This prestigious recognition is a testament to PNJ’s commitment to sustainability and social responsibility, setting them apart from hundreds of other businesses in the trade and service industry.