US stocks plunged overnight as indices simultaneously tested old peaks, dampening the domestic market’s enthusiasm this morning. Stocks fell across the board, with many blue-chips plunging, causing the VN-Index to evaporate 1.01% (-12.91 points). Bottom-fishing activities were quite active in the low-price region, boosting liquidity but failing to lift prices significantly.

Despite high expectations for the market to break through the 1300-point peak before and during the long holiday, the first trading day of September revealed a fragile market sentiment. The VN-Index opened 1.19% lower and ended the morning session down 1.01%. HoSE’s matched order liquidity surged 45% compared to the previous week’s closing session, reaching the highest level in the last three morning sessions. Additionally, the breadth ratio stood at 60 gainers to 342 losers.

These two factors alone indicate a clear dominance of sellers in the market. There were no sudden adverse events, but global stock markets turned negative, with US indices failing to surge past their peaks and instead witnessing sharp declines. Domestic inflows last week were meager, largely attributed to investors’ holiday wait-and-see attitude, but they also signaled a cautious approach, with money on the sidelines awaiting a breakout signal.

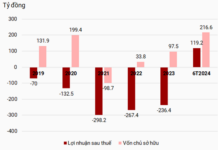

The index’s decline this morning could have been more profound if it weren’t for the recovery of a few key stocks. VHM initially fell 1.2% from its reference price but then rebounded strongly, gaining 2.56% to close 1.33% higher. GAS also reversed its downward trend, climbing 1.09% to finish 0.6% higher than its reference price. BID recovered by 1.87%, resulting in a 0.31% gain. VNM bounced back by 1.5%, ending the session 0.41% higher. These four stocks were the only gainers, contributing 1.4 points to the VN-Index.

Nevertheless, the decliners overwhelmingly outnumbered the advancers. By the end of the session, the VN30 basket had only four gainers against 25 losers, with 23 stocks falling by more than 1%. Among the top ten stocks by market capitalization, VCB dropped 1.2%, FPT tumbled 2.08%, CTG declined 1.57%, VIC slipped 1.13%, TCB fell 1.71%, and HPG decreased by 1.18%. In terms of percentage loss, GVR took the biggest hit, plunging 2.97%, followed by SSB with a 2.6% drop, HDB with a 2.53% loss, and PLX with a 2.26% decline. The large-cap VN30-Index led the decline among the capitalization-based indices, closing the morning session 1.3% lower.

The market breadth confirmed the intense selling pressure, with the number of losers nearly six times that of gainers, and among them, over 47% witnessed declines of more than 1%, accounting for approximately 69% of the matched order value on the HoSE. Blue-chip stocks once again faced prominent selling pressure, similar to previous occasions when the VN-Index struggled to surpass the 1300-point mark.

Among the gainers, only 60 stocks managed to stay in positive territory, with clear signs of buying support. Apart from VHM, notable mentions include HHV, which climbed 2.13% with a liquidity of 55.5 billion VND; DGC, which rose 1.32% with a turnover of 322.1 billion VND; and IMP, which surged 6.61% with a turnover of 23.9 billion VND. The remaining stocks had negligible price movements or insignificant liquidity.

The sudden price decline also triggered more dynamic bottom-fishing activities, contributing to the higher liquidity this morning. Without this bottom-fishing demand, the substantial selling pressure could have widened the decline. However, bottom fishers are currently passive, waiting for lower prices, as evident in their weak price recovery capabilities. Less than one-third (31.6%) of the total number of stocks traded on the HoSE recovered more than 1% from their intraday lows, and only about 30 of these stocks managed to climb back above their reference prices.

Foreign investors also unexpectedly ramped up their selling on the HoSE this morning, with a net sell value of 1,311 billion VND, the highest in the last eight sessions. Buying demand was relatively low at 729.3 billion VND, resulting in a net sell value of over 582 billion VND. No particular stock was targeted, as the net selling was spread across numerous tickers. The largest net sells were in DGC (-103 billion VND), HPG (-76.9 billion VND), MSN (-52 billion VND), FPT (-48 billion VND), HSG (-40.5 billion VND), MWG (-34.2 billion VND), and VPB (-28.2 billion VND). On the buying side, VNM (+32.8 billion VND) stood out. The VN30 basket alone witnessed a net sell value of 340.4 billion VND from foreign investors.

What Stocks to Pick After the 2-9 Holiday?

The recent market volatility and corrections present a prime opportunity for savvy investors to snap up potential stocks for the year-end rally, according to securities firms. This post-holiday dip is a chance to get in on the ground floor and position yourself for success as the market bounces back.