**Trungnam Solar Reports Profits: A Bright Outlook for the Future**

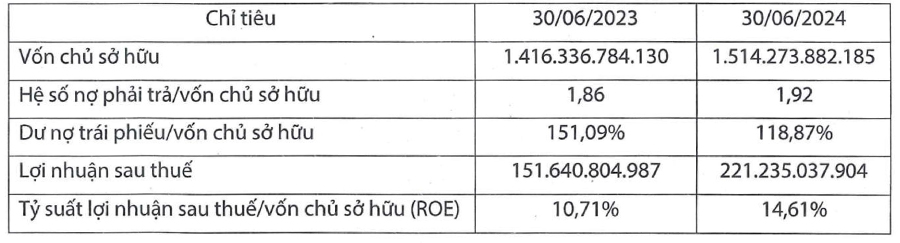

Trungnam Solar JSC has recently disclosed its financial report for the first half of 2024 to the Hanoi Stock Exchange, boasting an impressive after-tax profit of over VND 221 billion, marking a 46% increase compared to the same period last year.

As of the end of the second quarter of 2024, Trungnam Solar’s equity capital increased by 6.9% from the previous year, reaching VND 1,514 billion. The debt-to-equity ratio rose from 1.86 to 1.92, translating to a total debt of approximately VND 2,907 billion. Of this, bond debt accounted for more than VND 1,801 billion, a 25% decrease compared to the previous year.

Source: HNX

Currently, the company has 12 bond batches in circulation, with a total value of VND 2,100 billion, all issued in 2019 and maturing between 7 and 9 years. The maturity dates range from 2026 to 2028.

In the first half of 2024, the company fulfilled its interest payment obligations for these bond batches on time and also repurchased a portion of the principal of 3 batches (TBSCH1926003, TBSCH1926004, and TBSCH1926005) ahead of schedule, totaling VND 69.5 billion on February 2, 2024.

Last August, Trungnam Solar adjusted the interest rates for these 12 bond packages. Specifically, prior to the bondholders’ meeting on August 15, the interest rate applied was the CIB lending interest reference rate (for large customers) for a 60-month term from MB plus a margin of 2.43% from August 1, 2024, or when the Enterprise was downgraded between February 15 and July 31, 2024.

Following the change, the interest rate for the bond package from August 1 to December 31, 2024, will be fixed at 9.25% per annum. Thereafter, from January 1, 2025, the interest rate will be based on the CIB lending interest reference rate for a term of over 60 months from MB plus a margin of 2.43%, and the issue of debt rescheduling will not be mentioned.

Earlier in July 2024, the bondholders of Trungnam Solar also approved several matters related to the transfer of secured assets for this bond package.

Firstly, the bondholders agreed to allow Trungnam Renewable Energy JSC (a subsidiary of Trungnam Group and also the guarantor of this bond package) to transfer all 19.9 million shares of Trungnam Solar JSC. The recipients of these shares were Asia Renewable Energy Development Investment Co., Ltd. (18 million shares) and Mr. Nguyen Thanh Binh (1.9 million shares).

Secondly, Mr. Vu Nhat Thanh and Ms. Dao Thi Minh Hue, who are also guarantors of this bond package, were permitted to transfer their respective holdings of 10,000 and 90,000 shares of Trungnam Solar JSC to Mr. Nguyen Dang Khoa.

Consequently, Asia Renewable Energy, Mr. Binh, and Mr. Khoa have become guarantors of this bond package, using 18 million, 1.9 million, and 100,000 shares of Trungnam Solar JSC as collateral, respectively. All three will sign a mortgage contract with the managing organization.

Trungnam Solar JSC was established in June 2017 as a member of Trungnam Group, chaired by Mr. Nguyen Tam Thinh. The company is also the investor in the Trungnam Solar Power Plant in Loi Hai and Bac Phong communes, Thuan Bac district, Ninh Thuan province, with a capacity of 204 MW.

Following the transaction in July 2024 mentioned above, the shareholder structure of Trungnam Solar JSC changed. As a result, Asia Renewable Energy Development Investment Co., Ltd. is a subsidiary of Asia Industrial Technical Corporation (ACIT). Meanwhile, Mr. Nguyen Dang Khoa serves as the Deputy General Director of ACIT.

Previously, since 2021, ACIT had owned 49% of Trungnam Solar JSC’s shares. With the increased ownership through Asia Renewable Energy, ACIT now holds over 51% of the shares in Trungnam Solar JSC, thereby gaining control of the company from Trungnam Group.

The Haunting of Real Estate Stocks: Unraveling the Continuous Mishaps

In recent times, DIG shareholders and investors have been through a rollercoaster. From the tragic passing of the company’s chairman to the ongoing inspections and the subsequent stock volatility, it’s been a challenging period. As the company navigates these trials, one can’t help but wonder what the future holds for this business and those invested in it.

Renewable Energy Vietnam: Reducing Losses, Bond Debt Cleared Under SP Group’s Stewardship

The Vietnam Renewable Energy JSC (VRE) has made significant strides in reducing its losses, yet it continues to face a cumulative deficit of over VND 126 billion. A notable achievement for the company was the successful repayment of bond debts in the first half of 2024, shortly after coming under the ownership of SP Group.