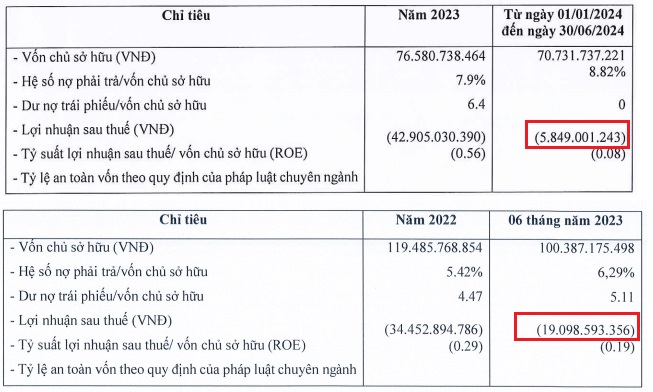

In its periodic financial report submitted to the Hanoi Stock Exchange (HNX), VNV reported a post-tax loss of over VND 5.8 billion in the first half of 2024, compared to a loss of VND 19 billion in the same period last year.

As of June 30, 2023, owners’ equity stood at nearly VND 71 billion, an 8.2% decrease from the end of 2022. The debt-to-equity ratio increased from 0.079 to 0.0882, equivalent to approximately VND 6.2 billion in debt.

|

Financial indicators of Vietnam Renewable Energy in the first half of 2024

Source: HNX

|

Although the loss has decreased, the company is still making a loss. Adding the losses from 2021 (VND 43 billion), 2022 (VND 34.5 billion), and 2023 (nearly VND 43 billion), VNV has accumulated losses of over VND 126 billion.

On a positive note, bond debt has been cleared in the first six months of 2024, with the bond debt-to-equity ratio dropping from 6.4 to 0. On January 15, 2024, the company made an early repayment of the remaining VND 492 billion principal and nearly VND 6.4 billion interest on the VNVH2030001 bond issue.

These were long-term bonds issued by VNV on December 3, 2020, with a 10-year term maturing on December 3, 2030. This issue comprised 6,000 bonds with a face value of VND 100 million each, equivalent to a total mobilization of VND 600 billion.

Vietnam Renewable Energy was established on April 24, 2018, with a charter capital of VND 100 billion, mainly operating in the fields of electricity production, transmission, and distribution. The company is the investor of My Hiep Solar Power Plant (Phu My district, Binh Dinh province), with a total area of nearly 56 hectares. The project was granted investment registration in 2019 with a total capital of VND 1,200 billion.

My Hiep Solar Power Plant

|

The founding shareholders included Ms. Tran Thi Huong Ha (holding 40% ownership), Ms. Tran Thi Thuy Trang (20%), and Mr. Le Duc Thoa (20%). Mr. Thoa served as the Director and legal representative at that time before transferring these roles to Ms. Huong Ha (Director, General Director) in April 2019.

In July 2019, VNV increased its charter capital to VND 300 billion, with Ms. Ha holding the majority stake (80%). Mr. Thoa’s stake decreased to 18.3%, while the remaining shares were held by Ms. Trang. However, in June 2020, the company unexpectedly reduced its capital to VND 200 billion. Ms. Huong Ha held 81.6%, Mr. Thoa nearly 16.7%, and Ms. Trang 1.67%.

In January 2024, the role of legal representative was transferred to Mr. Chia Seng Boon Brandon (Xie Shengwen, Singaporean nationality) – Chairman of the Board of Directors of VNV, and Mr. Nguyen Thanh Phat – General Director.

In reality, Ms. Huong Ha is a well-known entrepreneur in the energy sector and currently serves as the Director and legal representative of Wealth Power Vietnam Joint Stock Company. In addition to her stake in VNV, Wealth Power holds a significant number of other companies, such as Vietnam Renewable Energy Joint Stock Company, BS Vietnam Energy Joint Stock Company, Chan May LNG Joint Stock Company, etc. Ms. Ha is also a shareholder in almost all of these companies.

Entrepreneur Tran Thi Huong Ha

|

However, the investment in VNV has experienced years of losses. In late 2023, VNV proposed to Binh Dinh province regarding the capital transfer related to the My Hiep Power Plant project, and the investor was SP Group. This explains why Ms. Ha stepped down as the legal representative in January 2024, replaced by Mr. Shengwen from the SP Group. Although the company has not yet turned a profit, VNV has cleared its bond debt since coming under the ownership of SP Group.

SP Group is a leading energy company in Asia-Pacific, providing sustainable energy solutions to reduce CO2 emissions. SP also operates the national power grid in Singapore, serving approximately 1.6 million industrial, commercial, and residential customers. Additionally, they own and operate various electricity transmission and distribution businesses in Singapore and Australia, offering sustainable energy solutions for Singapore and China.

The Rise of a Real Estate Giant: Unveiling the Mystery Behind the Soaring Success and the Enigmatic 100,000 Billion Dong Portfolio.

The real estate company boasts an impressive profit of over 4,400 billion VND in the first half of the year, ending a long streak of consecutive years of losses.

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”