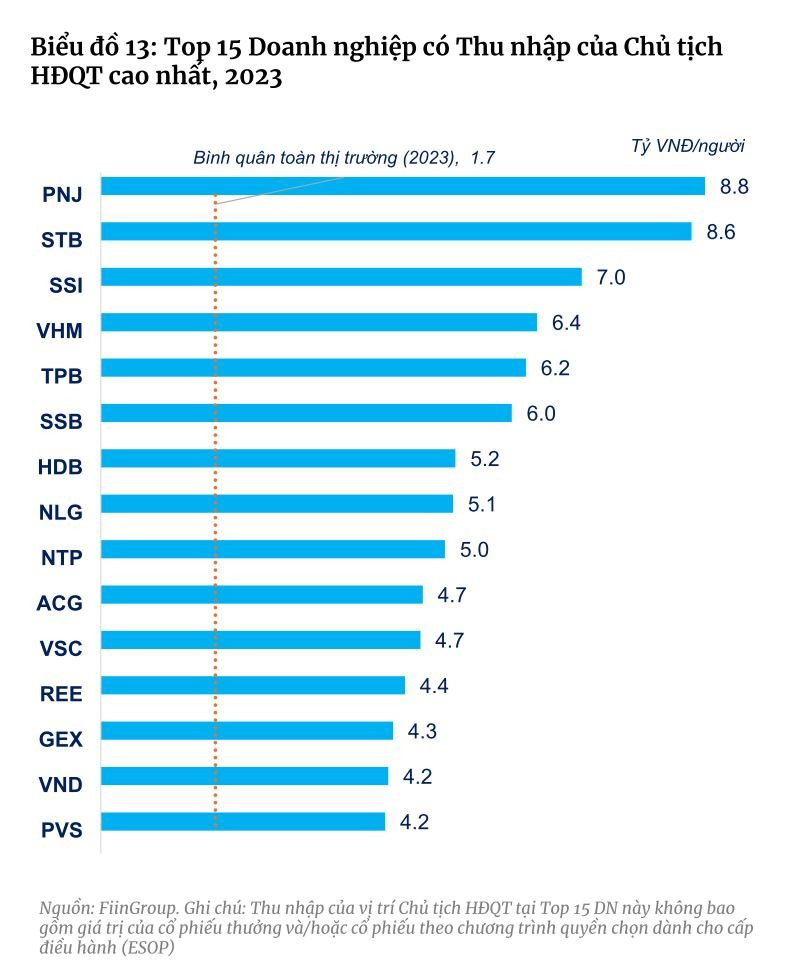

The report, “Income of General Directors, Chairpersons of the Board of Directors, and Independent Board Members at Public Companies in Vietnam in 2023,” conducted by FiinGroup, FiinRatings, and VNIDA, revealed interesting insights into the compensation of top executives. The study focused on 200 public companies with a market capitalization of 500 billion VND or more (as of the end of 2023) and found that the income of Chairpersons at banks (STB, TPB, HDB, etc.), financial services firms (mainly securities companies), and several other enterprises (including PNJ, VHM, NLG, NTP, and REE) exceeded that of their peers.

According to the research team, this disparity could be attributed to the fact that, in addition to the large size and leading position of these companies, the Chairperson of the Board of Directors also plays a role in management and shares some operational responsibilities typically handled by the CEO.

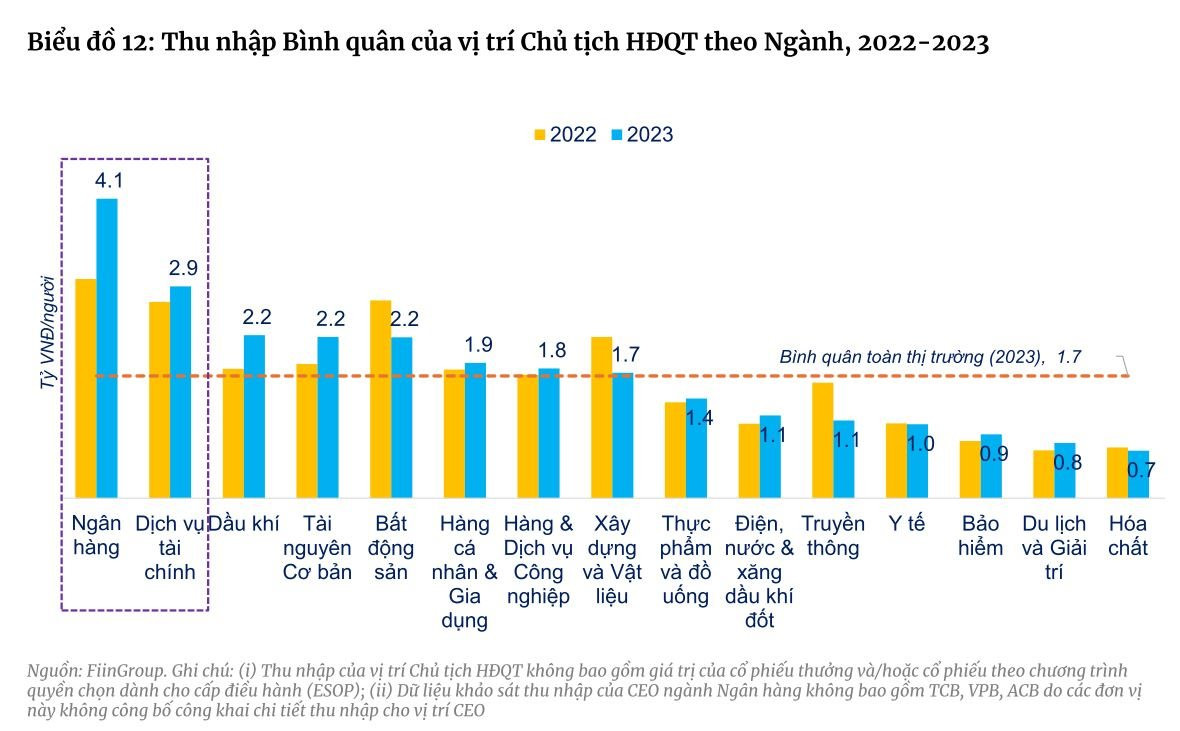

The banking and financial services sectors topped the list when it came to the average income of Chairpersons for the years 2022-2023. Specifically, the average income in the banking sector was 4.1 billion VND, while in the financial services sector, it was 2.9 billion VND.

Notably, in the top 15 companies with the highest incomes for Chairpersons in 2023, the Chairperson of Sacombank (STB) had the highest income among banks, pocketing 8.6 billion VND in 2023, second only to the Chairperson of PNJ, who earned 8.8 billion VND.

Mr. Duong Cong Minh has served as the Chairperson of Sacombank since June 2017.

Comparatively, Mr. Minh’s income for 2023 far exceeded the compensation of chairpersons at state-owned banks. For instance, at the “Big 4” state-owned banks, Mr. Phan Duc Tu of BIDV earned 2.48 billion VND, while the chairperson of VietinBank received the same amount. Mr. Pham Quang Dung, former chairperson of Vietcombank, earned 1.63 billion VND in 2023.

At VPBank, Mr. Ngo Chi Dung, the chairperson, received 3.36 billion VND in 2023, unchanged from the previous year. As for MBBank, Mr. Luu Trung Thai, who was appointed in April 2023, earned 1.98 billion VND last year, according to the financial report.

Sacombank has now gone nine years without paying dividends, despite accumulating retained earnings of over 18,000 billion VND in 2023. While the Chairperson’s income is the highest in the banking sector, Sacombank’s shareholders have not received dividends since 2015.

According to Sacombank’s (STB) documents from the April 2024 annual general meeting of shareholders, the consolidated after-tax profit after allocating reserves was 5,716 billion VND. The consolidated retained earnings from previous years amounted to 12,670 billion VND, bringing the total consolidated retained earnings to 18,387 billion VND.

For the 2024 financial year, Sacombank proposed to allocate only the reward fund and the welfare fund, each with 7% of the remaining profit after deducting the legal reserve fund and the financial risk provision fund. This decision not to distribute dividends has been a concern for many Sacombank shareholders.

At the 2023 annual general meeting (held on April 26, 2024), shareholders questioned the bank’s management about the decision to allocate funds for rewards and welfare while not distributing dividends. In response, Sacombank’s leadership explained that while the bank’s performance and stock price had improved significantly, it was still in the process of restructuring and did not yet meet the conditions for dividend distribution.

Mr. Duong Cong Minh, Chairperson of Sacombank, at the AGM on April 26, 2024.

“Sacombank is a special case and is undergoing restructuring, so it cannot pay dividends yet. The bank is still dealing with the issue of 32% of its shares held by Mr. Tram Be. After resolving this and completing the restructuring, the bank will be able to pay dividends,” said Mr. Duong Cong Minh.

As a result, Sacombank has now gone nine consecutive years without paying dividends, with the last dividend distribution occurring in 2015, when the bank paid a 20% dividend in shares.

“Nurturing Dreams, One Scholarship at a Time”

On the occasion of the 2024-2025 academic year commencement, Sacombank launched the 21st iteration of its scholarship program, “Nurturing Dreams,” with a total value of over 11 billion VND. This initiative aims to provide motivation and support for underprivileged students and aspiring scholars nationwide, helping them rise above their challenges and pursue their academic and life aspirations.

“Sacombank Offers Long-Term Deposit Certificates with 7.1% Annual Interest”

“Starting September 5, 2024, Sacombank is offering its clients an attractive investment opportunity with the launch of its registered long-term deposit certificates. With VND 5,000 billion on offer, individuals and institutions can now access a safe, long-term investment avenue, optimizing idle funds with higher returns compared to traditional savings accounts.”

The Art of Optimizing: Crafting a Captivating Headline

The Fed Adjusts Credit Limits: Who Benefits the Banks?

In the first half of the year, several banks achieved remarkable loan growth rates, outperforming the industry average. LPBank took the lead with an impressive 15.2% growth, followed by ACB at 12.8%, HDBank at 12.5%, Techcombank at 11.6%, MB at 10.3%, and VPBank at 10.2%. These figures showcase the resilience and dynamism of Vietnam’s banking sector, even amidst global economic uncertainties.