Vietnam’s stock market witnessed a lackluster performance on September 5th. A surge in selling pressure caused the VN-Index to unexpectedly turn bearish in the afternoon session, despite multiple attempts to push for gains earlier in the day. At the close, the VN-Index dipped by 7.59 points, settling at 1,268.21. Trading liquidity remained subdued, with the value of transactions on HOSE reaching approximately VND 16,600 billion.

In terms of foreign investment, foreign investors continued to offload Vietnamese stocks, with a net sell value of over VND 668 billion.

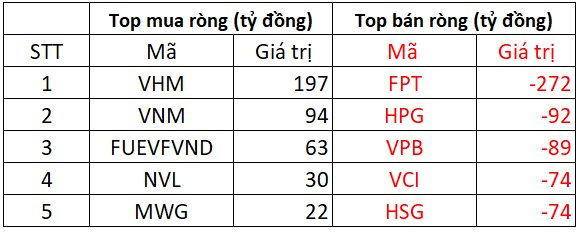

Foreign Investors Sold a Net Value of VND 684 Billion on HOSE

On the selling side, FPT witnessed the largest net sell-off on HOSE, with a net sell value of over VND 272 billion. HPG and VPB followed suit, with net selling values of VND 92 billion and VND 89 billion, respectively. Additionally, foreign investors offloaded VCI and HSG, with a net sell value of VND 74 billion for each stock.

Conversely, VHM attracted the highest net buying value, with nearly VND 197 billion. VNM and FUEVFVND also witnessed robust net buying, with values ranging from VND 63 billion to VND 94 billion.

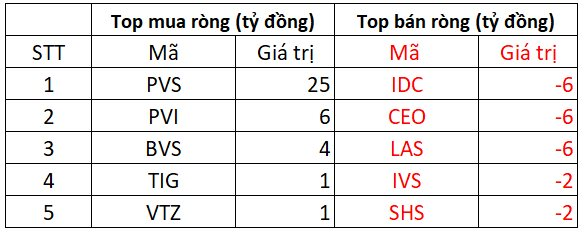

Foreign Investors Purchased a Net Value of VND 16 Billion on HNX

PVS topped the list of most-bought stocks by foreign investors on the HNX, with a net buy value of VND 25 billion. PVI and BVS trailed closely behind, with net buying values of VND 6 billion and VND 4 billion, respectively. Additionally, foreign investors allocated around VND 1 billion each to purchase TIG and VTZ.

On the opposite end, IDC, CEO, and LAS faced net selling pressure from foreign investors, with a net sell value of nearly VND 6 billion each. IVS and SHS also witnessed net selling in the billions.

Foreign Investors Purchased a Net Value of VND 230 Million on UPCOM

BSR attracted net buying attention from foreign investors on the UPCOM, with a net buy value of VND 8 billion. ACV followed suit with a net buy value of VND 2 billion, while KLB and PAT witnessed net buying in the range of VND 1 billion.

Conversely, LTG faced net selling pressure, with a net sell value of VND 5 billion. Foreign investors also offloaded a few billion Vietnamese dong worth of GDA, NTC, QNS, and other stocks.

Conversely, LTG faced net selling pressure, with a net sell value of VND 5 billion. Foreign investors also offloaded a few billion Vietnamese dong worth of GDA, NTC, QNS, and other stocks.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”