Portrait of Chairman Ho Huy

Entrepreneur Ho Huy was born in 1955 in Thanh Hoa province and holds a bachelor’s degree in law. After leaving the military, he was among the generation of young people sent to study in the Russian Federation in the 1980s.

After his studies abroad, where he specialized in automotive engineering, he returned to Vietnam and founded the Mai Linh transport company with an initial capital of just 300 million VND in 1993.

In April 1995, Mr. Huy ventured into Ho Chi Minh City and established the Saigon Taxi Enterprise, from which the Mai Linh Taxi service was born.

Mr. Ho Huy, Chairman of Mai Linh Group

In 2002, the Joint Stock Company Mai Linh Group was officially established. In 2018, the Mai Linh Group was granted a new tax code after the merger of three companies: Joint Stock Company Mai Linh Group – Joint Stock Company Mai Linh Northern – Joint Stock Company Mai Linh Central.

According to business registration as of July 2018, Mai Linh Group has a charter capital of approximately 1,729 billion VND. The company’s headquarters are located at 64-68 Hai Ba Trung, Ben Nghe Ward, District 1, Ho Chi Minh City. Mr. Ho Huy is the Chairman of the Board.

In addition to taxi services, Mai Linh has diversified into multiple industries, including tourism, construction, training, traditional advertising, information technology, finance, and real estate.

Mr. Huy used to own a series of subsidiaries in various fields, which are now inactive, such as: Thanh Do Limited Liability Company, Mai Linh Hue Limited Liability Company, Mai Linh Binh Duong Limited Liability Company, Mai Linh Dak Lak Limited Liability Company, Saigon Taxi Clock Inspection One Member Limited Liability Company, Mai Linh An Giang Limited Liability Company, Mekong Green Commercial Joint Stock Company, Saigon Binh Minh Transport Service Trading Limited Liability Company, Mai Linh Ninh Binh Limited Liability Company, Mai Linh Ha Nam Limited Liability Company, Mai Linh Hoa Binh Limited Liability Company, Mai Linh Hanoi Technology Transport Limited Liability Company, Mai Linh Lai Chau Limited Liability Company, and Mai Linh Lang Son Limited Liability Company.

Mr. Ho Huy also owns a private company called Ho Huy Investment One Member Limited Liability Company (established in 2014). As of the end of 2016, this company had a charter capital of nearly 520 billion VND and was responsible for contributing capital to a number of member companies within the Mai Linh ecosystem.

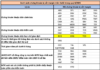

Mai Linh Group’s Losses Erode Owners’ Equity

According to the 2023 consolidated financial statements, Mai Linh Group recorded a revenue of 1,589 billion VND, a 3% decrease compared to 2022. After deducting the cost of goods sold, gross profit stood at over 400 billion VND, a nearly 4% decrease compared to the previous year.

During the period, financial revenue reached 54 billion VND, double that of the previous period. However, financial expenses also increased by 11.6% to more than 126 billion VND, almost entirely due to interest expenses.

Selling expenses decreased by 2%, and management expenses decreased by 11% to 69 billion VND and 300 billion VND, respectively.

It can be seen that the gross profit generated was insufficient to cover expenses, resulting in a loss from business activities of nearly 41 billion VND, while in 2022, there was also a loss of nearly 97 billion VND.

Although other income decreased by almost half to 55 billion VND, it was still enough to help Mai Linh report a profit after tax of nearly 4 billion VND. Profit after tax attributable to the parent company’s shareholders stood at only 1.2 billion VND, compared to a loss of 1.8 billion VND in the previous year.

Mai Linh Group has been consistently loss-making since its merger in 2018

Due to consecutive years of losses, Mai Linh Group recorded accumulated losses of 1,306 billion VND as of the end of 2023. This accumulated loss has exceeded the equity of the owners (1,246.6 billion VND).

As of the end of 2023, Mai Linh’s total assets amounted to 4,271 billion VND, an increase of 3.2% compared to the beginning of the year. Short-term receivables accounted for 1,942 billion VND. Construction in progress tripled to over 37 billion VND.

Total liabilities stood at 4,076 billion VND, an increase of about 70 billion VND compared to the beginning of the year. Short-term financial borrowings increased by 50 billion VND to 997 billion VND, and long-term borrowings increased by nearly 45 billion VND to nearly 404 billion VND.

At the 2024 Annual General Meeting of Shareholders held in April this year, Mai Linh Group announced its business plan for this year, with consolidated revenue of 1,650 billion VND, a slight increase compared to 2023, and a significant rise in profit after tax to 60 billion VND.

In addition to its business losses, Mai Linh Group has also failed to pay social insurance for its employees for an extended period. According to the Ho Chi Minh City Social Insurance data, as of the end of July 2024, Mai Linh Group had not paid social insurance for its employees for 10 months, amounting to more than 4.5 billion VND.

Additionally, Vina Taxi Limited Liability Company (formerly known as Mai Linh Insurance Agency Limited Liability Company) has also delayed social insurance payments for five months, totaling more than 76 million VND.