Vietnam’s Ride-Hailing and Food Delivery Unicorn Gojek Bids Farewell to the Local Market

Illustration of a cityscape with ride-sharing vehicles

The ride-hailing and food delivery unicorn, Gojek, has decided to exit the Vietnamese market. This leaves Grab as the sole foreign player in the local ride-hailing app landscape, currently facing mounting pressure from rising domestic competitors.

BE and Xanh SM are Making a Comeback in Market Share Against Grab

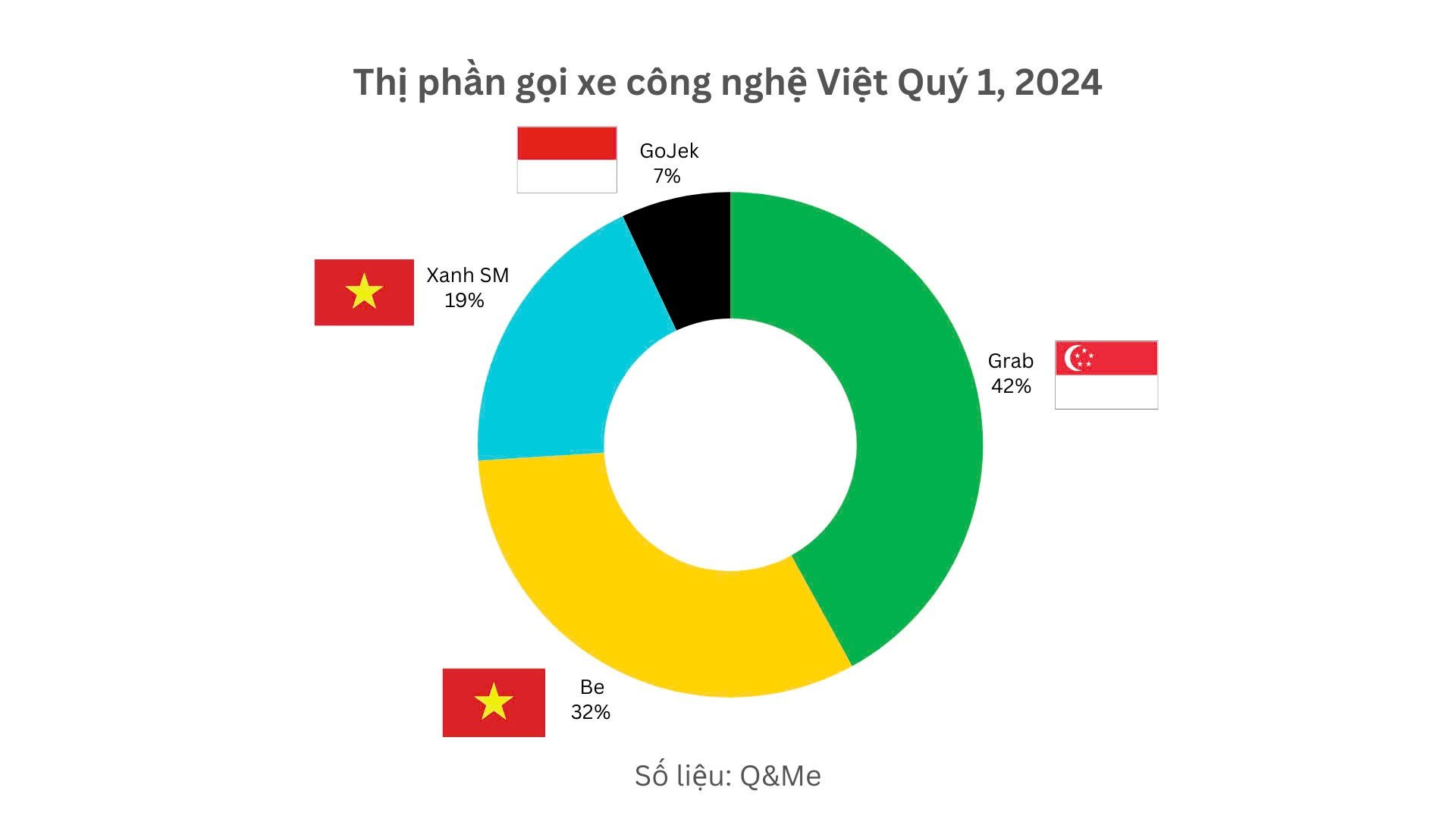

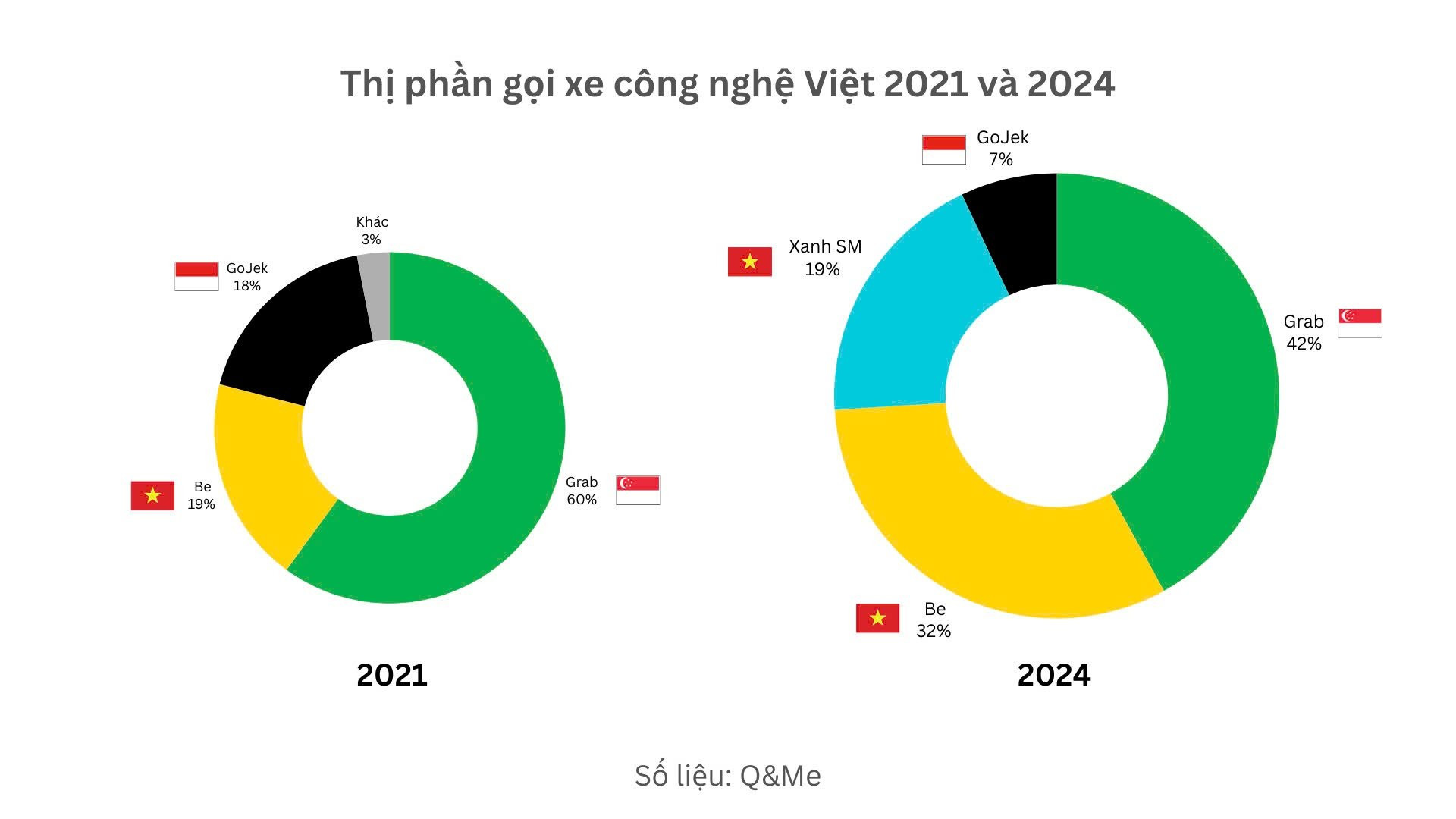

According to Q&Me’s report on the “Popularity of Motorbike Ride-Hailing Apps in 2024,” the gap between Grab and its rivals is narrowing. This shift is attributed to the increasing user base of Be and the emergence of a new player, Xanh SM.

While Grab remains the top choice for Vietnamese riders, its market share is being eroded by two homegrown ride-hailing apps, Be and Xanh SM. Gojek, meanwhile, has slipped to fourth place before announcing its departure from the market.

Specifically, 42% of Vietnamese riders would opt for Grab when using a motorbike ride-hailing service. Notably, Be has risen to second place with a 32% preference rate, followed closely by Xanh SM at 19%. In contrast, only 7% of users reported regularly using Gojek, an app that was once popular a couple of years ago.

Bar graph showing market share changes over time

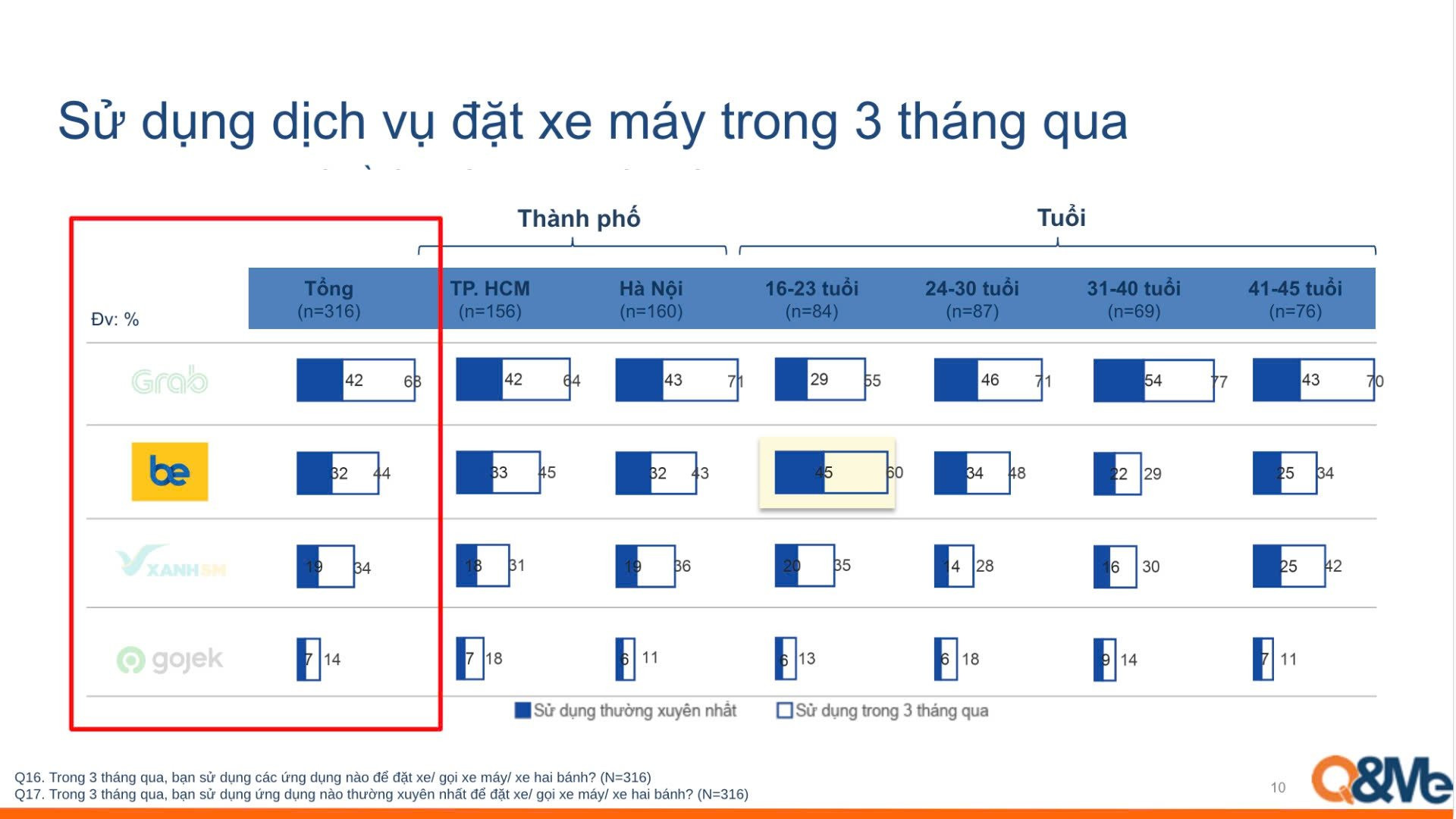

Gen Z Prefers BE Over Other Options

Interestingly, Gen Z, the target customer segment, is now prioritizing BE over other apps, indicating a potential challenge for Grab in the future.

Among individuals aged 24-30, 46% regularly use Grab, while 43% (nearly equal to Grab) opt for BE, and 14% choose Xanh SM.

While Grab attracts younger customers with its affordable pricing, BE focuses on enhancing the user experience with its “VIP” services, including beCar Plus and beBike Plus, which offer higher standards for drivers and vehicles.

Furthermore, while other apps solely focus on ride-hailing or ticket bookings, BE has integrated five different transportation options into a single super app: motorbike and car rides, as well as plane, train, and bus tickets. This comprehensive strategy has yielded positive results, with a doubling of air ticket values in the first half of 2024 compared to the same period in 2023. Additionally, the GMV of bus tickets increased fivefold, and the newly launched train ticket booking service generated three times the expected revenue in its first week.

Bar graph showing average monthly spending on ride-hailing apps

Q&ME’s 2024 survey on the usage habits of ride-hailing apps also revealed that BE has the highest per-capita spending among its users, surpassing Grab.

On average, Grab customers spend around 366,000 VND per month on ride-hailing services, while BE users spend 474,000 VND. Xanh SM and Gojek users have an average monthly expenditure of approximately 350,000 VND.

Although Grab’s monthly spending per customer is lower than BE’s, its vast customer base ensures that its revenue remains dominant in the market.

In 2023, Vietnam’s ride-hailing market was valued at 727.73 million USD, with Grab holding a 58.68% market share, six times that of BE. However, Q&Me noted that BE has the highest customer retention rate among all ride-hailing apps.

What Do Drivers Have to Say About Gojek’s Exit From Vietnam?

Gojek Vietnam has announced that it will provide necessary support to all affected parties during the transition period.

The Electric Revolution: Grab’s Surprising Choice for 1,000 New Electric Taxis

Gojek, the rival of Grab, has unveiled an ambitious plan to transition its fleet to electric motorcycles by 2030. This bold move underscores the company’s commitment to sustainability and reducing its environmental footprint. With this initiative, Gojek aims to lead the industry towards a greener and more sustainable future, one that promises a cleaner, quieter, and more efficient ride-sharing experience for both passengers and drivers alike.