In early 2024, QCGL, a Vietnam-based corporation with the stock code QCG, underwent significant changes. Its CEO, Ms. Nguyen Thi Nhu Loan, was arrested and detained in connection with a case involving misuse of public land in District 4, Ho Chi Minh City. As a result, Mr. Nguyen Quoc Cuong returned to the company, assuming his mother’s responsibilities.

Speaking to shareholders at the recent annual general meeting, Mr. Cuong reassured that he has been reviewing the company’s financial situation to devise a plan for business recovery. He also stated that, initially, the financial health of QCGL is not as concerning as it seems. However, the company’s most significant challenge is its debt of VND 2,882 billion owed to Ms. Truong My Lan, arising from a case involving Van Thinh Phat Group and the Phuoc Kien project in Nha Be, Ho Chi Minh City.

Mr. Cuong shared his intention to sell off valuable assets to ensure the company’s debt obligations are met. Specifically, QCGL plans to divest from three hydropower projects, expecting to generate approximately VND 1,000 billion in revenue. In the coming year, the company will also focus on clearing inventory from various projects, anticipated to bring in over VND 1,000 billion.

Regarding inventory clearance, the CEO of QCGL mentioned that there are two types of inventory: incomplete construction and completed projects. The company prioritizes clearing inventory from finished projects that are tangible products.

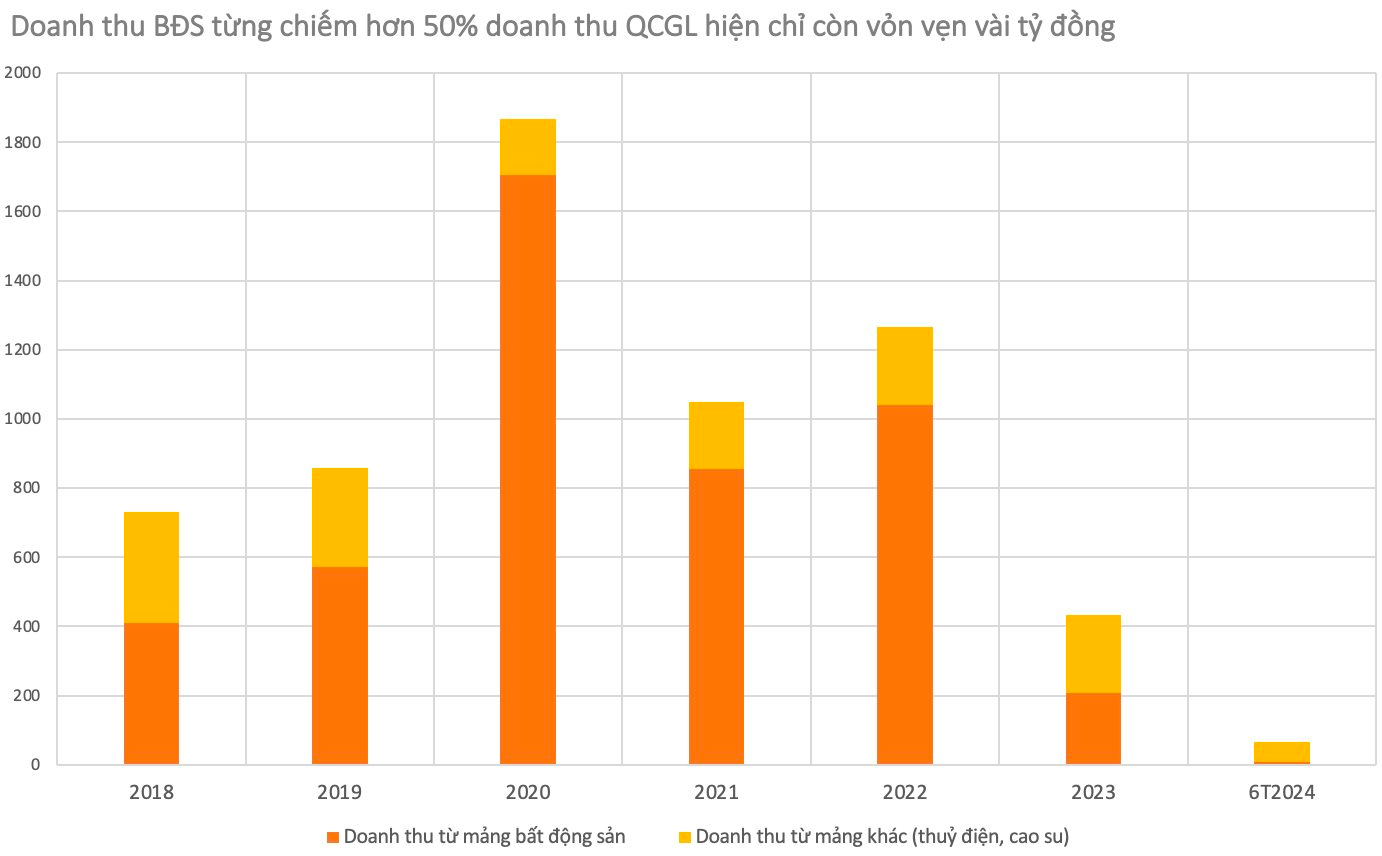

It’s worth noting that hydropower has been a significant contributor to the company’s revenue in recent years. In 2023, electricity sales revenue reached nearly VND 152 billion, accounting for 35% of the total. According to the reviewed financial statements for the first half of 2024, the hydropower segment continued to contribute more than VND 37 billion in revenue, accounting for nearly 60%. Together, the hydropower and rubber segments account for over 90% of the company’s revenue in the first half of 2024, while real estate contributed a meager VND 9 billion.

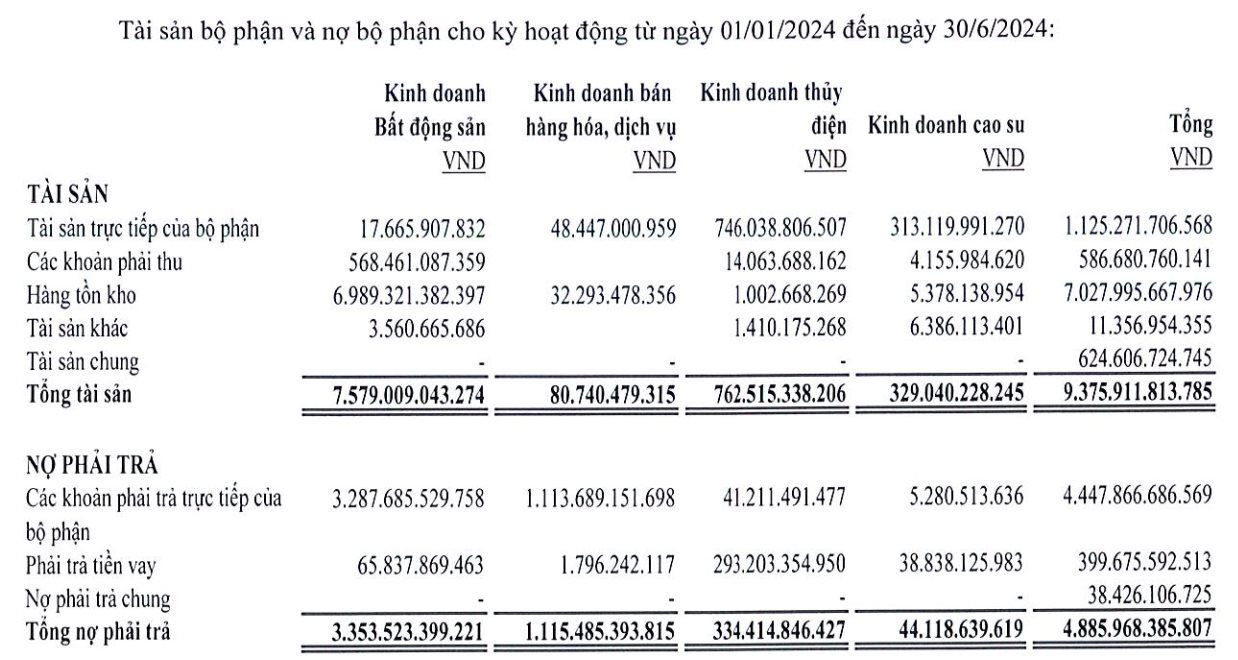

Apart from revenue, hydropower and rubber also contribute significantly to QCGL’s total assets. As of June 30, 2024, the hydropower segment accounted for VND 762.5 billion in total assets, while the rubber segment contributed VND 329 billion. Together, these two segments make up over VND 1,000 billion of the company’s assets.

On the other hand, the company’s real estate assets mainly comprise incomplete projects, including the Phuoc Kien Residential Area (Ho Chi Minh City), Lavida (Ho Chi Minh City), Central Premium (Ho Chi Minh City), Marina Da Nang, and several others.

Completed real estate projects include the QCG Apartment Building II – Lot A (Ho Chi Minh City), DeCapella Project (Ho Chi Minh City), Giai Viet Apartment Building (Ho Chi Minh City), and a few others. Regarding the divestment from hydropower, Mr. Cuong mentioned that the management is also considering divesting from other real estate projects instead of hydropower.

Consequently, after executing the planned sales, QCGL’s remaining significant asset will be the Phuoc Kien project. If the company settles the VND 2,882 billion debt to Van Thinh Phat, it expects to regain the project’s documents and resume development. However, the question arises as to where the funding for this development will come from, as the company’s current cash and cash equivalents stand at only VND 27.5 billion.

The Province with Vietnam’s Largest Lake and Second Largest Hydropower Plant Prepares for Three New Expressway Projects Worth VND 28,000 Billion, Attracting Global Attention from Industry Leaders.

The Hoa Binh province is home to the largest hydroelectric power plant in Southeast Asia, a feat of engineering in the 20th century, with a breathtaking reservoir that stretches 240 km in length. With plans to develop three new expressway sections – Ba Vi – Cho Ben, Hoa Lac – Hoa Binh, and Hoa Binh – Moc Chau – the province is set to become even more accessible and economically vibrant.

The Renewable Energy Revolution in Vietnam

In the midst of a global energy transition, renewable energy sources are taking center stage, and their importance is particularly evident in emerging markets such as Vietnam.