Liquidity in the market decreased compared to the previous trading session, with the VN-Index matching volume reaching over 517 million shares, equivalent to a value of more than 11.2 trillion VND; HNX-Index reached over 38.6 million shares, equivalent to a value of more than 721 billion VND.

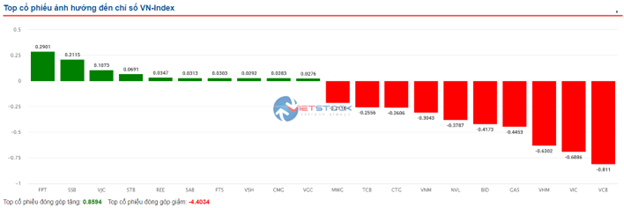

VN-Index opened the afternoon session less pessimistically as buying power emerged, helping the index regain the reference level. However, towards the end of the session, sellers continued to exert pressure, and the index remained in the red. In terms of impact, VCB, SSB, NVL, and GAS were the most negative stocks, taking away more than 2 points from the index. On the other hand, HPG, HVN, VHM, and FPT were the most positive stocks, but their contribution to the index was insignificant.

| Top 10 stocks impacting the VN-Index on 11/09/2024 |

HNX-Index followed a similar trend, negatively impacted by PVI (-1.77%), IDC (-0.68%), PVS (-0.49%), and BCF (-6.8%).

|

Source: VietstockFinance

|

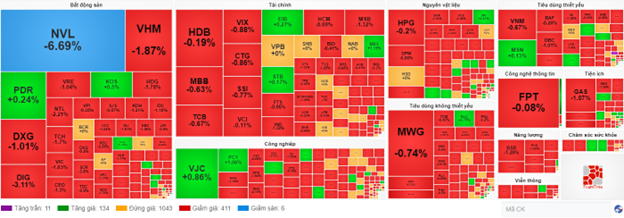

The non-essential consumer goods sector saw the sharpest decline in the market at -0.45%, mainly due to GEX (-0.24%), DGW (-1.28%), FRT (-0.28%), and TCM (-0.11%). This was followed by the real estate and financial information sectors, which fell by 0.35% and 0.31%, respectively. On the other hand, the information technology sector witnessed the strongest recovery in the market at 0.52%, mainly driven by FPT (+0.46%), CMG (+1.62%), ITD (+2.62%), and VBH (+13.18%).

In terms of foreign trading, they continued to sell a net of more than 61 billion VND on the HOSE exchange, focusing on MSN (70.94 billion), MWG (60.27 billion), HPG (54.49 billion), and VCB (33.65 billion). On the HNX exchange, foreigners bought a net of more than 1 billion VND, focusing on CEO (8.69 billion), MBS (3.77 billion), IDC (2.86 billion), and PVS (1.01 billion).

| Foreigners’ Buying and Selling Dynamics |

Morning Session: Recovery Efforts Fall Short

Pessimism dominated the market, causing the indices to remain in the red throughout the morning session. Buying interest emerged at the 1,250-point support level but was not significant. At the midday break, the VN-Index fell by 0.54%, settling at 1,248.41 points, while the HNX-Index dropped by 0.45% to 230.66 points. Sellers prevailed, with the market breadth indicating 442 declining stocks versus 162 advancing stocks.

The trading volume of the VN-Index exceeded 280 million units in the morning session, equivalent to a value of more than 5.8 trillion VND. The HNX-Index recorded a trading volume of nearly 20 million units, with a value of over 372 billion VND.

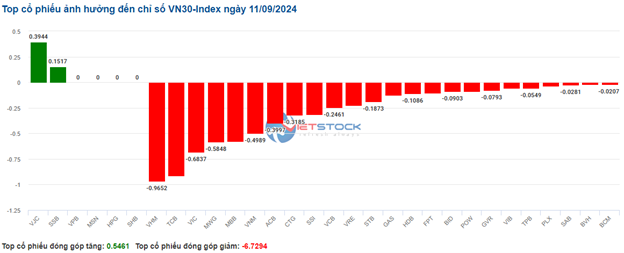

The large-cap stocks weighed heavily on the indices, with VCB, VIC, and VHM pushing the VN-Index down by more than 2 points. Meanwhile, the 10 most positive stocks contributed less than 1 point to the overall index, indicating the dominance of sellers.

Source: VietstockFinance

|

Most sectors were in negative territory. The real estate group faced intense selling pressure, experiencing the sharpest decline in the market during the morning session. Notably, NVL fell to its daily limit after the Ho Chi Minh City Stock Exchange (HOSE) placed it on the list of stocks ineligible for margin trading from September 10. The reason cited was the company’s delay in disclosing its semi-annual 2024 financial statements, exceeding the 5-day deadline as per regulations.

Additionally, many large-cap stocks in the sector also witnessed simultaneous declines, notably VHM (-1.4%), VIC (-1.74%), VRE (-1.3%), IDC (-1.54%), NLG (-1.47%), and DIG (-2.89%).

Following closely was the energy sector, which fell by approximately 1%. Most stocks in this sector were subjected to selling pressure, with prominent names including BSR (-0.86%), PVS (-1.47%), and PVD (-1.88%).

On the flip side, the information technology sector was the only bright spot in the market, rising by 0.64% thanks to the positive contributions from FPT (+0.62%) and CMG (+1.21%).

10:35 am: Money Flows Out of Real Estate, VN-Index Takes a Hit

Sellers continued to exert pressure on the market, causing the major indices to fall sharply. As of 10:30 am, the VN-Index dropped by 7.86 points, hovering around 1,247 points, while the HNX-Index lost 1.58 points, trading around 230 points.

Most stocks in the VN30 basket turned red, with notable declines in VHM, TCB, VIC, and MWG. Conversely, only VJC and SSB managed to stay in positive territory.

Source: VietstockFinance

|

The telecommunications sector recorded the steepest decline in the market as most stocks faced intense selling pressure. Specifically, VGI fell by 1.92%, CTR dropped by 0.32%, ELC decreased by 1.3%, and YEG slipped by 0.98%…

Following closely was the real estate sector, which exhibited a rather pessimistic performance as most stocks traded in negative territory. Currently, this sector has the most negative impact on the overall market. Specifically, NVL hit its daily limit, VHM fell by 1.52%, DXG declined by 1.35%, DIG dropped by 2.67%… Only a handful of stocks managed to stay in the green, such as KOS, which rose by 0.5%, SGR climbing by 4.56%, and CCL increasing by 1.16%…

Meanwhile, the information technology sector went against the market trend as money flowed into stocks like CMG, which rose by 0.81%, PIA surging by 2.37%, HPT advancing by 0.48%, and VBH jumping by 13.18%.

Compared to the opening, sellers remained in control. There were 411 declining stocks versus 134 advancing stocks.

Source: VietstockFinance

|

Opening: Caution Sets In Early

On September 11, by 9:30 am, the VN-Index hovered around the reference level, reaching 1,252.5 points. The HNX-Index also witnessed a slight decline, touching 231.47 points.

As of 9:30 am, the red color temporarily prevailed in the VN30 basket, with 17 declining stocks, 5 advancing stocks, and 8 stocks trading flat. Among them, CTG, VIC, and BCM were the top losers. Conversely, SSB, VPB, and HPG were the biggest gainers.

The telecommunications services sector declined and had a relatively negative impact on the overall market, with stocks such as VGI falling by 1.28%, FOX dropping by 1.77%, and YEG slipping by 0.33%. Smaller-cap stocks in this sector remained flat.

On the other hand, the materials sector showed positive signals from the start of the session, with a slight increase of 0.09%. Notably, stocks like HPG rose by 0.2%, HSG climbed by 0.75%, CSV advanced by 0.26%, GVR inched up by 0.15%, SPI jumped by 3.57%, and LAS grew by 0.45%,…