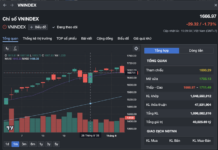

Market liquidity decreased compared to the previous session, with the matching trading volume of the VN-Index reaching more than 433 million shares, equivalent to a value of more than 10.2 trillion VND; HNX-Index reached more than 52.1 million shares, equivalent to a value of more than 939 billion VND.

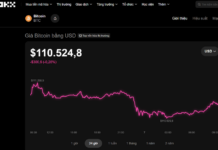

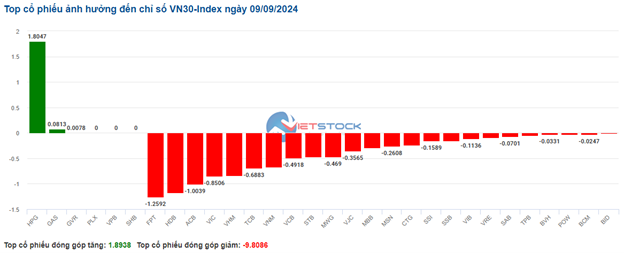

VN-Index opened the afternoon session with continued fluctuations, with the advantage tilting towards sellers, causing the index to sink in the red until the end of the session. In terms of impact, VHM, VIC, BID, and VNM were the most negative stocks, taking away more than 2.5 points from the index. On the other hand, GAS, HPG, NAB, and NVL were the most positive stocks, but their contribution to the index was insignificant.

| Top 10 stocks with the strongest impact on the VN-Index on 09/09 |

HNX-Index also followed a similar trajectory, with the index negatively impacted by KSV (-4.17%), DTK (-4.51%), HUT (-2.35%), and SHS (-2.56%)…

|

Source: VietstockFinance

|

The telecommunications sector saw the biggest decline in the market with -1.09%, mainly due to VGI (-0.79%), CTR (-0.08%), VNZ (-14.93%), and ELC (-2.1%). This was followed by the real estate sector and the information technology sector, with decreases of 1.02% and 0.64%, respectively. On the other hand, the energy sector witnessed the strongest recovery in the market with a gain of 1.51%, mainly driven by BSR (+2.18%), PVS (+0.49%), and PVD (+0.75%).

In terms of foreign trading, they net sold more than 538 billion VND on the HOSE exchange, focusing on FPT (114.74 billion), MSN (82.49 billion), HPG (76.26 billion), and VPB (51.87 billion). On the HNX exchange, foreigners net sold more than 1.5 billion VND, mainly in SHS (13.31 billion), LAS (5.02 billion), CEO (1.56 billion), and VC6 (0.41 billion).

| Foreigners’ net buying and selling activities |

Morning Session: Buying demand remains weak, steel sector stands out

The market remained in the red throughout the morning session. At the midday break, the VN-Index decreased by 0.49%, settling at 1,267.72 points; the HNX-Index dropped by 0.5%, falling to 233.47 points. The market breadth was negative, with 375 declining stocks and 200 advancing stocks.

The trading volume of the VN-Index reached nearly 206 million units in the morning session, equivalent to a value of almost 4.9 trillion VND, a decrease of more than 20% compared to the previous session’s low. Meanwhile, the HNX-Index recorded a trading volume increase of over 30% in the morning session, reaching over 23 million units with a value of nearly 426 billion VND.

VIC, VCB, VNM, and FPT were the main drags on the indices, causing the VN-Index to lose nearly 2 points. In contrast, HPG was a bright spot, preventing the index from a steeper decline, contributing over 0.6 points to the VN-Index. This was followed by GAS, NAB, and HSG, which also traded positively, but their impact on the overall index was not significant.

The steel sector was the main highlight of the morning session. According to the sector index chart from VietstockFinance, the steel sector has faced challenges since mid-July, erasing the impressive recovery seen in the first half of the year. However, the sector’s price movements have shown more positive signals since the beginning of September. Many large-cap stocks in this group witnessed strong breakouts in the morning session, including HPG (+1.57%), HSG (+2.51%), TVN (+3.33%), NKG (+2.64%), VGS (+1.99%), and TIS (+7.94%).

Source: VietstockFinance

|

The energy group also recorded a relatively positive performance, increasing by 1.2% by the end of the morning session. Notably, BSR (+1.75%), ITS (+1.92%), POS (+0.94%), PVC (+0.78%), and PVD (+0.56%) contributed to the sector’s gains. On the other hand, information technology and telecommunications were the two sectors at the bottom of the table, with declines of nearly 1%. This was mainly due to large-cap stocks in the sectors, such as FPT (-0.91%), CMG (-1.35%); VGI (-0.63%), and VNZ (-14.39%).

Foreigners continued to net sell more than 332 billion VND on the HOSE exchange, with the highest selling pressure on FPT (73 billion) and MSN (56 billion). On the HNX exchange, foreigners also net sold nearly 19 billion VND, mainly in the SHS stock.

10:35 am: Selling pressure persists

The cautious sentiment among investors resulted in a lackluster performance for the main indices, which fluctuated below the reference level. As of 10:30 am, the VN-Index dropped by 6.5 points, hovering around 1,267 points. Meanwhile, the HNX-Index lost 0.56 points, trading around 234 points.

Financial stocks within the VN30 basket, such as HDB, ACB, TCB, and VCB, were the main negative contributors to the index, deducting 1.18 points, 1 point, 0.69 points, and 0.49 points, respectively. Conversely, HPG, GAS, and GVR were the few stocks that helped the VN30 index recoup over 1 point.

Source: VietstockFinance

|

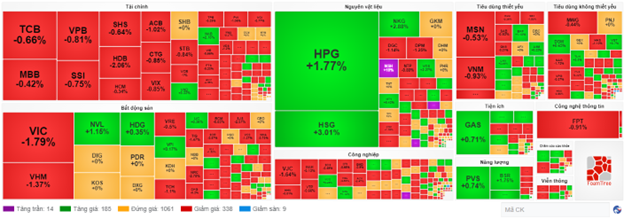

The financial sector exerted significant pressure on the market, with the majority of stocks in the sector trading in negative territory. Notable decliners included TCB, which fell by 0.66%, MBB decreased by 0.42%, VPB dropped by 0.54%, and SSI slipped by 0.75%. Only a handful of stocks in the sector managed to stay in positive territory, including VND, SHB, and BVB, but their gains were modest.

Similarly, the real estate sector continued to face headwinds, with strong fluctuations and selling pressure. Specifically, VIC declined by 1.79%, VHM fell by 1.25%, NTL dropped by 1.37%, and VRE decreased by 0.5%. On the other hand, a few stocks in the sector showed slight recovery, including HDG, which rose by 0.35%, KDH gained 0.13%, and IJC increased by 0.36%.

In contrast, the energy group led the market recovery with a gain of 1.06%. This was mainly driven by large-cap oil and gas stocks such as BSR, which advanced by 1.31%, PVS increased by 0.99%, PVD rose by 0.56%, and PVC climbed by 0.78%…

Notably, the materials sector also supported the market against the downward trend, with strong buying interest seen in steel stocks since the beginning of the session. HPG rose by 1.77%, HSG gained 2.76%, NKG increased by 2.88%, and TVN climbed by 4.44%.

Compared to the opening, sellers remained dominant in the market. There were 338 declining stocks and 185 advancing stocks.

Source: VietstockFinance

|

Opening: Broad-based declines, VN-Index loses nearly 10 points at the opening bell

The market opened with a negative sentiment, reflecting investors’ cautious approach. The main indices traded in negative territory, falling below the reference level.

The VN30 basket witnessed a majority of stocks in the red, with 27 decliners, 1 gainer, and 2 unchanged stocks. Among them, HDB, VIC, FPT, and SSB were the top losers. Conversely, HPG was the only stock that managed to stay in positive territory.

The energy sector, particularly oil and gas stocks, stood out at the beginning of the morning session. Stocks in this group traded firmly in the green, with notable gainers including BSR (+1.31%), PVD (+0.94%), PVS (+1.23%), MGC (+2.99%), and THT (+0.81%)…

In contrast, information technology stocks plunged into negative territory, recording a decline of 1.22% at the opening bell. Specifically, FPT dropped by 1.36%, CMG fell by 0.19%, and the remaining stocks in the sector remained unchanged.