The stock market is an attractive investment avenue, offering approximately 13% returns since the beginning of the year, outperforming traditional savings accounts. This growth in stock prices is accompanied by a recovery in business results and the economy.

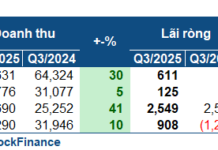

Accordingly, corporate profits for Q2 2024 increased by 26% year-on-year, surpassing the growth rate in Q1 2024 (+21.5%). Despite a decent recovery so far this year, the index has faced challenges when approaching the 1,300-point resistance level and has undergone recent corrections.

The stock market is entering a new growth phase

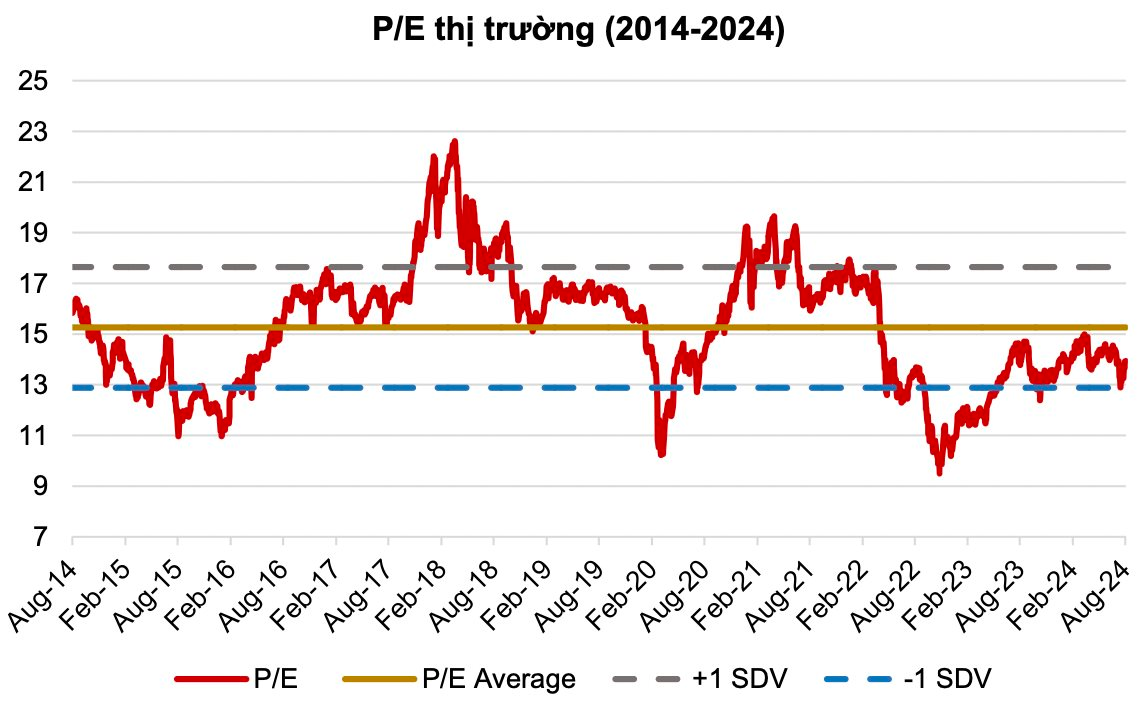

In a recent report, Agriseco Securities asserted that, from a valuation perspective, the market is currently at an attractive valuation compared to historical levels. Specifically, the VN-Index is trading at 13.9x (lower than the 2014-2024 average of 15.26 times) and P/B 1.7x (lower than the 2014-2024 average of 2.16 times). Agriseco believes that the current valuation levels are conducive to accumulating investment stocks in the medium and long term.

VN-Index Valuation

Agriseco asserts that business operations have almost entirely recovered and entered a new growth phase, presenting multiple opportunities for the stock market. Risk factors such as exchange rates, interest rates, and inflation remain latent but are under control, creating a favorable environment for the market’s upward trajectory.

“The second half of this year will also be pivotal for the new growth cycle in 2025, with prospects for market upgrade, an essential factor in attracting foreign investment,” the report states.

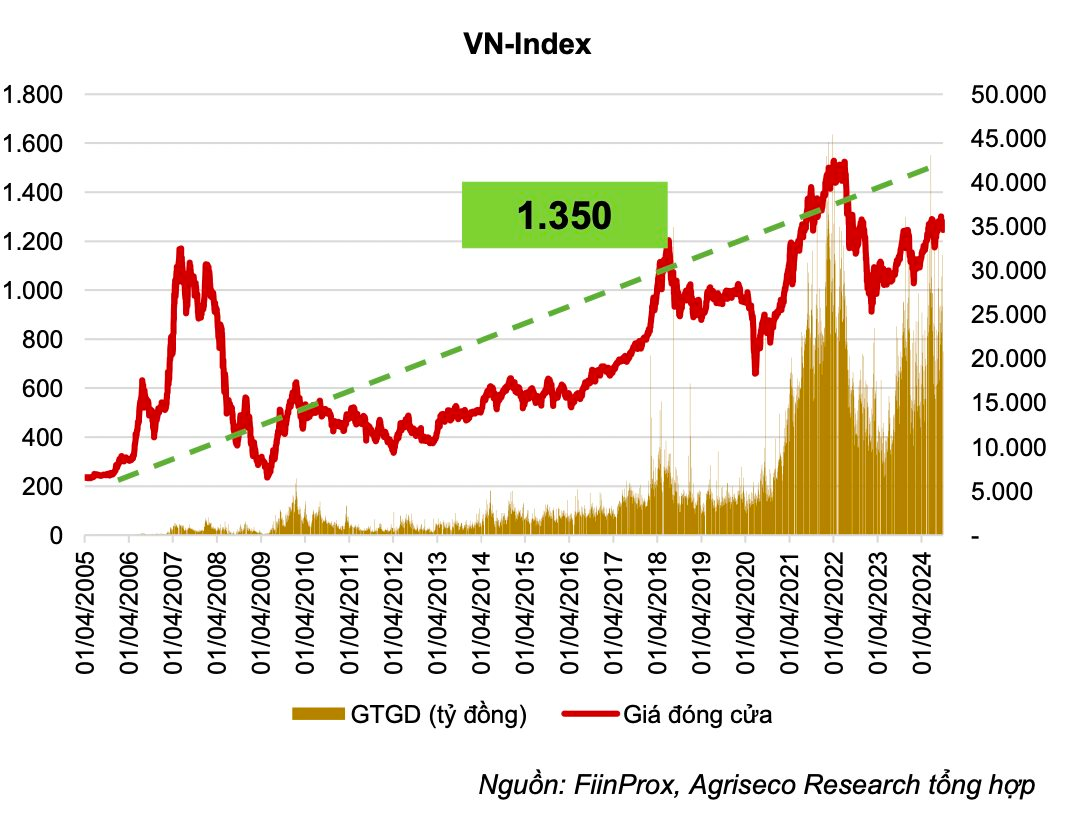

VN-Index to reach 1,350 points by year-end

According to Agriseco, the primary impetus for the market’s ascent will stem from both domestic and international factors. On the global front, the bright spot is the gradual recovery of global economic growth and the continued decline of inflation in the final months of 2024. Additionally, the gradual easing of monetary policies and the downward trend in interest rates serve as crucial catalysts for the market.

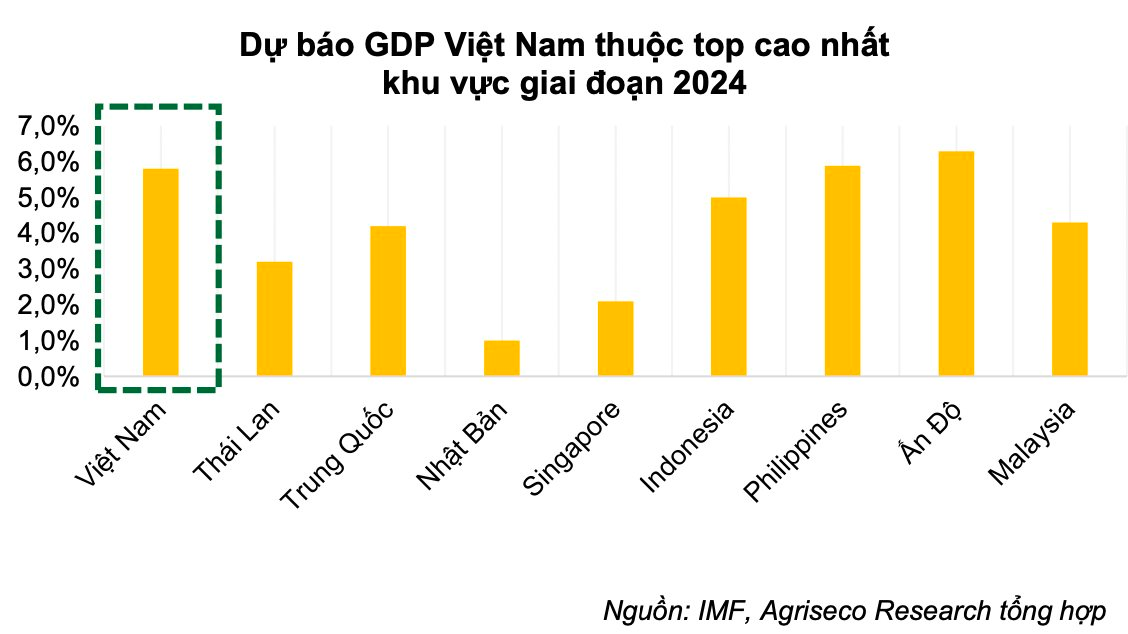

Domestically, Agriseco anticipates a sustained positive economic recovery momentum in the second half. Despite facing challenges due to the incomplete recovery of global demand, GDP for the latter half is expected to reach approximately 6.6%, surpassing the growth rate of the first half. Consequently, the full-year GDP for 2024 is projected to meet the government’s target of 6-6.5%, driven by: (1) The rebound in production and export activities; (2) More active disbursement of FDI and public investment; (3) Sustained growth in retail consumption.

GDP Growth Projection

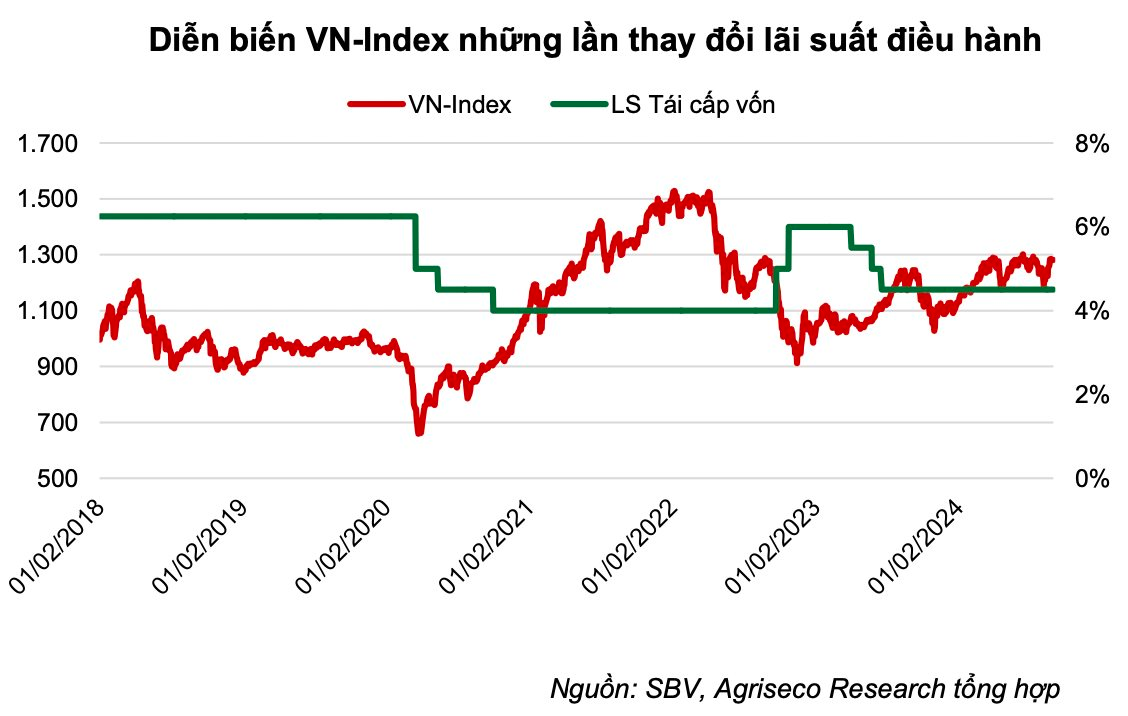

On the other hand, with the Fed expected to cut interest rates and exchange rates stabilizing, the interest rate environment may remain low to boost credit growth and facilitate economic recovery. The policy interest rate is forecasted to be maintained at its current level of 4.5%, while lending rates are projected to decrease further amid improving economic conditions and easing pressure from exchange rates and inflation.

The low-interest-rate environment remains a pivotal driver for the stock market’s sustainable growth. Reasonable interest rates will facilitate the recovery of production and business activities, enhance profitability, and subsequently augment the allure of the stock market. According to Agriseco Research, during periods of declining interest rates, the stock market tends to exhibit positive growth in the medium and long term.

Interest Rate and Stock Market Performance

Agriseco Research forecasts a 15% growth in market-wide profits in 2024 compared to 2023, with improvements continuing throughout the year.

Market Profitability Projection

Agriseco Research predicts that the VN-Index will rebound to 1,350 points in the final quarter of 2024, based on: (1) A projected 15% growth in market-wide profits in 2024; (2) A reasonable P/E ratio of 14 times.