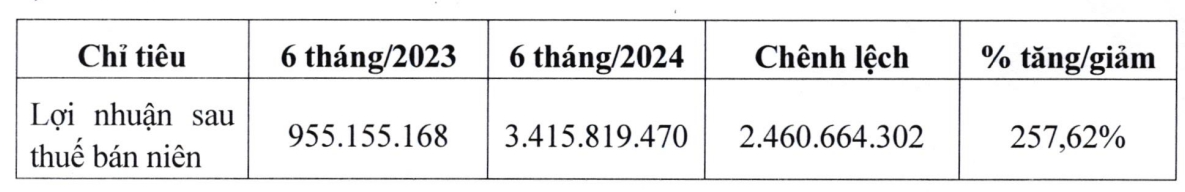

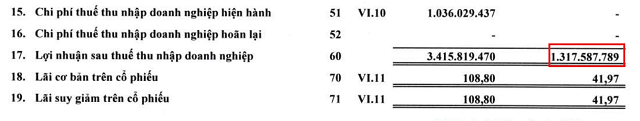

Following a review, HOSE noted that the semi-annual 2023 after-tax profit in DHM‘s explanatory statement dated August 14, 2024, was 955 million VND, inconsistent with the figure of 1.3 billion VND announced by the company the previous year.

HOSE issued a reminder and requested the company to strictly adhere to information disclosure regulations. They also asked DHM to issue a rectifying announcement regarding the discrepancy in the disclosed semi-annual after-tax profit for 2024 compared to the same period in 2023 and submit it by September 13, 2024.

DHM’s information disclosure on August 14, 2024. Source: DHM

|

The reviewed semi-annual 2023 financial statements show an after-tax profit of 1.3 billion VND. Source: DHM

|

This is not the first time DHM has disclosed incorrect figures. The company previously had to issue rectifications due to errors in its 2023 financial statements and Q1/2024 financial statements, both attributed to accounting department oversights during data processing.

On August 14, 2024, DHM explained in a statement that the 257.6% surge in semi-annual after-tax profit for 2024 compared to the first half of 2023 (955 million VND) was due to a rebound in the steel market during the first six months. The company seized this market opportunity by intensifying its commercial activities, resulting in a doubling of revenue to over 2,000 billion VND compared to the same period last year. This record-high revenue has been achieved since the company began operations.

With positive business performance, DHM took on more debt during the period, resulting in interest expenses of over 15 billion VND, the second-highest in the company’s history, only surpassed by the 36 billion VND recorded in the same period in 2021. The cash flow statement from financing activities shows that the company borrowed 748 billion VND, triple the amount borrowed in the first half of 2023. Consequently, principal repayments also doubled to 591 billion VND.

For 2024, DHM set optimistic targets, with revenue and after-tax profit plans of 3,500 billion VND and 11.1 billion VND, respectively, representing increases of 30% and 86% compared to the actual figures for 2023. After the first six months, the steel trading enterprise has achieved approximately 57% of its revenue target but only 30% of its profit goal.

The management team anticipates a positive economic outlook for the year, driven by a recovery in domestic consumption, trade, increased public investment, and a surge in foreign investment. However, they also acknowledge potential risks, including global economic volatility, geopolitical tensions disrupting supply chains, rising raw material prices, and increasing credit and bad debt risks.

The company’s leaders expect a certain level of recovery in the real estate market as relevant legal policies are issued and take effect in 2024. They anticipate continued promotion of public investment policies, stable or decreasing input factor prices, and output prices closely following global fluctuations, particularly in China. Consequently, domestic steel prices may maintain a sideways trend as the real estate market recovery takes time, and demand improvement is gradual.

| DHM‘s first-half revenue from 2012 to 2024 |

The Profitable Flamingo: How the Resort Chain Soared to Success in 2024

Flamingo Holdings has just released its financial report for the first half of 2024, and the results are impressive. The company has seen significant growth in both revenue and profit, surpassing expectations and setting a strong precedent for the remainder of the year. With a strong performance across the board, Flamingo Holdings is poised for continued success and a bright future ahead.

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.