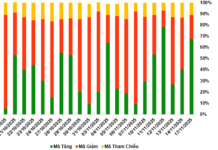

Vietnam’s stock market opened positively and maintained its green color for most of the trading session. The VN-Index ended the session on September 12 at 1,256 points, a 3-point gain. Total trading volume on the three exchanges reached approximately VND 11,900 billion, an 18% decrease compared to the previous session as selling pressure eased.

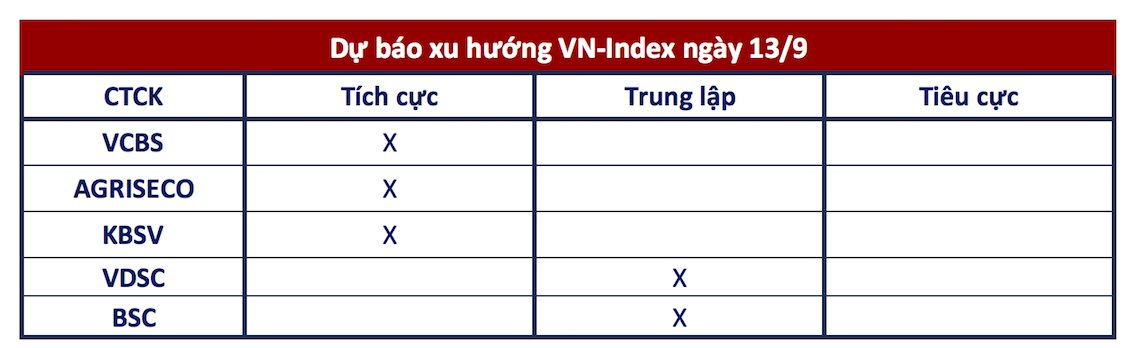

Ahead of the weekend, securities companies offered mixed forecasts, but most agreed that the market would continue to recover, and investors could consider adding to their positions.

Continued Uptrend and Accumulation

VCBS Securities

The VN-Index formed a Spinning Top candle, indicating market hesitation and caution around the 1,250-1,260 point level.

On the hourly chart, the RSI indicator turned down after forming its first bottom, so a 10-point market fluctuation is normal. The VN-Index is moving closely with the MA20, supporting the market’s recovery and accumulation trend.

Investors are advised to maintain their portfolio allocation and consider adding to positions in stocks with successful support-testing signals, performing well around the MA20, and attracting stable cash flow from sectors such as fertilizers-chemicals, steel, and securities.

Downtrend Has Slowed

Agriseco Securities

Agriseco Research believes that the downtrend has slowed, and the market is forming a new equilibrium around the 1,250-1,260-point level. The VN-Index may see a rebound, and investors are advised to increase their trading positions, focusing on stocks attracting cash flow in the food, steel, and securities sectors. It is important to consider allocation ratios to manage short-term risks.

Uptrend Remains Intact

KBS Securities

The market entered a cautious trading state as the VN-Index formed a “Spinning” candle with declining trading volume. However, cash flow showed supportive force in large-cap stocks, and the number of advancing stocks exceeded declining ones. In the absence of supportive news, the mild recovery is relieving selling pressure, and the market is likely to move sideways with an uptrend bias.

Investors are advised to hold their existing positions and consider partially increasing their allocation at support levels.

Probe Oscillation

VDSC Securities

The market is expected to oscillate around the MA(150), 1,253 points, to test support and signals from the previous day’s trading. Investors should observe supply and demand dynamics at the support level and prioritize stocks with stable performance and recent cash inflows. However, they should also consider the recovery rhythm for short-term profit-taking or portfolio restructuring to minimize risks.

Continued Sideways Movement

BSC Securities

In the coming sessions, the VN-Index may continue to trade sideways around the 1,255 level to find a balance.