Gold prices surged on Wednesday as investors sought safety amid growing expectations of a rate cut by the Federal Reserve.

On September 13, the price of gold futures for December delivery on the New York Comex exchange officially surpassed the $2,600 per ounce mark. The precious metal witnessed a strong upward momentum as investors became increasingly confident that interest rates globally would remain low in the near future.

In the spot market, gold prices also reached a historic high of $2,573 per ounce, marking an increase of about $70 per ounce since the beginning of the week.

Both fundamental and technical factors supported the rise in gold prices. According to Kitco News, the price of gold is being buoyed by looser monetary policies from major central banks and the recent depreciation of the US dollar in the foreign exchange market. Meanwhile, Asian and European stock indices showed mixed results overnight. US stock indices were expected to open on a stronger note as the trading session began in New York. Investors in the US stock market had a very good trading week, making up for much of the losses incurred in September.

The European Central Bank (ECB) decided to cut interest rates by 0.25 percentage points at its meeting on September 12, marking the second consecutive cut this year. Interest rates in the Eurozone now stand at 3.5%.

Most traders are confident that the US Federal Reserve will also cut interest rates next week. With inflation under control and lower interest rates, bond yields will decrease, benefiting the gold and silver markets. Expectations of a US rate cut have also weakened the US dollar, which is advantageous for gold and silver prices.

The Ultimate Dual-Lens Smartphone Camera: A Smooth Operator That Rivals the iPhone 16 at a Fraction of the Cost

This is one of the most impressive smartphones currently on the market. A true powerhouse of technology, it boasts an array of features that will satisfy even the most demanding user. With a sleek design and powerful specifications, it is a device that truly stands out from the crowd. An exceptional smartphone that delivers an unparalleled user experience.

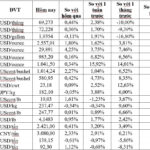

The Calming Forex Rates and “Breathable” Interest Rates

The U.S. dollar plummeted, prompting the State Bank to purchase this foreign currency to boost its reserves. This strategic move helped to temper the exchange rate and provided more room for interest rate stability on loans, offering a much-needed reprieve to borrowers.