Over the past weekend, gold prices consecutively hit multiple new record highs. With spot prices reaching a record high of $2,582.04 per ounce, gold’s year-to-date gains have been the highest since 2020, surging by 24%. This surge in gold prices can be attributed to safe-haven demand amid geopolitical and economic uncertainties, as well as strong buying from central banks.

Gold prices are consecutively reaching new highs.

Investment banks and analysts are increasingly optimistic about gold due to the monetary easing policies of major central banks and the US presidential election race.

According to Investing.com, “Gold prices could hit $3,000 per ounce in the next 12-18 months, although current market conditions suggest that this price level is not achievable in the near term.”

Goldman Sachs Bank predicts that gold prices could rise to $2,700 per ounce by early next year. The metal remains the bank’s preferred geopolitical and financial risk hedge.

“The US Federal Reserve (Fed) is about to cut interest rates, and this will attract Western capital back to the gold market,” Goldman Sachs said. The bank added that in the previous two years of gold price increases, there was no significant role played by Western capital. Therefore, with the potential inclusion of Western investors, gold prices are sure to rise even more robustly.

Bank of America forecasts that gold could reach $3,000 per ounce in the future, possibly by 2025.

Aakash Doshi, head of the North American commodities division at Citi Research , also predicts that gold prices could reach $2,600 by the end of 2024 and $3,000 by mid-2025 due to the US entering an interest rate cut cycle, strong demand from gold exchange-traded funds (ETFs), and robust physical gold demand.

Macquarie Bank of Australia recently upgraded its outlook for gold prices, expecting them to reach $2,600 per ounce in the first quarter of 2025 and possibly surge to $3,000. However, the bank’s analysts warned: “While the challenging outlook for developed market equities still has the potential to positively impact gold, there are also other influences, with the potential for some cyclical headwinds to emerge later next year.”

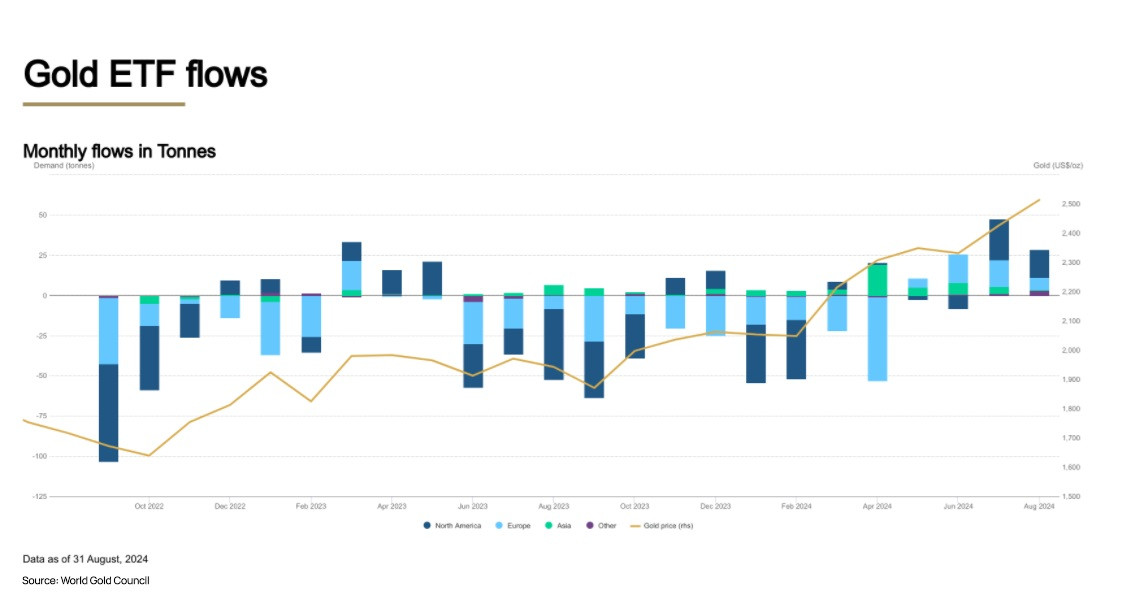

Recently, the World Gold Council reported that gold ETFs globally have witnessed capital inflows for four consecutive months up to August 2024. Specifically, the gold holdings of the world’s largest gold-backed ETF, SPDR Gold Trust GLD, reached their highest level since early January 2024 as of September 12, 2024.

Capital inflows into gold ETFs globally.

The upcoming meeting of the US central bank on September 18 is attracting particular attention from the markets as there is a high possibility that the US will decide to cut interest rates for the first time since 2020. Low-interest rates tend to support gold, a non-interest-bearing asset.

Investors are currently predicting a 55% probability that the Fed will cut interest rates by 25 basis points at this meeting, with a 45% chance of a 50 basis point cut, according to the CME’s FedWatch tool.

Predicted probability of the Fed’s interest rate cut.

Peter A. Grant, vice president and senior metals strategist at Zaner Metals , stated that if the upcoming US data indicates a weak economy and labor market, it would increase the likelihood of a 50-basis point rate cut by the Fed in November or December 2024, providing additional momentum for the gold market and accelerating the timeline for gold to reach the $3,000 mark.

Daniel Pavilonis, senior market strategist at RJO Futures , also believes that the $3,000 per ounce gold price target is achievable, adding that this scenario could unfold due to political instability after the election.

The interest rate cuts by major central banks are proceeding smoothly, with the European Central Bank cutting interest rates by a quarter-point last week.

“We are also assessing other factors driving demand from Western investors, including the upcoming US election – which could increase uncertainty – and gold’s role as a hedge against risks,” said Joseph Cavatoni, market strategist at the World Gold Council.

The US presidential election on November 5 could push gold prices higher as potential market volatility may drive investors towards gold as a safe haven.

Additionally, the efforts of some BRICS countries to cooperate more closely in the monetary field are also driving gold prices higher. Everett Millman, director of market analysis at Gainesville Coins , stated, “The positive momentum for gold is also coming from the closer cooperation among some BRICS countries on the currency issue that they will discuss next month.” The move towards de-dollarization has been ongoing for quite some time and is becoming more urgent for some countries.”

Gold price chart.

Reference: Reuters

The Greenback Takes a Tumble: Will the State Bank Step In to Buy?

The recent loosening of monetary policy by the State Bank of Vietnam (SBV) in the context of a sharp decline in exchange rates has led to speculation that the central bank may buy USD at a higher price at the Trading Center to boost foreign exchange reserves. This move is expected to enhance the liquidity of VND in the commercial banking system, ensuring a more stable and robust financial environment.

Deputy Prime Minister: Comprehensive Environmental Impact Assessment of the Can Gio ‘Mega Port’

As the Can Gio port project is associated with Vietnam’s first-ever World Biosphere Reserve, it holds immense value and significance for Ho Chi Minh City and the region. Due to its potential environmental implications, Deputy Prime Minister Tran Hong Ha has emphasized the need for a thorough and comprehensive assessment of its environmental impact.