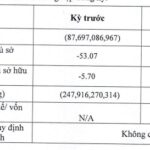

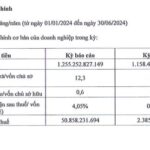

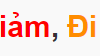

TNR Holdings Vietnam JSC announced its financial statements for the first half of 2024, with a post-tax profit of nearly VND 6 billion, down 93% over the same period in 2023. As a result, the after-tax profit margin (ROE) also decreased from 3.86% to 0.22%.

In 2022, the company impressively earned a profit of over VND 464 billion, then decreased by 81% to over VND 86 billion in 2023.

Source: Consolidated

|

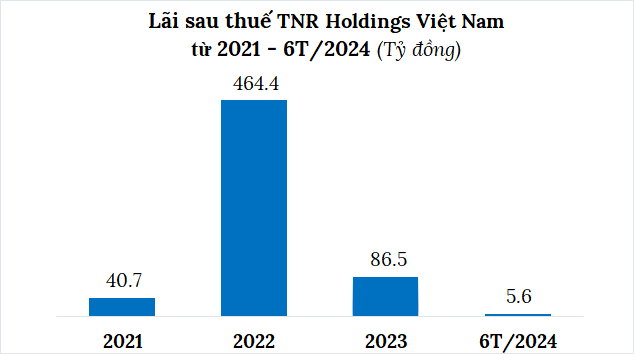

As of June 30, 2024, TNR Holdings Vietnam’s equity was nearly VND 2,593 billion, up 18% over the same period last year. The debt-to-equity ratio increased from 8.66 to 11.06 times, equivalent to VND 28,678 billion in debt; of which, bond debt was about VND 9,309 billion.

Source: Consolidated

|

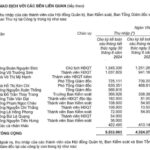

According to data from the Hanoi Stock Exchange (HNX), TNR Holdings Vietnam has issued a total of 469 lots of bonds in the 2017-2021 period, with terms ranging from 2 to 7 years and interest rates ranging from 9.15% to 10.9%.

Of these, 323 lots of bonds have been redeemed, and 146 lots are still outstanding. The most recent bond issuance by TNR Holdings Vietnam was in 2021, with a total of 5 issuances with a total par value of VND 2,300 billion, a term of 7 years, and an interest rate of 10% per annum.

The company also spent more than VND 546 billion to pay interest on 95 lots of bonds in the first half of this year.

TNR Holdings Vietnam is a member of ROX Group Joint Stock Company, established on June 6, 2016, with a capital of VND 20 billion. In early December 2017, the Company increased its capital to VND 500 billion. According to HNX, the company currently has a charter capital of VND 2,000 billion, with Mr. Ha Dang Sang as General Director and legal representative.

The company has many real estate projects across the country, such as TNR GoldSeason (Thanh Xuan, Hanoi), TNR Goldmark City (Bac Tu Liem, Hanoi), TNR GoldSilk Complex (Ha Dong, Hanoi), TNR The GoldView (District 4, Ho Chi Minh City), TNR Stars Le Ninh (Le Thuy, Quang Binh), TNR Stars Dong Van (Duy Tien, Ha Nam), TNR Stars Tan Truong (Cam Giang, Hai Duong), TNR Stars Riverside (Nam Sach, Hai Duong), TNR Stars Center Cao Bang (Hop Giang, Cao Bang), TNR Stars Thoai Son (Thoai Son, An Giang), and more.

Thin profit, two enterprises related to ROX Group owe more than VND 57,000 billion

“BB Sunrise Power Plagued by Losses, Negative Equity Exceeds VND 200 Billion”

BB Sunrise Power, owned by Chairman Vu Quang Bao, reported a loss of over 134 billion VND in the first half of 2024, with a negative equity of 222 billion VND. The company is facing financial challenges, and its future remains uncertain. With losses continuing to mount, the company’s survival hangs in the balance.