Farewell to a Longstanding Board Member

The General Meeting of Shareholders approved the resignation of Mr. Ronald Nguyen Anh Dat from the Board of Directors, effective September 16th. Prior to this, on August 22nd, Mr. Dat had submitted his resignation from the position, just two months after passing on the chairmanship of VTSS to Ms. Nguyen Thi Thanh Thuy.

Mr. Ronald Nguyen Anh Dat (born in 1972), an Australian national, served as Chairman of VTSS from September 2015 until his resignation at the Extraordinary General Meeting of Shareholders on July 1st, 2024, marking almost nine years in the position.

Additionally, the General Meeting of Shareholders approved the resignation of two members of the Supervisory Board, Ms. Pham Thi Le Minh and Mr. Nguyen Anh Minh, also effective from September 16th.

In a related development, the General Meeting of Shareholders elected two new members to the Board of Directors, Mr. Nguyen Thanh Phu and Mr. Le Quoc Trung, and up to three new members to the Supervisory Board, Mr. Pham Truong Tan Duc, Ms. Vo Thi Luy, and Ms. Nguyen Vu Thuy Ngan.

In another recent personnel change, on September 17th, Mr. Le Quang Tien submitted his resignation from the position of General Director. Mr. Tien had served as General Director of VTSS since June 2014, following a stint as Deputy Head of Brokerage at VTSS from March 2007 to May 2014.

A Change of Name, Headquarters Relocation, and Capital Increase to 3,000 Billion VND

Another important agenda item was the change of the company’s name from Vietnam Securities Joint Stock Company to VTG Securities Joint Stock Company, with the English name VTG Securities Corporation, abbreviated as VTGS.

Simultaneously, the company’s headquarters will relocate from the 1st and 2nd floors of 40 Phan Boi Chau, Hoan Kiem District, Hanoi, to a new address in Ho Chi Minh City: 1st floor and mezzanine of Ben Thanh Tower, 172 – 174 Ky Con Street, Nguyen Thai Binh Ward, District 1.

Ben Thanh Tower – New Headquarters of VTSS

|

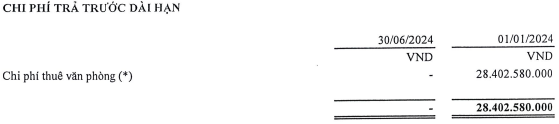

In the reviewed financial statements for the first six months of 2024, VTSS no longer recorded office rental expenses of over 28 billion VND due to the termination of the lease agreement with Ms. Hoang Ngan Ha and the refund of prepaid expenses.

Source: VTSS’s Reviewed Financial Statements for the First Six Months of 2024

|

Ms. Hoang Ngan Ha is the wife of the former Chairman, Mr. Ronald Nguyen Anh Dat, and a former member of the VTSS Board of Directors, who was also relieved of her duties in August 2024. Two months prior, Ms. Ha divested her entire 50% stake in VTSS. Following this transaction, VTSS’s ownership structure changed significantly, with TIN Global Pte. Ltd. (Singapore) and Minh Thanh Tourism Joint Stock Company holding 49%, and Ms. Nguyen Thi Thuy Trang holding the remaining 2%.

|

Changes in VTSS’s Ownership Structure over the Past Year

Source: Compiled by the Author

|

Another notable item on the agenda was the approval of a plan to privately offer 286.2 million shares (20.74 times the current number of shares) to strategic investors and professional securities companies. If successful, VTSS’s charter capital will increase from 138 billion VND to 3,000 billion VND, a 21.74-fold increase.

These recent moves evoke memories of the transformative period between 2009 and 2010, which witnessed significant changes for VTSS.

Specifically, in 2009, VTSS officially relocated its headquarters to 40 Phan Boi Chau. At that time, VTSS stated that the new facility, equipped with modern amenities, would best serve securities investors. In October 2010, VTSS received approval from the State Securities Commission to increase its charter capital from 71.4 billion VND to 138 billion VND.

Adding Securities Proprietary Trading and Underwriting Businesses

The General Meeting also approved the addition of securities proprietary trading and underwriting businesses. Currently, VTSS holds licenses for securities brokerage and securities investment advisory services.

The submission of the application for additional business operations will take place after the company meets the capital requirements and complies with other relevant regulations as stipulated by the law.

Furthermore, VTSS shareholders approved depositing 106 billion VND in savings at credit institutions, including banks and non-bank credit institutions, with flexible terms based on the company’s actual business situation.

In fact, VTSS has consistently maintained a high proportion of cash and cash equivalents in its asset structure in recent years, with an increasing trend. As of June 30, 2024, VTSS recorded over 113 billion VND in cash and cash equivalents, accounting for nearly 98% of total assets, almost entirely in bank deposits for the company’s operations.

| Increasing Proportion of Cash and Cash Equivalents in VTSS’s Asset Structure |