South Korea’s Exporters Struggle to Compete with Chinese Rivals

South Korea, known for its diverse exports ranging from steel to petrochemicals, textiles, and cosmetics, is facing difficulties in competing with rival products from China. This challenge is a result of overproduction and a slowdown in domestic demand.

Notably, even South Korea’s kimchi producers – a symbolic dish of the nation – are feeling the pressure. South Korea imported more kimchi in the first half of 2024, mostly from China, than it exported. This is due to the intense competition from cheaper Chinese products that are up to six times less expensive than their South Korean counterparts.

South Korea was predicted to benefit from the rising trade tensions between China and the West as the US and Europe continued to impose tariffs and hinder China’s access to next-generation technologies. South Korea’s export value had been increasing month-over-month since October of last year.

However, trade experts attribute most of this growth to the high demand for memory chips, South Korea’s top export. In other sectors, South Korean exporters are losing market share to lower-cost competitors from China.

Yeo Han-koo, former South Korean trade minister and current researcher at the Peterson Institute for International Economics in Washington, stated, “Much of the narrative about China’s overcapacity has focused on its trade disputes with the West, as well as electric vehicles, solar energy, and batteries.” He further added, “But this is an issue that is impacting the entire global economy and is much broader than just the green industry.”

According to a survey of manufacturing companies published by the Korea Chamber of Commerce and Industry (KCCI) last month, 70% of the companies anticipated damage to their business operations due to China’s exports.

Much of this competition is occurring in markets such as Southeast Asia, the Middle East, Central Asia, and Latin America, where Chinese exporters are seeking growth to counter overcapacity and sluggish domestic demand.

Data from the Korea International Trade Association (KITA) revealed that China’s average export price globally declined monthly from January 2023 to April this year, falling by 10.2% overall. In contrast, South Korea’s export prices only decreased by 0.1% during the same period.

China’s average export price globally declined monthly from January 2023 to April 2024

Do Won-bin, a researcher at KITA, commented, “China’s redirection of exports away from the US and Europe is a double-edged sword for us.” He added, “We have more export opportunities to the US due to China’s absence, but China’s exports to countries like Saudi Arabia, Brazil, and Kazakhstan have increased significantly this year, challenging South Korean companies in those markets.”

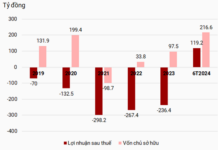

South Korean steel manufacturers have been particularly hard-hit as the increasing competition from China coincides with a slowdown in the domestic construction industry.

Hyundai Steel reported a 78.9% decrease in operating profit year-over-year in Q2, while Posco’s steel division reported a 50.3% drop, and Dongkuk Steel experienced a 23% decline. According to the Korea Iron and Steel Association, the average price of Chinese steel is $863 per ton, compared to $2,570 per ton for South Korean steel.

South Korea’s leading petrochemical companies are also struggling, with some halting production, exiting joint ventures, and postponing expansion plans due to mounting losses in their core businesses.

Do emphasized that South Korean companies need to differentiate their products through quality. However, the KCCI survey revealed that South Korean manufacturers are also losing confidence in their ability to maintain their advantage. Only 26.2% of the companies maintained their technological and quality advantage over Chinese competitors in the past five years, and 73.3% expect to be overtaken in the next five years.

South Korean companies are increasingly fighting back through legal means, filing more anti-dumping and patent infringement complaints against Chinese rivals.

According to the Ministry of Industry, South Korean companies, led by the steel, petrochemical, and battery industries, are on track to record the highest number of anti-dumping cases against Chinese competitors since 2002, the year after China joined the World Trade Organization. China accounted for 10 out of 12 significant technology leak cases identified by the Korea National Police Agency this year.

Choi Byung-il, a trade expert and honorary professor at Ewha Womans University, stated, “Until recently, South Korea was comfortable with Chinese investment despite the risk of technology leaks.” He added, “But now, the country needs more sophisticated measures for its economic security – a more active role from the government to create a level playing field.”

Financial Times