According to information from Dabaco Group JSC (Ticker: DBC), the company’s revenue for August 2024 surpassed 2,024 billion VND, an 11% increase compared to July.

Revenue for the second month of Q3 2024 rose 12% from the previous two months and increased 33% year-over-year. The animal feed and pig farming sectors remained the primary contributors to this growth.

The Group’s leadership has instructed its units to focus on implementing key solutions to accelerate and make a breakthrough in the remaining months, determined to accomplish the 2024 business plan with a revenue target of 25,380 billion VND and a profit-after-tax goal of 729.8 billion VND, setting a foundation for the following year.

Dabaco’s modern animal feed factory in Tien Du district, Bac Ninh province. Source: Dabaco.

Dabaco, formerly a state-owned enterprise established in 1996, was privatized in 2005. Since then, the company has successfully developed an integrated value chain encompassing breeding, animal feed production, contract farming, and meat processing.

One of Dabaco’s significant breakthroughs was investing in modern farming technology, particularly the closed-loop “3F” (Feed – Farm – Food) model. This model enables the company to maintain tight control over quality, from raw materials to the final product, ensuring food safety and hygiene. However, raw material prices and diseases remain significant risks for this sector.

Impressive Growth Followed by Navigating Market Volatility

In reality, Dabaco has witnessed notable growth in recent years. After privatization, the company reported a profit of over 10 billion VND in 2006, which surged to 176.3 billion VND in 2010—a 17.6-fold increase. Dabaco achieved its highest profit after tax of 1,400 billion VND in 2020.

The record profit in 2020 was mainly attributed to the upward trend in pork prices and the recovery of the livestock industry from the impact of the African Swine Fever.

However, in 2021, the COVID-19 pandemic severely affected production and business operations, trade, transportation, and consumption. Particularly, agricultural enterprises faced a double challenge of diseases affecting both humans and livestock. The market purchasing power declined sharply, leading to a decrease in livestock and poultry production and prices, resulting in a 41% drop in Dabaco’s profit for 2021, reaching just over 829 billion VND.

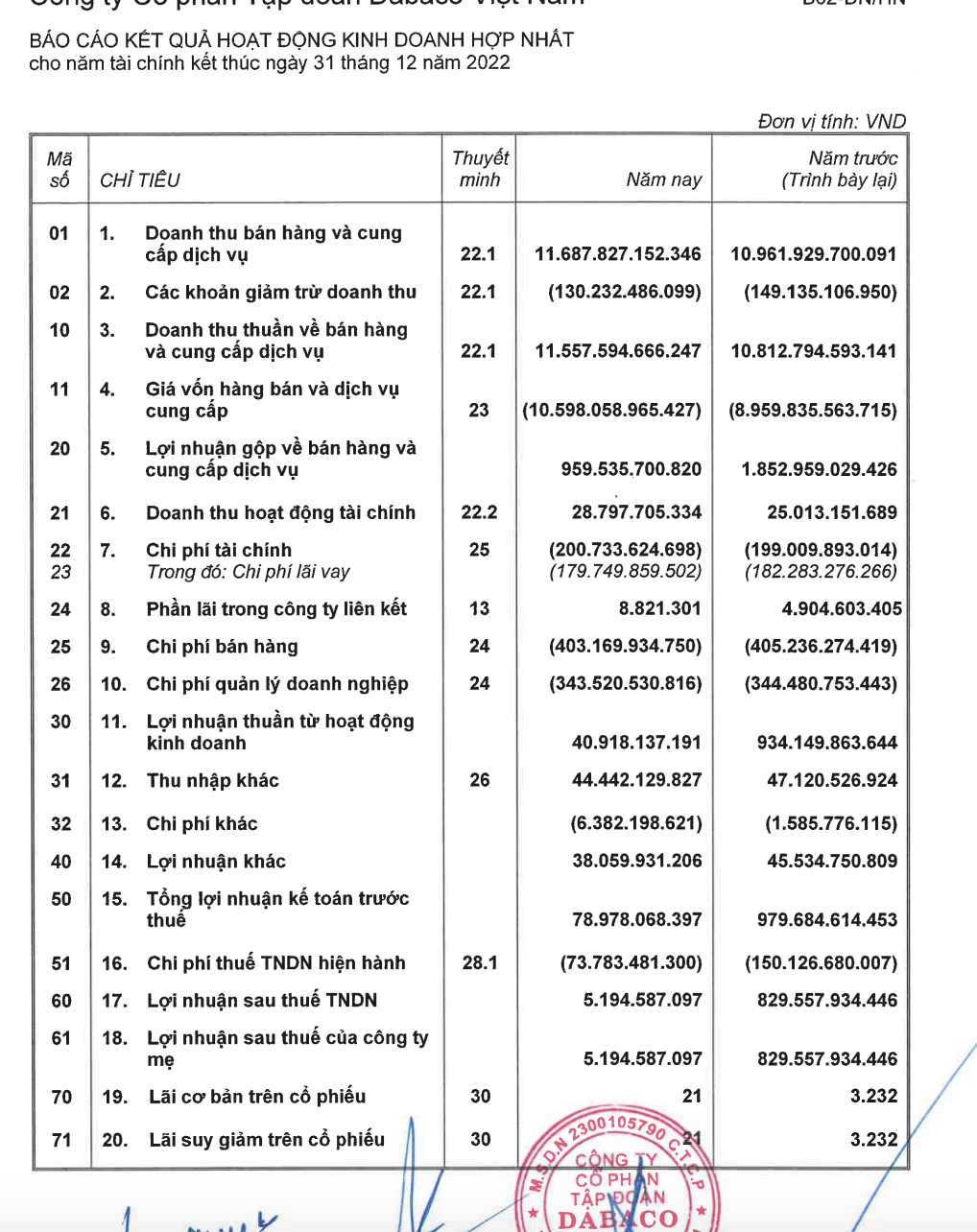

In 2022, while the company’s net revenue grew by nearly 7% to 11,558 billion VND, its profit after tax plummeted by 99.4% to a mere 5.2 billion VND, equivalent to a decrease of nearly 824 billion VND. Compared to the targeted profit of 918 billion VND for 2022, the company achieved less than 1% of its plan.

Despite revenue growth, Dabaco’s profit after tax in 2022 “evaporated” by 99.4% to 5.2 billion VND, the lowest since privatization, due to rising raw material and transportation costs. Source: DBC’s 2022 Audited Financial Statements.

According to DBC, the company’s profit plunge in 2022 resulted from soaring raw material and transportation costs, complex diseases in livestock and poultry, sluggish consumption of livestock products, and low selling prices, prompting farmers to scale down or cease production, directly impacting the performance of the group’s units.

During the year, the company continued to invest heavily in development and expansion projects, such as the high-tech commercial pig breeding and raising area. Construction costs tripled to 1,397.7 billion VND, mainly due to increases in projects like the Thanh Hoa breeding project, which rose from 76.7 billion VND to 780.2 billion VND; the Dabaco Phu Tho pig breeding project – phase 3, which increased from 23.5 billion VND to 192.1 billion VND; the oil mill project phase 2, which recorded 99.1 billion VND; and the vaccine factory project, which accounted for 84.8 billion VND…

In tandem with substantial investments in these projects, DBC’s debt also increased significantly by the end of 2022, with total debt reaching nearly 4,591 billion VND, a 39.7% surge from the beginning of the year, equivalent to an increase of over 1,304 billion VND.

After a year of steep decline, in 2023, Dabaco continued to pursue its strategy of developing in the fields of agriculture and food under the closed-loop 3F (Feed – Farm – Food) model and expanding projects in related fields while seizing opportunities in other sectors to enhance production and business efficiency.

For 2023, Dabaco set a profit-after-tax target of 569 billion VND, more than 109 times higher than the previous year’s performance. However, in reality, while the company achieved a profit 4.8 times higher than the previous year, it only accomplished 4.4% of its ambitious 569 billion VND profit goal.

In 2024, Dabaco aims for a total revenue of 25,380 billion VND (including internal consumption) and a profit-after-tax target of nearly 730 billion VND.

The basis for Dabaco’s ambitious goals lies in expanding farm scales and developing vaccines against African Swine Fever (ASF). The successful commercialization of this vaccine could provide a new revenue stream for the business, along with diversifying other income sources such as real estate and construction.

As of the end of the first half of 2024, Dabaco recorded net revenue of 6,437.3 billion VND, an increase of 11.2%, and a profit after tax of 218 billion VND, 36.3 times higher than the same period last year, thus achieving 30% of the annual profit plan.

Dabaco attributed this growth to improved prices and consumption of certain domestic food products and relatively stable piglet prices in the first six months of 2024. Additionally, the Group’s companies in the livestock sector implemented a synchronized biosecurity farming process, from animal feed production to ensuring compliance with all farming conditions at the farm, and strict control over transportation and disease prevention, resulting in improved productivity, quality, and cost savings compared to the previous year.

As of June 30, Dabaco’s total assets amounted to 13,326.3 billion VND. Short-term assets reached 7,385 billion VND, an increase of 284 billion VND from the beginning of the year, mainly comprising inventory valued at 5,827.2 billion VND. Within DBC’s inventory structure, the increase of 27.5% in raw materials and supplies to 1,117.5 billion VND suggests that the company may be stockpiling production inputs to cope with market fluctuations. The company’s construction in progress also rose by 46% from the beginning of the year to 697 billion VND.

Regarding capital sources, as of the end of Q2 2024, DBC’s total liabilities stood at 8,441 billion VND, including short-term liabilities of 7,354.5 billion VND, a 3% increase from the beginning of the year.

DBC’s financial debt was approximately 6,667 billion VND, primarily short-term debt of 5,749 billion VND, a 19% rise from the beginning of the year, equivalent to an increase of 903 billion VND. Long-term debt decreased by 10.6% to 917.7 billion VND.

Despite the increase in short-term debt, Dabaco maintained a stable solvency position with a current ratio of approximately 1, indicating sufficient ability to meet short-term debt obligations with current assets.

Earlier this September, Dabaco announced changes to its business registration certificate. Consequently, the company’s charter capital increased from 2,420 billion to nearly 3,346.7 billion VND due to the issuance of shares to existing shareholders and the employee stock ownership plan.

The Sa Pa Airport Project: Seeking Investors for Takeoff

The Lao Cai province had set its sights on commencing construction of the Sa Pa Airport in 2023. However, due to a lack of investor interest, the project remains grounded. With a projected payback period of nearly 44 years, the local government is now seeking adjustments to the investment policy to make the airport a reality.