Hanoi Stock Exchange (HNX) has recently announced the cancellation of the registration for trading of over 64.3 million PTX shares of Petrolimex Nghe Tinh Transportation and Services JSC. The cancellation took effect on September 30, with the last trading day on the UPCoM system being September 27.

The reason for the cancellation of the trading registration is that Petrolimex Nghe Tinh Transportation and Services JSC has been approved for listing on the Hanoi Stock Exchange (HNX).

The PTX shares were listed on the UPCoM since July 30, 2018, but were almost illiquid. It was not until the last four months that the shares started to see some movement, with several trading sessions in mid-August recording tens of thousands of matched orders.

Despite the low liquidity, PTX has been the best-performing stock on the Vietnamese stock market so far this year.

At the close of the trading session on September 20, PTX shares stood at VND15,900 per share, slightly lower than the previous session, but still nearly 32 times higher than the price at the beginning of the year (up nearly 3,100%). Thus, PTX is still about 26% away from its peak of VND21,400 per share on August 23.

In a clarification announcement regarding the five consecutive ceiling price increases in mid-July, the company stated that the sharp rise in its share price was mainly due to supply and demand factors in the stock market. The company emphasized that there were no direct influences or impacts on the trading price in the market.

According to our understanding, Petrolimex Nghe Tinh Transportation and Services JSC is a member of Petrolimex Vietnam and was established through the equitization of a state-owned enterprise, according to Decision No. 1364/2000/QD-BTM dated October 3, 2000, by the Ministry of Industry and Trade.

The company officially started trading on the UPCoM in 2018. After several rounds of capital increases, PTX currently has a charter capital of nearly VND64 billion, of which its parent company, Petrolimex Services Joint Stock Company, holds 3.2 million shares, equivalent to 51%.

The company’s main business activities include petroleum transportation, wholesale and retail of petroleum products, and vehicle driving training and testing. Petroleum transportation is its core business, with a fleet of 81 vehicles serving the transportation and supply of petroleum products to Nghe An, Ha Tinh, part of Thanh Hoa and Quang Binh provinces, and Laos.

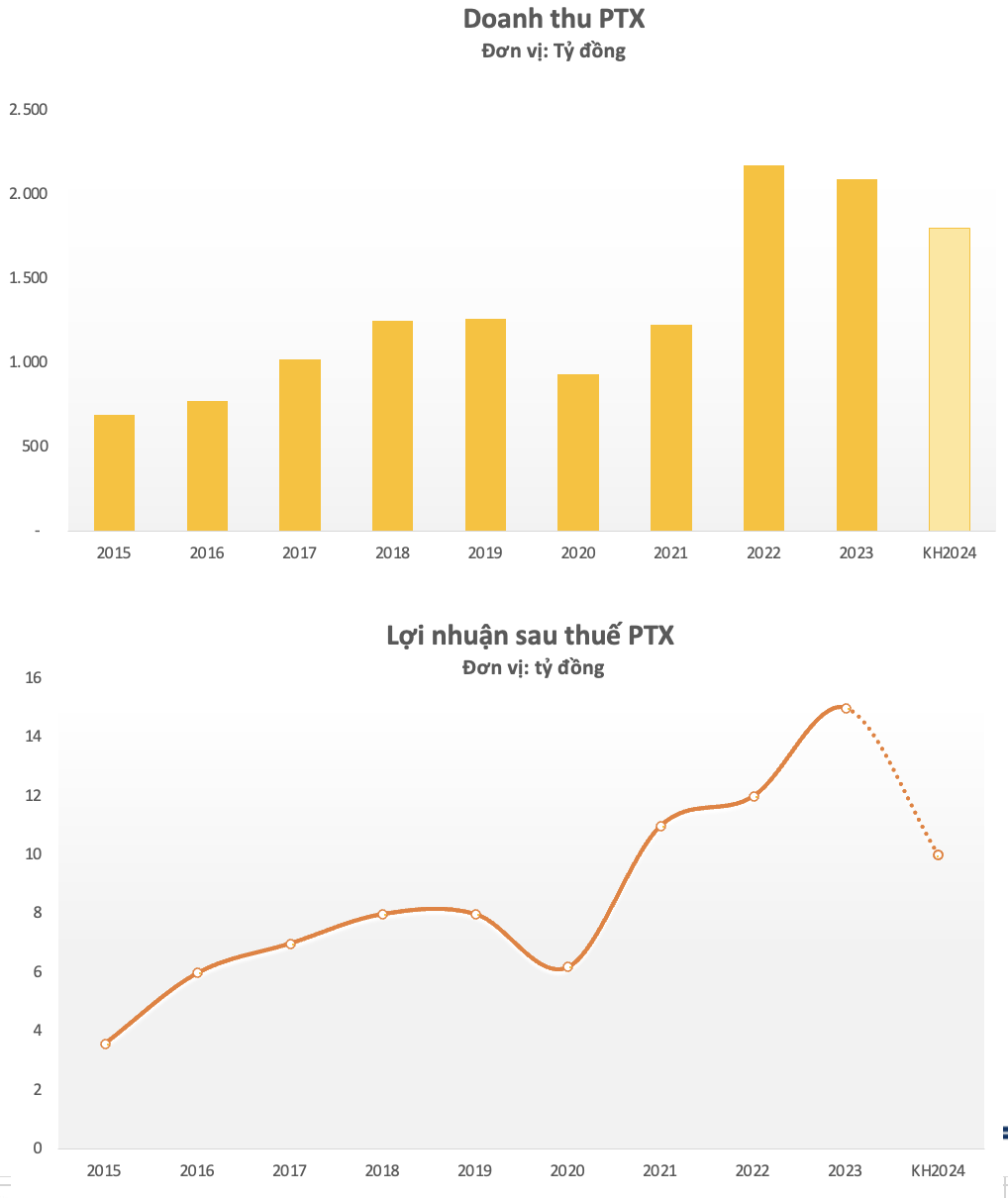

As a leading company in the petroleum trading and transportation industry, PTS Nghe Tinh has been generating thousands of billions of dong in revenue annually (except for 2020 due to the impact of COVID-19). 2020 was also the only year the company experienced a decline in profit growth in the last decade. In 2023, the company’s after-tax profit surged by more than 21% to VND12.5 billion, the highest in its operating history.

For 2024, the company expects to achieve revenue and pre-tax profit of VND1,843 billion and VND10.4 billion, respectively, down 12% and 14% compared to the previous year. The expected dividend payout ratio is 10%, lower than in 2023.

According to the semi-annual financial report for 2024, PTX’s revenue in the first six months of this year reached VND1,075 billion, up 4% over the same period last year. Its after-tax profit was VND7.56 billion, an increase of 38% year-on-year. Despite the profit increase, the company’s gross profit margin remains thin, improving from 6% to 7% in the first half of the year.

The Gourmet Chairman Pledges $4 Million to Buy HNF Shares

Mr. Trinh Trung Quyet, Chairman of the Board of Directors of Huu Nghi Food JSC, has announced his intention to purchase an additional 3.5 million HNF shares, increasing his ownership stake to 39.09%. This move underscores Mr. Quyet’s confidence in the company’s prospects and his commitment to its long-term growth. With a strong track record in the food industry, Huu Nghi Food JSC is well-positioned for success, and Mr. Quyet’s increased investment highlights the company’s potential for expansion and profitability.