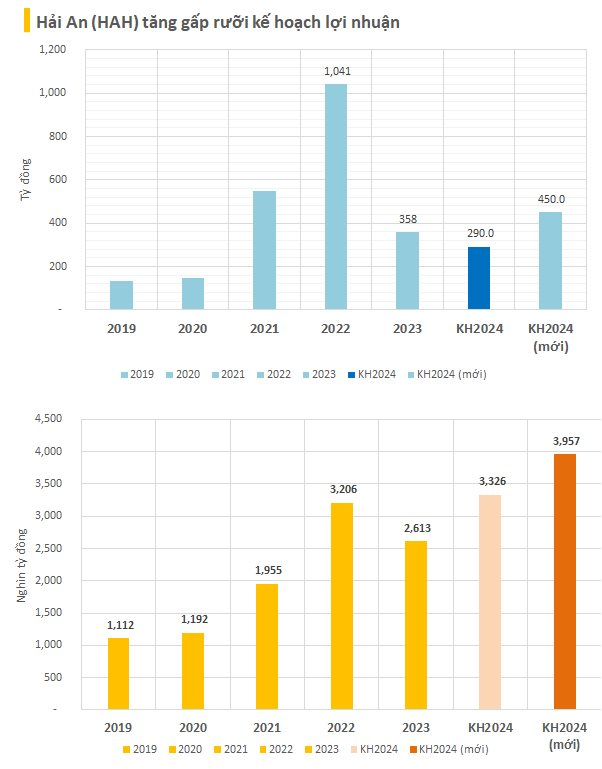

The Board of Directors of Hai An Shipping and Stevedoring JSC (stock code: HAH) – Vietnam’s largest container shipowner – has recently announced an adjusted business plan for 2024. Accordingly, the company has raised its revenue target to VND 3,957 billion and aims for a net profit of VND 450 billion, an increase of 19% and 55%, respectively, from the previous plan.

This adjusted plan also represents a significant surge of 51% in revenue and 25.7% in net profit compared to the company’s performance in 2023.

Furthermore, the Hai An Board has approved the investment in purchasing used container ships of the Panamax type (3,500-5,000 TEU) to prepare for the expansion of its business operations.

For the first half of the year, Hai An reported consolidated net revenue of VND 1,653 billion, a 30.5% increase year-over-year. However, net profit attributable to parent company shareholders decreased by 21% to VND 176 billion. Thus, the company has accomplished 58% of its revenue plan and 38% of its profit target for the year.

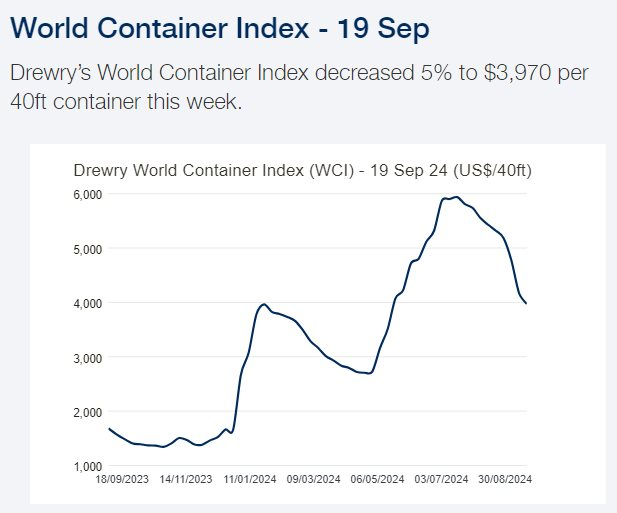

Hai An’s management attributed the profit decline primarily to lower charter rates and higher operating costs, which resulted in increased freight rates in the first quarter of 2024.

Container freight rates are declining after peaking in early Q2 but remain twice as high as last year.

Unlocking Profits: FPT’s August Success Story with Overseas IT Services

As of August 2024, FPT has successfully secured 29 large-scale projects, each valued at over $5 million. This impressive feat highlights the ever-growing global demand for technology investments and cements FPT’s position as a leading technology provider.