Vietnam’s economy since the Renovation (1986) has witnessed a remarkable transformation, evolving from a low-income country with an average income of just around $95, according to the World Bank, to a lower-middle-income country. In 2023, this figure had risen to $4,180, officially entering the upper-middle-income group. With 16 free trade agreements in force and over 60 partners, Vietnam has become one of the world’s top 20 countries in terms of international trade, a stark contrast to its pre-1986 image as a closed and isolated economy.

Continuing on this development journey, the 13th National Congress Representatives (January 25 – February 1, 2021) set even more ambitious goals. Accordingly, by 2045, Vietnam will become a developed country with high income. On the other hand, Vietnam, along with 147 other countries at the COP26 conference, committed to the goal of net-zero emissions by 2050.

Facing these high goals, Vietnam also has many advantages for development. Vietnam is becoming an attractive destination for foreign investors, with a young and educated population. In addition, favorable geographical location and economic diplomatic efforts create many great opportunities, with many “big players” choosing Vietnam as an investment and cooperation destination.

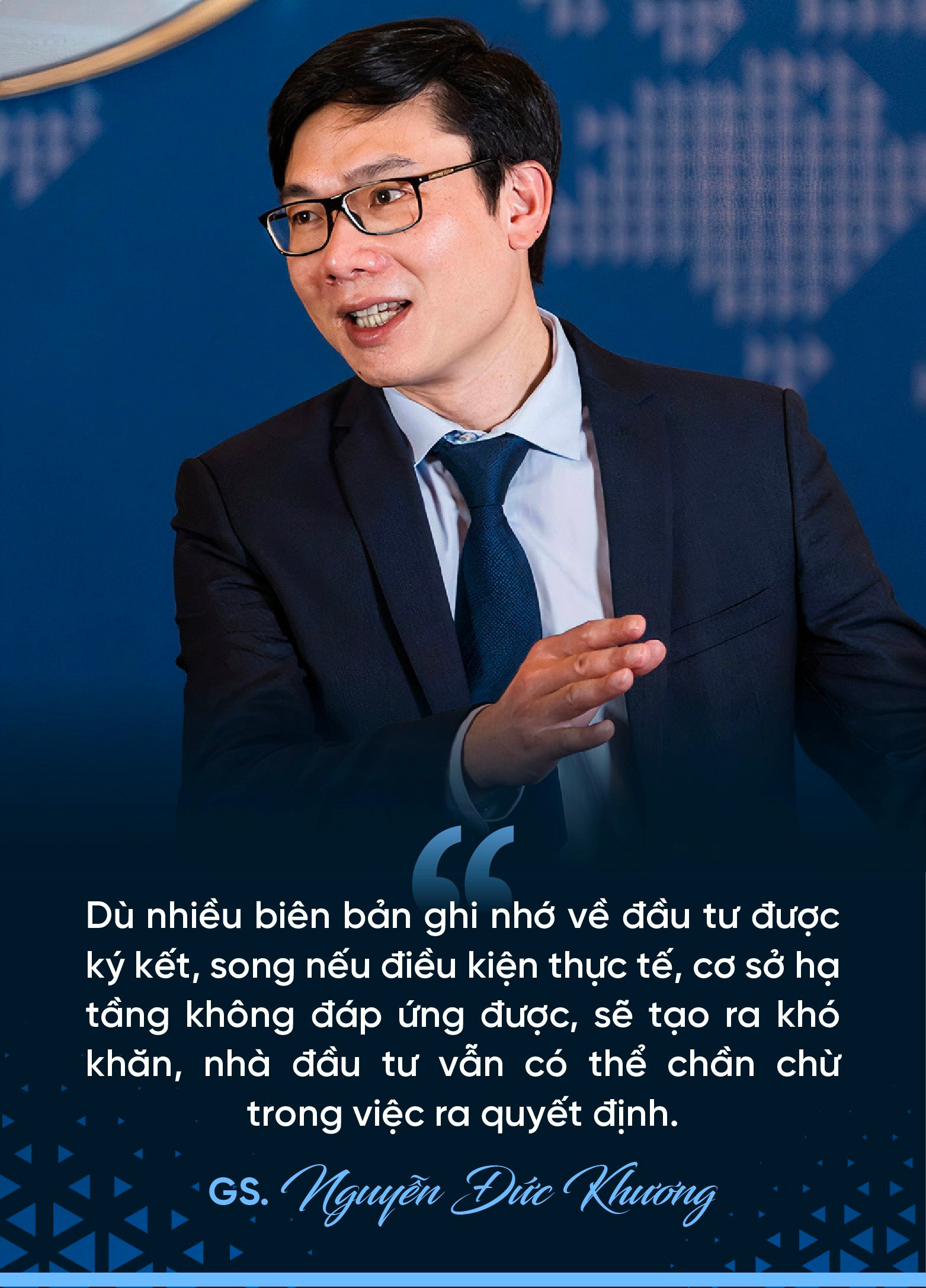

However, to turn these opportunities from both domestic and foreign sources into benefits for Vietnam, according to Prof. Nguyen Duc Khuong, Chairman of AVSE Global, Director of EMLV Business School (Paris, France), the number one factor is infrastructure, both hard and soft infrastructure.

“For now, we need to build hard infrastructure to connect bridges, ports, roads, and solve problems related to transportation, power supply, water… These are essential needs for large corporations to bring production bases here,” shared Prof. Nguyen Duc Khuong, adding that despite the signing of many memoranda of understanding on investment, if the actual conditions and infrastructure are not met, it will create difficulties, and investors may still hesitate to make decisions.

The Provincial Competitiveness Index (PCI) report of VCCI over the years has pointed out that the quality of infrastructure is not yet a comparative advantage for Vietnam in the eyes of foreign investors when considering investment locations, although there have been improvements in recent years.

To meet the investment needs in socio-economic development under the condition of limited state budget resources, a solution chosen by many countries in the world is to attract the private sector to participate in socio-economic development , especially in investing in infrastructure development in the form of public-private partnerships (PPP). This is very meaningful for developing countries, as PPP supports the necessary capital investments without increasing public debt, thereby promoting projects, especially infrastructure investment projects, under the condition of mobilizing capital and resources from society.

Collaboration between the public and private sectors can leverage the strengths of both sides, with the private sector bringing its experience, skills, modern technology, and management capabilities. In addition, the participation of the private sector is considered one of the effective ways to implement sustainable development activities and enhance competitiveness.

In the past, the private sector in Vietnam has contributed significantly to the investment in the development of the country’s transport infrastructure. Many new infrastructure projects have demonstrated the effectiveness of the PPP model, especially expressways and road tunnels, giving people better travel options and contributing to local economic activation.

Some sections of the Bac Giang – Lang Son, Trung Luong – My Thuan, Nghi Son – Bai Vot, and Cam Lam – Vinh Hao expressways belonging to the North-South Expressway Phase 1, a series of large tunnels running along the central region, such as Co Ma to Deo Ca, Cu Mong, and Hai Van 2 tunnels connecting Thua Thien Hue and Da Nang… and the Vinh Phuc ICD Dry Port and Bach Dang Bridge spanning the Bach Dang River on the Ha Long – Hai Phong expressway are typical projects that have received private investment.

Along with this, in recent years, the Prime Minister has issued a series of decisions approving the policy and investors for construction investment and business infrastructure of industrial parks in many localities nationwide, and the private sector has also made significant contributions to the construction of this industrial infrastructure.

However, there are still institutional, policy, and implementation-related obstacles that make attracting private investors less vibrant in some fields. Typically, one of the most challenging areas to attract private investment is aviation. Some aviation experts believe that private investment in aviation is like “walking in the dark,” meaning that investors are unclear about administrative procedures and investment procedures, and localities do not know how to implement socialization schemes. An airport project may take more than 40 years to recoup its investment, and of the airports operated by ACV, only 6 are profitable, while 16 are operating at a loss.

After 10 years of discussing aviation socialization, Vietnam has only had 2 PPP projects: Van Don International Airport and Quang Tri Airport. T&T Group’s investment in Quang Tri Airport is a positive signal because before Quang Tri, after more than 5 years of operation, Van Don Airport – the first PPP airport – has not had any other airport successfully invested in under the PPP model. Although Sa Pa Airport was inaugurated more than 2 years ago, after 2 invitations to bid, there are still no investors as of now. The locality explained that investing in airport infrastructure requires a large amount of capital, while the capital recovery period is prolonged, making many investors hesitant, especially due to the impact of the Covid-19 pandemic and difficulties in the real estate sector.

Although investing in infrastructure is still a “narrow gate” for private investors, the reality shows that there are still investors interested and determined to implement it.

“Investing in infrastructure is still a difficult problem for private investors, as there are still many issues that need to be addressed. However, along with Quang Tri Airport and a series of other infrastructure projects that we are promoting and interested in investing in, T&T Group always demonstrates its determination when assigned to implement projects and hopes to work with the Government and localities to find the best way to implement these projects,” affirmed Mr. Do Quang Hien, Founder and Chairman of the T&T Group Strategy Committee.

According to Mr. Edward Clayton, Deputy General Director and Leader of Project Investment and Infrastructure Advisory Services, PwC Vietnam, the participation of the private sector is also essential in developing sustainable infrastructure, especially in areas with limited public resources. With their financial resources, expertise, and capabilities, private entities can help bridge the infrastructure gap and support the transition to sustainable development.

Prof. Tran Dinh Thien, former Director of the Vietnam Economics Institute, said: “If we support private enterprises by creating favorable conditions for them to participate in important projects, these enterprises will achieve excellent results.”

“The Role of Private Sector Participation in Vietnam’s Infrastructure Projects on its Path to Becoming a Dragon Economy by 2045”

“At a time when ambitious development goals demand extensive resources, attracting private investment is crucial to alleviating the burden on the public sector. This strategy plays a pivotal role in addressing the pressing need for infrastructure investment, notably in transportation. By doing so, we can enhance the country’s economic competitiveness and improve the quality of life for its citizens.”

“Sprint to Success: 3,000 km of Expressway in 500 Days”

Vice Prime Minister Nguyen Hoa Binh signed Decision No. 1008/QD-TTg on September 19, 2024, to launch a special campaign, “500 Days and Nights to Build 3,000 Kilometers of Expressways.”

The New Auctioned Land in Hanoi: A Post-Cancellation Opportunity?

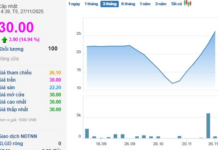

The 32 land lots offered by Me Linh District, Hanoi, for auction witnessed a thrilling bidding war, with the highest successful bid reaching an impressive 48.9 million VND per square meter, almost double the starting price. The intense interest in these lots is a testament to their desirability, with even the lowest successful bid standing at a substantial 33.3 million VND per square meter.