The market witnessed a surge in liquidity towards the end of the session, closing with a total trading value of nearly 19.9 trillion VND across the three exchanges, higher than the previous session.

The market breadth inclined towards the green, with 466 stocks rising (including 26 stocks that hit the ceiling price) and 255 stocks declining (including 15 stocks that hit the floor price), while the remaining 886 stocks were stagnant.

|

The top 10 stocks that positively impacted the VN-Index contributed 5.1 points to the index’s gain, led by BID, which added 0.77 points, followed by VHM with 0.64 points, and GVR with 0.6 points. Conversely, the top 10 stocks with negative impacts only took away more than 0.4 points.

Most sectors were painted green, led by media and entertainment, which rose by 5.15% thanks to the momentum from VNZ, continuing its recovery in recent days. This was followed by the hardware group, which increased by 3.84% due to POT’s gain of 8.09% and SMT’s rise of 1.85%.

The market also recorded another sector that rose by more than 1%—telecommunications. This growth was supported by CTR, which climbed by 3.41%, and VGI, which gained 1.82%. Meanwhile, among the sectors that increased by less than 1%, there was the presence of credit institutions, which, due to their large market capitalization, positively contributed to the overall result. On the other hand, only a few sectors declined, and most of them fell by less than 1%.

Foreign investors continued net buying today, with a value of more than 108 billion VND, notably MWG, with nearly 92 billion VND, and STB, with almost 65 billion VND. On the selling side, VND experienced the strongest net selling, but it did not exceed 48 billion VND.

Morning Session: Market Continues to Divergence

The tug-of-war hasn’t ended yet, as the market diverged amid weak liquidity. By midday break, the VN-Index hovered near the reference level, at 1,268.31 points, while the HNX-Index dropped 0.16% to 233 points. The market breadth was relatively balanced, with 325 declining stocks and 279 advancing stocks.

The matched volume of the VN-Index in the morning session reached just over 173 million units, equivalent to a value of more than 4 trillion VND. The HNX-Index recorded a matched volume of nearly 16 million units, with a value of over 259 billion VND.

In terms of impact, although the number of declining stocks dominated, the large-cap stocks didn’t show a very negative performance. Hence, CTG, ACB, and VNM, despite being the stocks with the most negative influence on the index, didn’t cause a significant impact. Conversely, VCB, GAS, and SSB were the main drivers, contributing more than 1.2 points to the VN-Index’s gain.

The most positive performance was observed in the telecommunications sector, which climbed by 1.27%. Buying interest focused mainly on VGI (+1.22%), CTR (+3.8%), and VNZ (+5.56%). Apart from this group, other sectors diverged and fluctuated within a narrow range, rising or falling by less than 0.5%.

In the essential consumer goods group, although the number of declining and stagnant stocks was slightly higher, the green of the stock with the largest market capitalization in the industry, MCH (+2.59%), helped the sector’s overall index rise by 0.38% at the end of the morning session. Most other stocks rose or fell by less than 1%. While SAB (+0.35%), MPC (+0.62%), QNS (+0.21%), MCM (+0.82%), ASM (+0.33%), among others, maintained their gains, VNM (-0.43%), MSN (-0.27%), KDC (-3.66%), DBC (-0.34%), PAN (-0.42%), ANV (-0.42%), and a few others, remained under selling pressure.

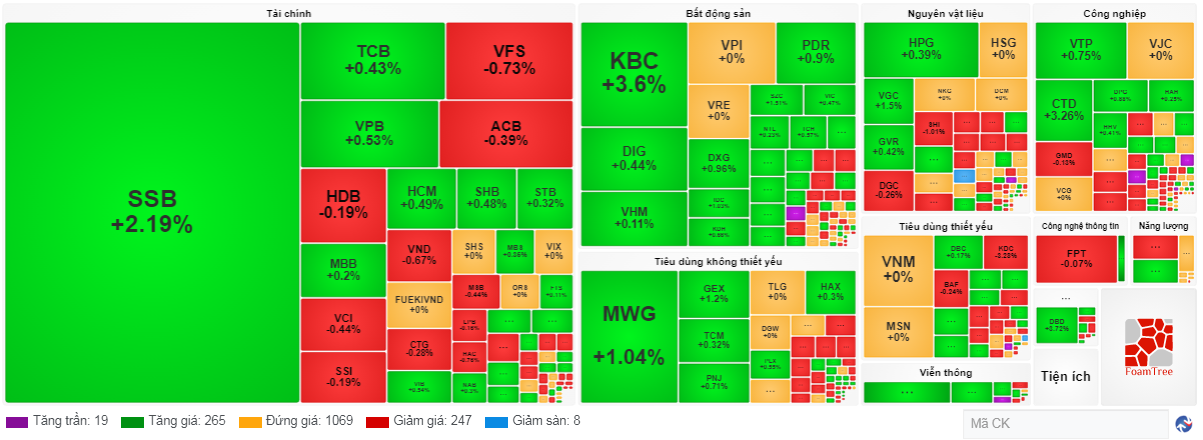

In the financial group, among the large-cap stocks, only SSB (+2.19%) saw a significant increase, while the rest mostly rose or fell slightly by less than 0.5%. On the declining side, the industrial, energy, and materials sectors dropped slightly by less than 0.3%.

Foreign investors net sold over 116 billion VND on the HoSE in the morning session, with VND being the stock that experienced the most net selling. On the HNX, they net sold over 7.5 billion VND, focusing their sales on IDC.

10:30 am: Liquidity Declines, Caution Prevails

Investors remained hesitant, resulting in unchanged trading volume. The main indices fluctuated around the reference level, with the VN-Index trading slightly above 1,269 points and the HNX-Index trading slightly below 233 points.

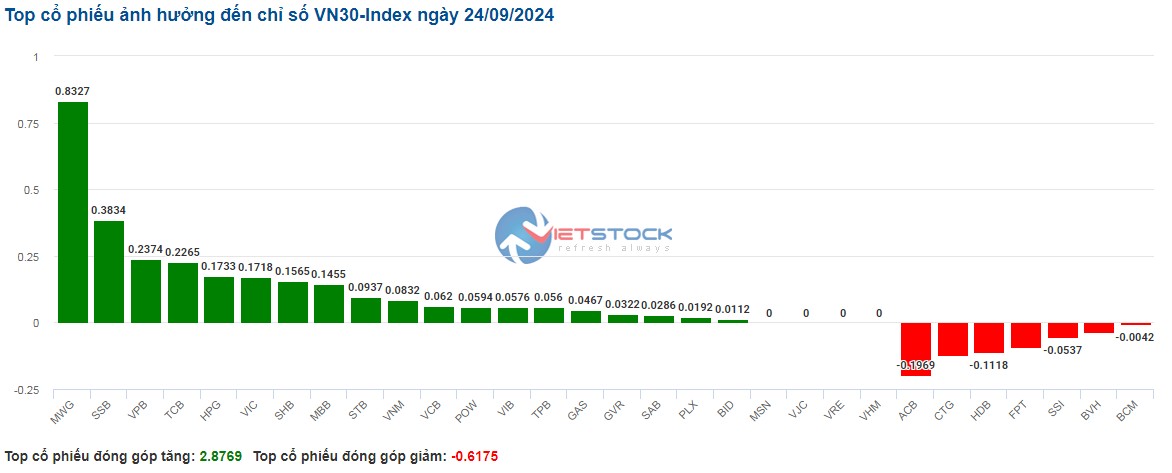

Stocks in the VN30 basket rose and fell interchangeably, but buying interest prevailed. Specifically, MWG, SSB, VPB, and TCB respectively contributed 0.83 points, 0.38 points, 0.24 points, and 0.23 points to the overall index. Conversely, ACB, CTG, HDB, and FPT faced selling pressure, taking away nearly 0.5 points from the VN30-Index.

Source: VietstockFinance

|

Maintaining the market’s upward trend was the telecommunications services sector, which witnessed the most significant increase of 1.72%. This growth was mainly driven by large caps VNZ (+7.26%), CTR (+2.79%), and VGI (+1.98%). Moving in the opposite direction were ABC (-1.83%), POC (-1.47%), CAB (-12.71%), and the rest, which remained unchanged, acting as a drag on the sector.

Following the upward trend was the essential consumer goods sector, which also exhibited divergence but with a slight edge towards the green. Specifically, stocks that maintained their gains from the beginning of the session included VNM (+0.28%), SAB (+0.52%), VHC (+0.14%), and MCH (+2.54%)… Meanwhile, a few other stocks, such as BAF, DBC, PAN, LSS, and VLC, faced selling pressure but didn’t fall significantly, with losses not exceeding 0.5%.

Compared to the beginning of the session, the number of stagnant stocks remained high, at over 1,069, indicating the continued tug-of-war. However, buyers held the upper hand. There were 247 declining stocks and 265 advancing stocks.

Source: VietstockFinance

|

Opening: Maintaining a Slight Uptrend

On September 24, as of 9:30 am, the VN-Index rose nearly 2 points to 1,270.28 points, while the HNX-Index also edged higher to 233.45 points.

Gold prices climbed to an all-time high on Monday (September 23) as market sentiment turned optimistic after the US Federal Reserve (Fed) cut interest rates the previous week, coupled with geopolitical tensions, boosting gold despite a stronger US dollar.

At the close of the September 23 session, spot gold rose 0.2% to $2,627.94 an ounce after hitting an all-time high of $2,634.16 an ounce during the session.

As of 9:30 am, the VN30 basket slightly inclined towards the green, with 5 declining stocks, 20 rising stocks, and 5 stagnant stocks. Among them, BCM, BVH, and VJC were the most negatively impacted stocks. Conversely, SSB, POW, and MWG were the stocks with the strongest gains.

The telecommunications services sector maintained stable growth from the beginning of the session, with stocks such as DST surging to the ceiling price of 8.82%, CTR climbing by 3.25%, VGI rising by 3.34%, VNZ surging by 10.43%, and ELC gaining 0.82%, among others…

Ly Hoa