STOCK MARKET REVIEW FOR THE WEEK OF 16-20/09/2024

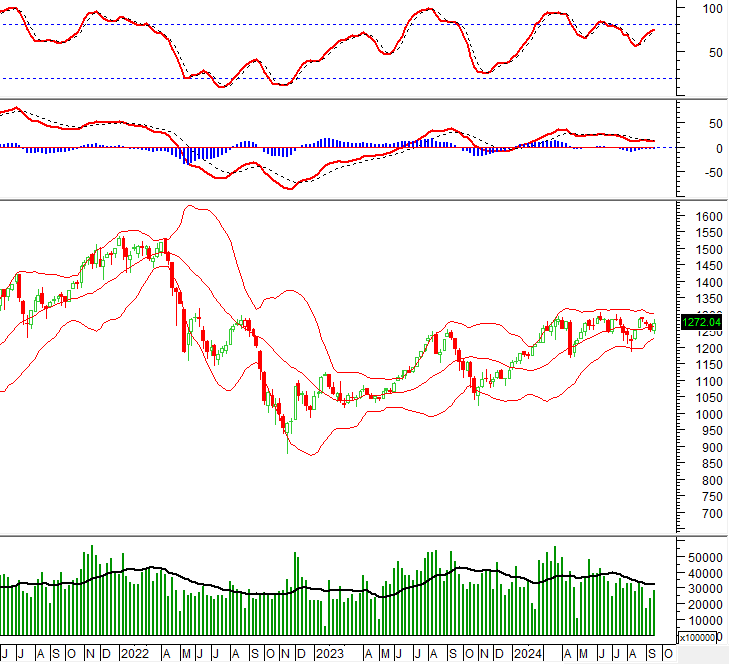

For the week of September 16-20, 2024, the VN-Index staged a strong recovery after a prolonged downturn since late August 2024. The index also moved above the Middle Bollinger Band.

However, trading volume remained below the 20-day average, indicating that investor caution is still prevalent. If this improves next week, it will bolster the index’s upward momentum.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Re-testing July-August 2024 highs

On September 20, 2024, the VN-Index gained slightly and is re-testing the July-August 2024 highs (equivalent to the 1,280-1,300-point range) with trading volume exceeding the 20-day average, indicating investor uncertainty.

Currently, the index is above the Middle Bollinger Band, while the Stochastic Oscillator has given a buy signal and continues upward, suggesting a positive short-term outlook.

Additionally, the MACD is narrowing the gap with the Signal line. If a buy signal reappears in the coming sessions, the recovery trend will be reinforced.

HNX-Index – Three White Candles pattern emerges

On September 20, 2024, the HNX-Index rose, forming a Three White Candles pattern, accompanied by trading volume surpassing the 20-day average, indicating investors’ optimism.

Meanwhile, the MACD is narrowing the gap with the Signal line. If a buy signal reappears, it will further support the recovery scenario.

However, the HNX-Index tested the Middle Band but failed to break above it, suggesting that the short-term outlook remains cautious.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index of the VN-Index cut above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors continued net selling on September 20, 2024. If this trend continues, it will bode well for the market.

Technical Analysis Department, Vietstock Consulting

The Flow of Funds: Market Confirms Bottom, Shaking Hands to “Seal the Deal”

A week brimming with news and significant events propelled the market to surge beyond many investors’ expectations. The rapid ascent left some feeling like they missed the boat. However, experts believe that latecomers still have opportunities as the market is due for more volatility, shaking off short-term speculative positions while welcoming new investors.