Due to personal financial reasons, Ms. Nguyen Thi Thanh Thuy, a member of the Board of Directors of XMP and also a major shareholder, has registered to sell all of her 1.84 million XMP shares, representing a 12.27% stake, through a combination of matched and negotiated deals.

The sale is expected to take place between September 27 and October 25, 2024. If successful, Ms. Thuy will no longer be a shareholder of XMP.

During the morning session on September 25, 2024, the share price of XMP was hovering around VND 16,400 per share, marking a over 17% decrease compared to the beginning of the year. Based on this price, Ms. Thuy is estimated to receive more than VND 30 billion from the sale.

| Price Movement of XMP Shares Since the Beginning of 2024 |

Regarding the 2023 dividend, XMP will distribute a cash dividend of 2% – equivalent to VND 200 per share. With 15 million shares currently in circulation, the company plans to spend VND 3 billion on this dividend payout. The payment will be made starting from September 25, 2024.

As a 12.27% shareholder of XMP, Ms. Thuy is likely to receive nearly VND 400 million in dividends before selling her shares during the aforementioned period.

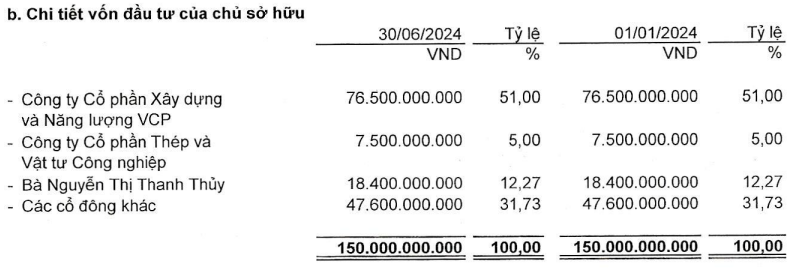

Apart from Ms. Thuy, as of June 30, 2024, VCP Joint Stock Company – Construction and Energy (UPCoM: VCP) is the parent company of XMP with a 51% stake, while Steel and Industrial Equipment Joint Stock Company holds 5%. These companies are expected to receive VND 1.5 billion and VND 150 million in dividends from Xuyen Minh Hydropower, respectively.

Notably, Ms. Thuy also serves as the Chairman of the Board and General Director of Steel and Industrial Equipment Joint Stock Company.

|

Shareholder Structure of XMP as of June 30, 2024

Source: XMP

|

In terms of business performance, during the first half of 2024, XMP recorded net revenue of nearly VND 37 billion, a 4% decrease compared to the same period last year, while net profit reached nearly VND 10 billion, an increase of 41%.

Compared to the set plan of nearly VND 66 billion in revenue and VND 8 billion in after-tax profit, the company achieved 56% of the revenue target and exceeded the profit target by 19% in the first six months.