For real estate businesses, buyer deposits or unearned revenue are advances from customers intending to purchase properties from the developer but have not yet received the transfer by the end of the accounting period. These can be considered “savings” for the company to recognize as revenue and profits after completing the property transfer.

When the market did not show a clear recovery in the first half, these “savings” were treated as accumulated assets, serving as a reserve for the business in the following quarters.

Preliminary statistics from approximately 115 real estate enterprises on the stock exchange revealed that Vinhomes and Novaland continue to lead in accumulating these “savings.”

Specifically, Vinhomes Joint Stock Company (code: VHM) possesses more than VND 47,400 billion in buyer deposits and unearned revenue, a 30% increase compared to the beginning of the year. In March 2024, Vinhomes launched the Royal Island project in Hai Phong. According to statistics from Vietcap Securities, by the end of the second quarter, approximately 2,800 houses in this project had been sold to individual customers, equivalent to 90% of the total number of houses offered for sale. The value of sales contracts reached VND 51,700 billion in the first half, up 27% over the same period last year. Unrecognized sales reached VND 118,700 billion by the end of the second quarter. Vinhomes’ management expects 55% of unrecognized sales to be recognized in the second half.

Next, Novaland Investment Group Joint Stock Company (Novaland, code: NVL) has VND 19,700 billion in buyer deposits and unearned revenue, a 3% increase compared to the beginning of the year.

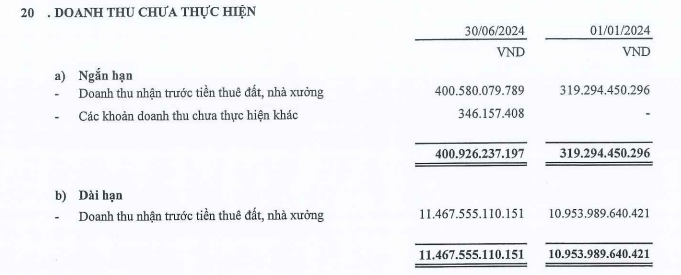

Ranking third is Saigon VRG Investment Joint Stock Company (code SIP, HoSE floor) with VND 11,894 billion in unearned revenue, a 5% increase in the first six months.

Source: SIP

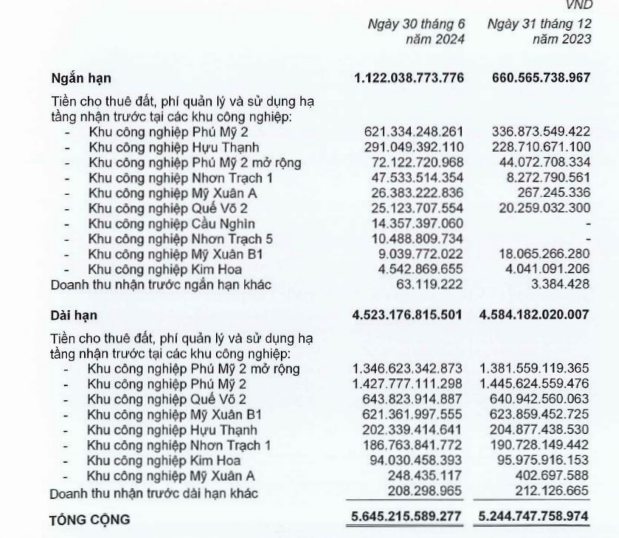

In fourth place is Idico General Corporation – Joint Stock Company (code IDC) with VND 5,869 billion, up 3% in the first half. The most significant contribution came from unearned revenue, including land rent received in advance from industrial parks, with VND 4,523 billion, of which Phu My 2 and Phu My 2 Expansion alone accounted for VND 2,600 billion.

Source: IDC

In fifth place is Nam Long Investment Joint Stock Company (code NLG) with VND 4,754 billion, up 16% compared to the beginning of the year. This year, NLG set an ambitious target with sales of over VND 9,500 billion, up 148% over the same period last year, from Akari City, Mizuki Park, Southgate, and Nam Long 2 – Can Tho projects.

In terms of growth rate, Urban Development and Investment Corporation of Tu Liem Joint Stock Company (code: NTL) recorded a total of VND 549 billion in “savings,” 30 times higher than at the beginning of the year. The surge resulted from a short-term unearned revenue of over VND 538 billion that arose in the second quarter, while there was none at the beginning of the year.

On the other hand, many enterprises experienced double-digit declines in the value of these “savings.” The most significant decrease was of Hanoi Construction and Import-Export Joint Stock Corporation (code: HDG), which fell by 92% to just over VND 19 billion. This was due to a significant reduction in advances under real estate transfer contracts.

Similarly, An Gia Investment and Development Joint Stock Company (code: AGG) unexpectedly reported a 60% decrease in buyer deposits to VND 767 billion. Specifically, the amount of advance payment by individual customers to purchase apartments decreased by more than 69%, from over VND 1,500 billion to VND 469 billion. The advance payment from related parties also decreased by 19%, to VND 297 billion.

Additionally, Van Phu – Invest Investment Joint Stock Company (code: VPI) experienced a 76% decline in short-term buyer deposits + unearned revenue to VND 258 billion. This was because, during the period, VPI sold Hung Son Company – the investor of the Vlasta Sam Son project, so it no longer recognized the advance payment for the capital contribution of the subsidiary worth VND 700 billion as in the beginning of the year. Moreover, the value of advance payment by customers at The Terra – Bac Giang project also decreased from VND 264 billion to VND 236 billion.

The Pen Is Mightier Than the Sword: Crafting Words to Conquer and Inspire.

On September 20, 2024, DBFS officially signed a contract to develop a luxury apartment project on nearly 1-hectare land in Tan Phu District, Ho Chi Minh City, with the investor, TC Tower Co., Ltd. This marks the beginning of an exciting journey towards creating a prestigious commercial residential project.

The Green Revolution: Leading the Way to a Sustainable Future

As the demand for “green living” continues to shape the sustainable development trend in the real estate market, green buildings have become a top priority for homebuyers when choosing their urban dwellings.

A Billion-Dollar Urban Shift: Vietinbank Union to Phu My Hung

The Hong Hac – Xuan Lam eco-city in Bac Ninh boasts a staggering total investment of approximately 1.06 billion USD. This ambitious project is led by a reputable company, previously owned by the Vietnam Commercial Joint Stock Bank Trade Union (Vietinbank), which held a 98.9% stake before it was acquired by Phu My Hung.

What Types of Land Use Projects Require an Investor Tender Process?

In accordance with Decree 115/2024/ND-CP, there are two groups of investment projects that utilize land and fall under the category of requiring a bidding process to select investors.