Conference on Implementing Banking Credit Solutions to Support Businesses (DN) and People Affected by Storm No. 3 – Photo: VGP/HT

|

In her opening speech at the conference, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong stated that Storm No. 3 was the strongest storm in 70 years, a super typhoon with devastating power and wide-ranging impact. 26 provinces bore the brunt of the storm, which directly affected the economy. According to statistics as of September 17, the economic loss caused by the storm exceeded VND 50,000 billion, and it is predicted to reduce the economic growth rate by 0.15%. Although the storm and floods have passed, many provinces are still struggling to restore stable lives for their people.

For the banking industry, businesses and people are the customers of credit institutions (CIs) severely impacted by the storm, facing challenges in debt repayment and accessing new loans. Statistics show that the affected credit institutions’ outstanding loans amount to approximately VND 100,000 billion.

Governor Hong emphasized that the Party and the State have paid great attention to this matter, with the Government and the Prime Minister providing direct and resolute guidance in dealing with the storm’s aftermath. The Prime Minister has issued ten dispatches, and the Government has held conferences with the affected provinces to devise solutions.

The SBV, led by Governor Nguyen Thi Hong, has also taken swift and decisive action. They immediately issued documents instructing credit institutions to proactively review outstanding loans impacted by Storm No. 3 and implement solutions such as interest waivers, debt rescheduling, and grace periods. The SBV has also coordinated with local authorities to support businesses and people. Additionally, credit institutions have contributed nearly VND 40 billion to the social security work initiated by the Vietnam Fatherland Front.

Moreover, the functional departments of the SBV have promptly coordinated with local authorities and credit institutions to discuss support measures for people and businesses. As of now, the Prime Minister has issued ten dispatches, and the Government has held conferences with the affected provinces to devise solutions.

On September 17, the Government issued Resolution No. 143/NQ-CP, outlining key tasks and solutions to urgently address the aftermath of Storm No. 3, stabilize the lives of the affected people, promote the recovery of production and business activities, actively boost economic growth, and control inflation.

According to the Governor, the SBV has been assigned two tasks. The first is to report to the Prime Minister in September 2024, based on the provisions of Clause 4, Article 147 of the Law on Credit Institutions 2024, regarding the classification of assets, the level of risk provision, the method of risk provision, and the use of risk provision to support customers affected by Storm No. 3.

The second task is to direct credit institutions to proactively calculate support plans, restructure debt repayment periods, maintain debt groups, consider interest exemptions and reductions for affected customers, develop new credit programs with appropriate interest rates, and continue providing new loans to help customers restore production and business activities in accordance with current legal regulations.

On September 18, the State Bank held a working session with credit institutions to discuss solutions to remove difficulties for businesses and people affected by Storm No. 3. The session revealed that banks have proactively implemented solutions to support affected customers through the development and deployment of new credit support packages, interest waivers and reductions for existing and new debts, etc., using their financial capabilities.

SBV Governor Nguyen Thi Hong speaks at the conference – Photo: VGP/HT

|

At the conference, the SBV’s leaders directed and assigned tasks to the SBV’s branches in the 26 affected provinces and cities to focus on implementing solutions to remove difficulties, restore and promote production and business activities, thereby contributing to local economic growth. In addition, banks have publicly announced their programs, policies, and credit packages to promptly support and overcome the damage caused by storms and floods in the localities and remove difficulties for customers to restore and promote production and business activities.

Currently, the SBV is coordinating with relevant ministries and sectors to report and submit to the Prime Minister for consideration regarding the classification of assets, the level of risk provision, the method of risk provision, and the use of risk provision to handle risks and support customers affected by Storm No. 3. They are also guiding credit institutions in restructuring debt repayment periods for customers facing difficulties due to the storm.

Nhat Quang

The Cold Front Brings Heavy Rain: Stay Alert for Flash Floods and Landslides in Northern Mountainous Regions

As of September 23, 2024, at 7 a.m., the reported damage inflicted by Typhoon No. 4 was significant. The Vietnam Dyke Management and Flood Control Department reported three fatalities in Nghe An province, where flash floods swept away residents, and their bodies have now been recovered. The storm also left 261 homes damaged across central provinces, with the highest number in Thanh Hoa (113), followed by Nghe An (93), Ha Tinh (26), Thua Thien Hue (12), and Quang Nam (17).

The Power of Collaboration: How Businesses Stabilize Consumer Markets During Turbulent Times

The Ministry of Industry and Trade has directed the Domestic Market Department to coordinate with localities to ensure the supply of essential goods in provinces and cities that are at risk of flooding. This directive aims to support affected regions by facilitating the distribution of essential goods from unaffected areas upon the request of local authorities.

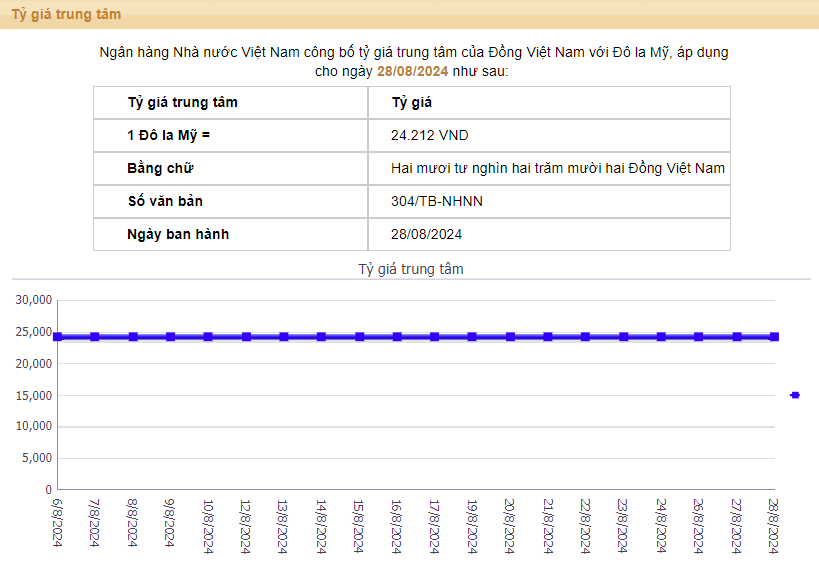

Unlocking Capital Flow: Three Insights from Techcombank’s Chairman for the Final Quarter of 2024

“The Chairman of Techcombank’s Board of Directors, Ho Hung Anh, emphasizes the need for a range of supportive measures to ease financial burdens on businesses. These include introducing and extending loan packages with low-interest rates, stabilizing the foreign exchange market, and implementing tax relief policies such as reductions in corporate income tax and value-added tax (VAT). He also suggests extensions for tax payments and controlling production and business-related costs, such as transportation and import-export expenses, to ensure businesses can weather economic challenges.”