Source: VietstockFinance

|

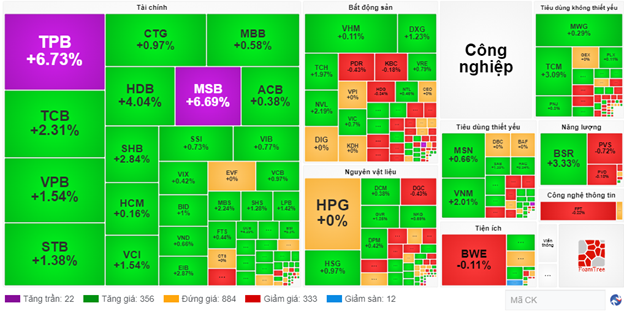

The banking group was the main driving force, with TCB and VCB contributing almost 2 points to the index. Within this group, many stocks witnessed robust gains, including TPB and MSB, which hit the maximum daily limit, HDB surging 4.04%, SHB climbing 2.37%, and TCB rising 2.31%.

Apart from banking, the real estate sector, which boasts large market capitalization, also painted a positive picture with stocks such as DXG, VHM, and NVL in the green.

|

Banking sector stirs up a frenzy, with TPB and MSB hitting the ceiling

Source: VietstockFinance

|

Foreign investors increased their net buying, pushing the net buy value to over 665 billion VND, led by two banking stocks, TPB and HDB, with a net buy value of over 116 billion VND. These moves during the session have raised expectations among many investors for another net buying session by foreign investors.

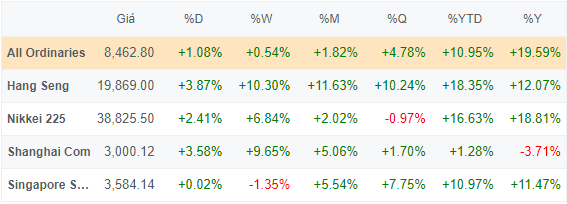

The Vietnamese market’s positive performance somewhat echoed the sentiment in other Asian markets, with the Hang Seng Index surging more than 3.8%, the Nikkei 225 climbing 2.4%, and the Shanghai Composite rising nearly 3.6%.

|

Green hues across Asian stock markets

Source: VietstockFinance

|

Morning session: Entering the resistance zone of 1,290, the VN-Index immediately witnessed volatility

Despite an enthusiastic first half of the morning session, with the index even breaching the 1,295-point level at one point, the resistance zone proved challenging to overcome as the index soon entered a downward correction phase. On a positive note, the VN-Index managed to temporarily hold the 1,290-point level, marking a gain of over 3.3 points compared to the previous day’s close.

In contrast to the VN-Index, both the HNX and UPCoM indices turned red, with the former dipping 0.3 points to 235.53 and the latter slipping 0.1 points to 93.41.

At the end of the morning session, 340 stocks advanced, including 17 stocks that hit the ceiling price. Conversely, 308 stocks declined, of which 11 touched the floor price. Overall, the disparity between the two sides was not significant, and the market’s gains were primarily driven by large-cap stocks.

Specifically, the top 10 stocks positively influencing the VN-Index contributed nearly 4 points, outpacing the index’s gain. VCB took the lead, contributing almost 1.1 points, followed by VNM, GVR, HDB, TCB, and others.

Energy stocks continued to lead the market in terms of gains, rising 2.06% on the back of strong performances from BSR, TMB, and POS. The second-best performing sector was food and essential goods retail, which climbed 1.59%.

Seven sectors witnessed declines during the morning session, fewer than the number of sectors in the green, but three of these sectors dropped more than 1%, including media and entertainment, down 1.75%; household appliances and personal items, down 1.47%; and semiconductors, down 1.19%.

As the morning session drew to a close, foreign investors’ net buying became more evident, with a provisional value of nearly 533 billion VND, almost matching the previous session’s net buy value. This buying momentum was concentrated in TPB, with a net buy value of over 102 billion VND, followed by HDB, with over 60 billion VND, and VNM, with more than 51 billion VND.

On the other side of the spectrum, the most heavily net-sold fund certificate, FUESSVFL, witnessed net selling of just under 13 billion VND, a figure lower than the net buy value of any stock in the top 10 net-bought list.

| Top 10 stocks with the highest net buy and sell values by foreign investors during the morning session of September 26, 2024 |

10:45 am: Cooling off after a rapid ascent

Building on the gains from the start of the morning session, the VN-Index continued its upward trajectory, adding over 5 points within just 25 minutes to approach the 1,295-point level. However, the index soon entered a correction phase, retreating to 1,292, representing a gain of more than 4.7 points compared to the previous day’s close.

VCB remained the shining star, contributing nearly 1 point to the index, followed by GVR, which added almost 0.6 points, and VNM, which contributed nearly 0.4 points. Conversely, CTG exerted downward pressure, erasing nearly 0.5 points.

In terms of sector performance, energy stocks stood out, climbing 2.18% to lead the market, propelled by BSR‘s 3.33% jump and PVD‘s modest 0.36% gain.

Foreign investors temporarily net bought over 300 billion VND, with this buying momentum spread across various stocks, including VNM, with a net buy value of over 36 billion VND, HDB, at more than 29 billion VND, and VCB and STB, each with a net buy value of over 27 billion VND.

If this trend persists until the end of the session, foreign investors will record their second consecutive net buying session and their seventh net buying session in the last 10 sessions.

Market Open: VN-Index approaches the 1,290-point threshold

Extending the winning streak from previous days, the VN-Index started the session on September 26 on a positive note, climbing 2.35 points to near the 1,290-point level at 9:30 am. Green hues were also observed in the HNX and UPCoM indices.

The market witnessed a surge in advancing stocks, with 290 stocks posting gains, nearly double the number of declining stocks, which stood at 159. The remaining 1,159 stocks remained unchanged, indicating a relatively widespread dissemination of positive sentiment during the initial trading period.

Liquidity was robust, outpacing the previous day’s levels and aligning with the 5-day average.

GVR was the top contributor to the index’s gains, adding 0.85 points, followed by VHM, which contributed 0.37 points, and VNM, which added 0.2 points. On the flip side, the stocks of two banking giants, CTG and MBB, were the biggest detractors, erasing nearly 0.2 points each.

Asian markets also kicked off the day in positive territory, with the Nikkei 225 climbing nearly 2.4% and the Hang Seng Index advancing over 1.8%. However, on the other side of the globe, the Dow Jones and S&P 500 indices retreated from their latest record highs, closing lower on Wednesday (September 25).