KITA Group, a prominent real estate company owned by Nguyen Duy Kien, has unveiled an ambitious 10-year development strategy. This includes plans to transform KITA Airport City into a new economic, administrative, and entertainment hub for Can Tho and the Mekong Delta region.

In addition to their real estate ventures, KITA Group’s leadership has announced their intention to diversify into a multi-sector economic group. This includes expansion into import-export, e-commerce, automobile assembly, mineral exploitation, and healthcare services.

Known for their aggressive M&A deals, KITA Group has quickly risen to prominence in the real estate industry. They boast a diverse portfolio of large-scale projects in key cities, including Stella 927, Stella 1595, and Stella Riverside in Ho Chi Minh City, Stella Quoc Oai in Hanoi, Stella Hai Duong in Hai Duong, Stella Ocean Park in Phan Thiet, Golden Hills City in Danang, and a project on the 50m strip of extended Nguyen Tat Thanh Street in Danang.

The company has also accumulated 700 hectares of prime real estate in major cities such as Hanoi, Danang, Ho Chi Minh City, and Can Tho. In the real estate sector, in addition to residential projects, KITA Group is developing several resort projects, including a high-end urban area within the massive Golden Hills project and Stella Ocean Park in Phan Thiet.

For 2024, the company has set a revenue target of approximately VND 6,000 billion. With the real estate market showing signs of recovery, KITA Group intends to seize the opportunity to increase its presence in the market.

KITA Group has also launched its first luxury apartment project, Stella Icon, within the KITA Airport City township. This project comprises 294 apartments and 15 shophouses, with a total area of 6,026 square meters. Stella Icon has partnered with leading banks such as Vietinbank, VP Bank, and OCB to offer customers loan support of up to 70% of the total value of the property.

Notably, KITA Airport City was previously known as Stella Mega City. This 150-hectare project, located in Binh Thuy District, Can Tho, with an initial investment of VND 8,000 billion, was the project that put KITA on the map.

In April 2019, Global Auction Service Joint Stock Company organized an auction for a 602,226-square-meter land lot in Binh Thuy District, Can Tho City, which was previously owned by a company belonging to the Tram Be family. KITA Invest, a subsidiary of KITA Group established just three months prior, won the auction for this land, which was part of the Stella Mega City project.

KITA Group intends to develop KITA Airport City based on the TOD (Transit-Oriented Development) model, with a focus on public transportation. They aim to create a large community within the next ten years. In addition to the land from Stella Mega City, KITA Group also acquired Stella 927 on Tran Hung Dao Street in Ho Chi Minh City from Sacombank.

Image: KITA Group aims to establish a new economic center in Can Tho, Mekong Delta.

Many multi-sector conglomerates in Vietnam, such as Vingroup, Muong Thanh, MIK Group, Sunshine, and Song Da, have their roots in the real estate industry. These diverse enterprises share a common thread of success in their core business, with large-scale real estate projects, and have leveraged their financial surplus to expand into new sectors, creating their own unique ecosystems.

This strategy has long been regarded as a prudent approach, aiming to integrate ecosystems, optimize resources, enhance brand value, and increase profit margins. In today’s volatile business landscape, companies prioritize diverse development to reduce dependence on a single industry.

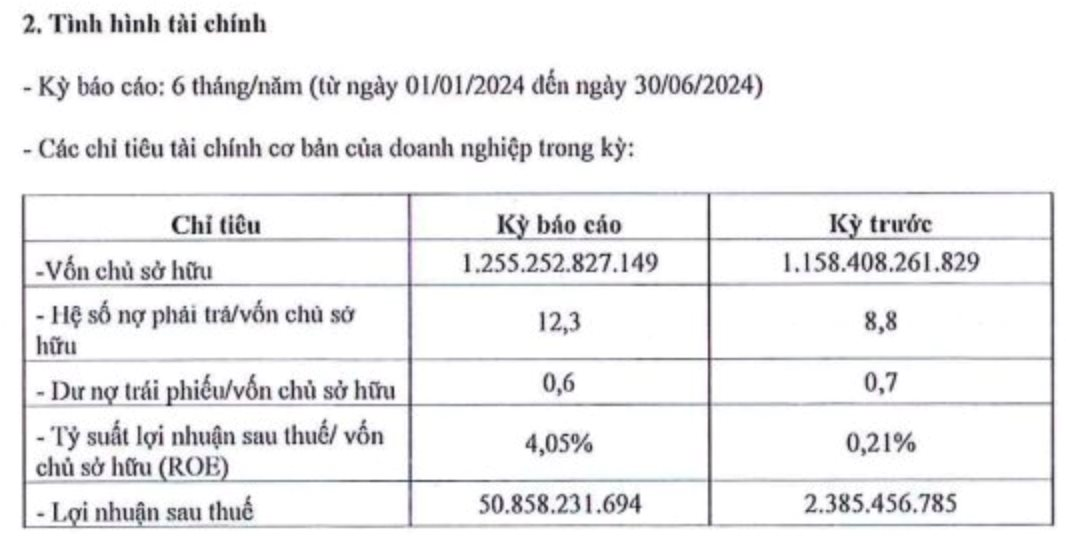

In terms of business performance, the Hanoi Stock Exchange (HNX) has released the financial report for the first half of 2024 for Kita Invest Joint Stock Company.

According to the report, Kita Invest recorded a net profit of nearly VND 51 billion in the first six months of the year, a more than 21-fold increase compared to the same period last year. The company’s equity increased by 8.4%, from VND 1,158 billion to VND 1,255 billion.

Notably, the bond debt of about VND 2,000 billion has brought the bond debt/equity ratio down from 0.7 times to 0.6 times.

No More Red Eyes: Hunting for Apartments Over $43,000 in Major Cities

The sub-2 billion VND apartments in Ho Chi Minh City have been absent for years, putting immense pressure on the housing market in Vietnam’s most populous city. The resurgence of apartments priced above 1 billion VND in near-central and satellite town locations will help alleviate this bottleneck. This new offering provides a glimmer of hope for homebuyers, promising a chance to secure a home in desirable locations without breaking the bank.

The Signature Collection by Van Phu – Invest: Introducing Vlasta to Hai Phong’s Thuy Nguyen District

“For over two decades, Van Phu – Invest has been a leading force in Vietnam’s real estate market, renowned for its expertise in developing urban projects in major cities nationwide. Now, for the very first time, they are bringing their unparalleled expertise to Thuỷ Nguyên, the emerging economic center of Northern Vietnam. This new project promises to be an iconic landmark and a testament to their exceptional reputation.”