According to the report by the management board, the current limitation on capital scale will impact brokerage activities, margin trading services, and especially in the context of fierce market competition. Meanwhile, the Company expects to incur additional costs related to the operation of the KRX system as required by HOSE in 2024.

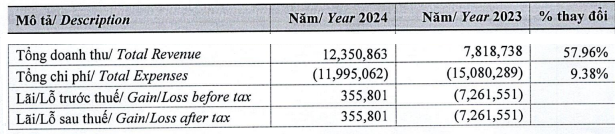

With the business orientation mentioned above, along with the stock market scenario in 2024 expected to be stable and not much different from 2023, assuming the second half of the year can mobilize capital, the total revenue is estimated at 12.4 billion VND, an increase of about 58% compared to the implementation in 2023. Pre-tax profit of 356 million VND, post-tax profit at the corresponding level, in 2023, SBBS incurred a loss of nearly 7.3 billion VND.

|

The 2024 business plan of SBBS

Unit: Thousand VND

Source: SBBS’ 2024 annual general meeting documents

|

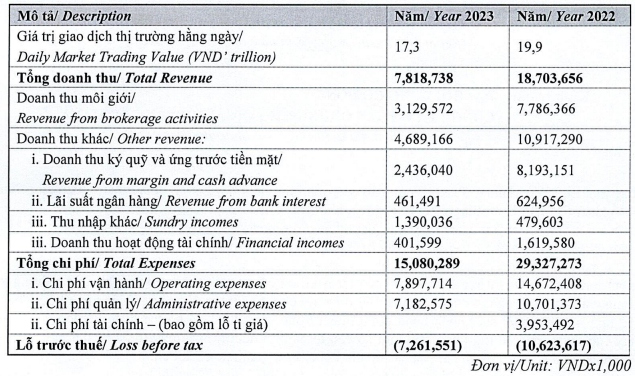

Looking back at the financial results of 2023, the Company had total revenue of over 7.8 billion VND, a decrease of 58% compared to the previous year. Specifically, brokerage revenue was over 3 billion VND, a decrease of 60% compared to the previous year. Margin trading and cash advances revenue was over 2 billion VND, a decrease of 70%, mainly due to the Company narrowing down its margin trading lending activities, reducing the value of margin lending to each customer from 3 billion VND to 1 billion VND.

“In general, SBBS’ capital limitation is the main reason for the significant decline in revenue, both in terms of margin trading interest income and brokerage fees. However, thanks to the reduction in operating expenses, management costs, and financial costs, the Company only incurred a pre-tax loss of over 7 billion VND in 2023,” SBBS said.

|

SBBS’ 2023 financial results

Source: SBBS’ 2024 annual general meeting documents

|

On the balance sheet, SBBS’ total assets as of December 31, 2023 amounted to nearly 38 billion VND, a decrease of 32% compared to the beginning of the year. The receivables of 210 billion VND in the Huynh Thi Huyen Nhu case, the Company has only been able to recover over 9.3 billion VND.

At the end of 2023, SBBS accumulated losses were nearly 270 billion VND, and the equity capital remained over 34 billion VND.

Another important agenda to be presented for approval at the annual general meeting is the election of an additional member of the Board of Directors for the term 2021-2026. The document does not disclose the candidate’s profile.

|

The 2024 annual general meeting of the Company will be held on March 29th at the Berjaya Group’s office, 6th floor, Bao Viet Building, 233 Dong Khoi Street, Ben Nghe Ward, District 1, Ho Chi Minh City. |