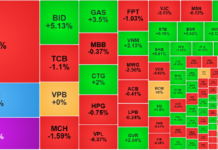

Today’s trading session was highly positive, with a convergence of factors leading to a surge in liquidity and price gains. Once the big money has entered the market, it tends to stick around. As a result, there’s no need to focus on the index; instead, pay attention to your individual stocks.

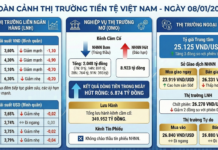

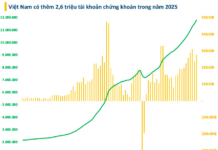

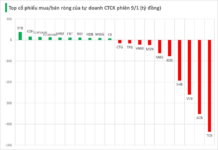

The buying sentiment was strong today, with investors willing to take on risk and push prices higher. Notably, the market witnessed a massive turnover of 22 trillion VND, excluding negotiated deals. This indicates a significant influx of new money into the market, as the average matched order volume of HSX and HNX in the 20 consecutive sessions before today was only 13.6 trillion VND per session.

The high turnover reflects a widespread shift in market perception, acknowledging that prices are unlikely to drop further. The prolonged period of low liquidity was not due to a lack of funds but rather a reluctance to buy. Even at this point, some investors might still be waiting for the VNI to surpass the 1300-point threshold before investing. However, focusing solely on the index can cause one to miss out on opportunities, as individual stocks can outperform the index significantly.

The largest groups in the VNI have not seen uniform gains, with some even trading in the red or experiencing negligible increases. Technically, the VNI has limitations regarding capitalization weighting, which can make the market seem less impressive. In reality, many stocks have been performing well and will continue to do so, regardless of the VNI’s lackluster performance. Ultimately, money flows into individual stocks, not indices, and when large sums of money enter a stock, the resulting supply-demand imbalance drives up prices.

As we near the end of September, the market is leaving its concerns behind and looking forward with optimism. Interestingly, a change in sentiment can create excitement, regardless of whether the expectations are accurate or not. The same information can be interpreted differently depending on one’s outlook—for instance, the Fed’s interest rate cut or the market upgrade. Therefore, investing entails not just risk management but also psychological management.

In summary, the market is experiencing positive dynamics, and a “change of sides” is underway. For now, it’s best to remain patient and wait for latecomers to join the fray.

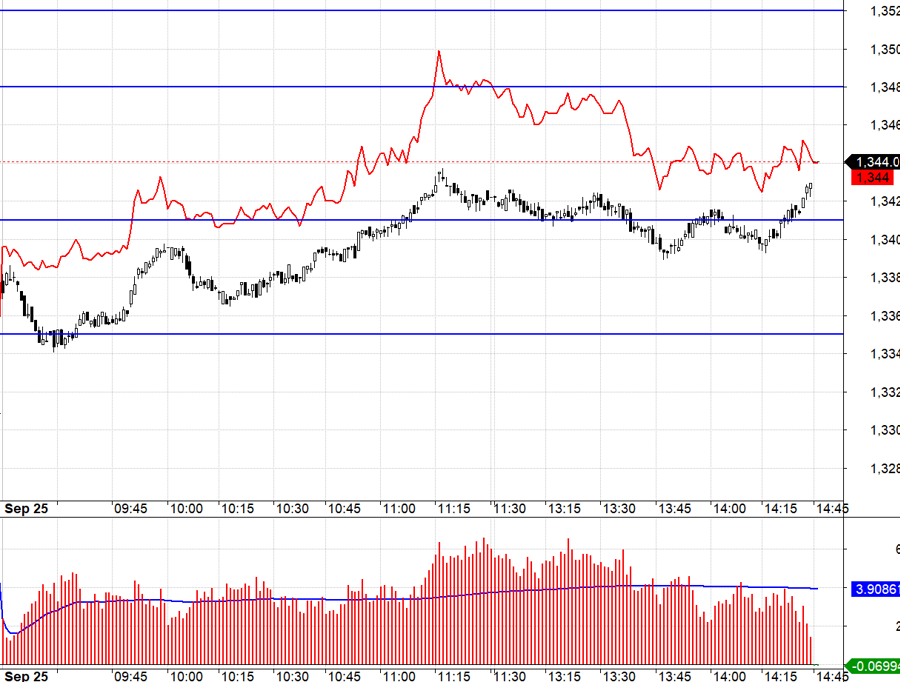

The basis remained positive in the F1 futures contract today, although it narrowed slightly, reducing the risk on the Long side. VN30 opened with a significant jump, briefly retreated to retest 1335.xx, and then climbed higher. A basis of over 3 points is acceptable, given the scenario of VN30 continuing to fall below 1335.xx. After yesterday’s reversal, the odds of further gains are high, favoring Long positions over Short ones. However, the lack of a spread in VN30 above 1335.xx, at 1341.xx and 1348.xx, is a disadvantage. Therefore, we must rely on maintaining the spread or widening the basis.

The cash market is benefiting from the influx of new money. While the VNI may face challenges due to the tug-of-war between large caps, individual stocks are expected to hold steady. Banks are contributing to the VN30’s positive performance, and opportunities remain in derivatives. The recommended strategy is to be flexible with Long/Short positions, favoring the Long side.

VN30 closed today at 1344.07. Tomorrow’s resistances are 1348; 1353; 1362; 1371; 1377; 1380, and supports are at 1341; 1335; 1327; 1318.

Disclaimer: “Blog Chứng Khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The insights and opinions expressed are solely those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and risk management presented in this blog.

The Most Investor-Beloved Listed Company: HDBank

On September 24, 2024, HDBank (stock code: HDB) was voted as the “Listed Company in the Large-cap Finance Sector with the Most Favorite Investor Relations Activities” according to the results announced at the IR Awards 2024 by Vietstock, the Vietnam Association of Financial Executives (VAFE), and Fili Magazine.