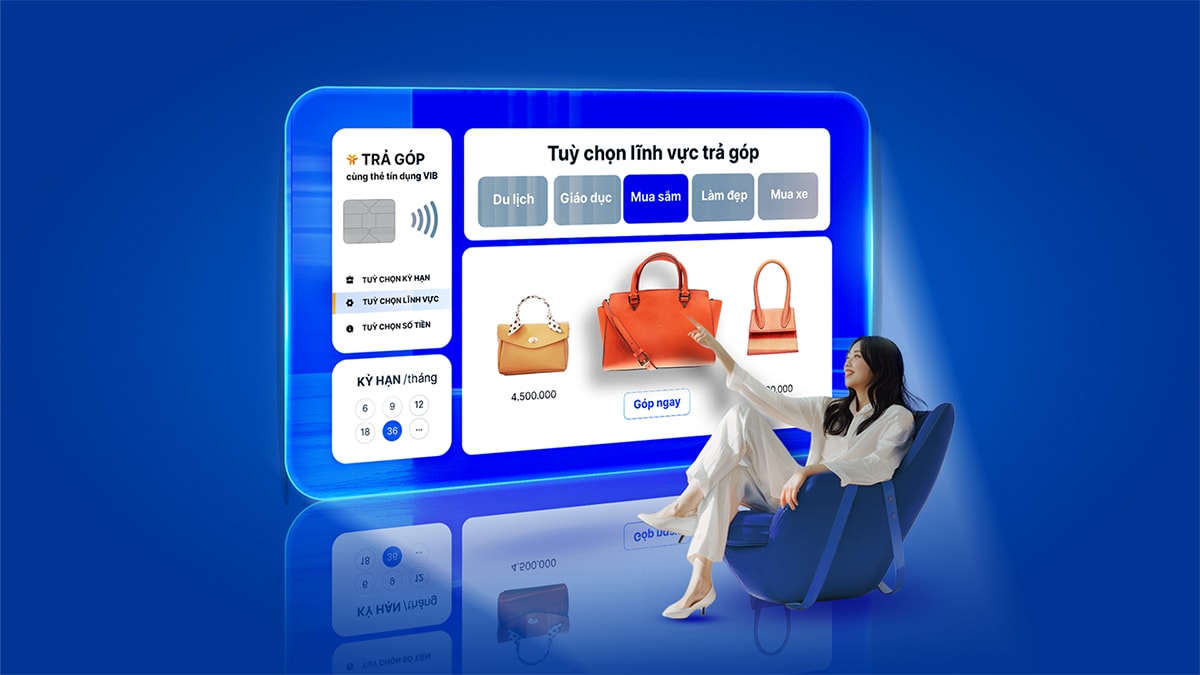

Starting from the 4th month onwards, the new installment plan offers a periodic fee of 0.4%/month for a term of 6-9 months, and 0.8%/month for a term of 12-36 months.

The registration process for the installment plan is easy and automatic – register once and it will apply until you cancel the conversion at the VIB website.

Shopping for the Family

As the weather turns cooler, homemakers will be looking to purchase pressure cookers for hearty stews, and washing machines and dryers to tackle rainy-season laundry. These appliances can be expensive, but with VIB’s credit card, you can own them now and pay light installments.

Don’t miss out on the opportunity to own these modern appliances at attractive discounts of up to 45% at LG.vn and 15% at Electrolux.vn. Why wait? Enjoy a more convenient life with VIB’s credit card!

Buying Motorcycles and Mobile Phones

Besides household expenses, the end of the year is also the time to upgrade motorcycles and mobile phones. Starting from September, Apple, Samsung, Yamaha, and Honda will launch their new products with advanced technologies and attractive offers that are hard to resist.

Tech enthusiasts who don’t want to miss out on the new Galaxy Z Fold6 and Flip6, or the soon-to-be-released iPhone 16 in Vietnam on September 27, can opt for VIB’s installment plan to own these devices immediately. Cardholders can also save significantly by taking advantage of the VIB Shop’s shopping discounts: get up to 500,000 VND off on orders between 800,000 VND and 3 million VND at Shopee and Lazada, and up to 500,000 VND cashback on bills between 5 and 10 million VND at Diamond Plaza…

Especially, when purchasing products from the iPhone 16 series from September 27 to December 31, 2024, VIB credit cardholders will get a discount of 2 million VND at CellphoneS and Di Động Việt, and a discount of 1.5 million VND at Hoàng Hà Mobile and Digibox, applicable at their nationwide store systems.

Autumn and Winter Travel

Traveling during the autumn and winter seasons is an annual tradition for many families. This year’s trip can be a short one to the chilly northwestern region, or a more distant and expensive journey to admire the red leaves of Japan or the northern lights of Iceland.

In addition to enjoying the lowest interest rates in the current consumer loan market, cardholders can also save up to 40% on airfare, tour packages, hotel bookings, and more with VIB Travel’s universe of benefits, thanks to partnerships with over 60 travel partners such as Traveloka, Klook, Booking.com, Trip.com, KtoursStory, Vietravel, Lửa Việt Tours, Qatar Airways, and China Airlines.

Beauty and Dental Care

The year-end is also a time when women spend a significant amount on specialized skincare for the cold season, beauty services, and cosmetic dentistry. These services should be planned in advance to ensure they are ready in time for the biggest festive season of the year.

Take advantage of incredible discounts of up to 50% from premium cosmetic brands like Kosé and Menard, and from healthcare services at Otis Dental, Peace Dental, Viet Nga Dental, Victoria Fitness, and La Bella Pilates with your VIB credit card!

School Fees for Young Children

In addition to the regular school fees typically due in September-October, parents also have to pay for monthly language and talent development classes.

With VIB’s credit card, cardholders can conveniently opt for 0% installments to spread out the investment in their children’s education at reputable brands such as Apollo, ILA, VUS, Direct English, The English Forum, and Mathnasium, as well as the Hạnh Phúc preschool system.

Depending on your spending needs for the last three months of the year, you can find the most beneficial card from VIB’s ecosystem of 10 credit card lines, each tailored to specific needs: shopping (Cash Back, Super Card, Online Plus 2in1, LazCard), travel (Travel Élite, Premier Boundless), family, and education (Family Link, Ivy Card)…

Each card line has its own exclusive privileges according to specific spending categories. For example, the Family Link card offers up to 10% cashback on all education, healthcare, and insurance spending, helping parents save on their children’s school fees. The Super Card offers flexible cashback of up to 15% on shopping, travel, and dining, while the Cash Back card offers up to 24 million VND/year cashback on shopping, beauty, and dental care, making it ideal for periods of high spending.

The “Buy Now, Pay Light” program runs until December 31, 2024. Before making a purchase, cardholders only need to spend a few minutes registering for the program through its website.

Customers who apply for a new credit card here before September 30, 2024, will receive a waiver of the first-year annual fee if they spend at least 1 million VND within 30 days of card activation and 45 days of card issuance.

The Power of Collaboration: How Businesses Stabilize Consumer Markets During Turbulent Times

The Ministry of Industry and Trade has directed the Domestic Market Department to coordinate with localities to ensure the supply of essential goods in provinces and cities that are at risk of flooding. This directive aims to support affected regions by facilitating the distribution of essential goods from unaffected areas upon the request of local authorities.

The Capital’s Mooncakes: Slashed Prices, Still No Takers

This Mid-Autumn Festival, consumer demand was lackluster, leaving many mooncake vendors in Hanoi with an abundance of unsold goods. In an effort to boost sales and clear inventory, numerous shops implemented significant post-holiday discounts.

The Ultimate Mid-Autumn Treat: Indulge in Our Exquisite Mooncakes, Priced at Almost 300,000 VND Each, But Buy One and Get… 3 for Free!

With an array of enticing promotions such as “buy one, get three or four” and competitive pricing, mooncake sellers at markets and sidewalks in Ho Chi Minh City are pulling out all the stops to attract customers. Despite their efforts, many of these businesses are still struggling with low sales and empty stalls.