Speaking at the 3rd International Conference on Vietnam’s Startup, Finance, and Innovation (VSEFI 2024) on September 26 in Hanoi, Professor Neil Pearson, a renowned expert in financial instrument valuation and risk management from the University of Illinois Urbana-Champaign, USA, shared his insights on the risks faced by retail investors.

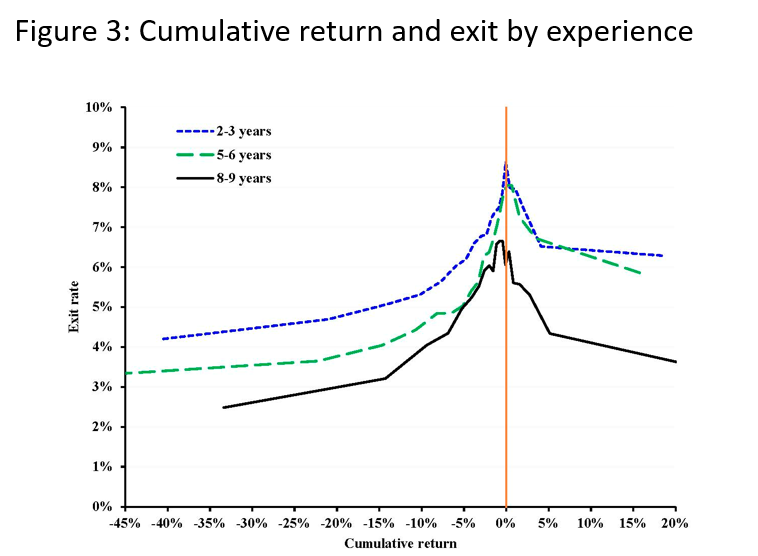

Citing a 15-year research study (2006-2020) on the behavior of retail investors in the Chinese market, Professor Pearson noted that retail investors tend to execute more transactions than professional investors. Notably, the highest rate of position liquidation (profit-taking/loss-cutting) occurred within a cumulative profit margin range of +/- 5-7%.

Within this same profit margin range, the group of retail investors with 2-3 years of experience had a higher rate of position liquidation compared to those with 5-6 or 8-9 years of experience. This highlights the speculative and short-term oriented mindset of retail investors.

Meanwhile, according to Professor Pearson, despite their small account sizes and limited ability to withstand losses, retail investors in the Chinese market tend to have low loss-cutting rates due to a lack of portfolio management experience and effective portfolio balancing skills. This paradoxical situation exposes them to higher risks, especially when their successful transaction rate is typically lower than the total number of transactions made.

Based on the research findings on the behavior of retail investors in the Chinese market, Professor Pearson, from the University of Illinois Urbana-Champaign, emphasized the need for risk mitigation strategies for retail investors.

“Retail investors are an essential component of most markets, including developed ones. Therefore, we should consider enhancing their portfolio management and market analysis skills while encouraging the participation of mutual funds and investment funds in the market,” suggested Professor Pearson.

According to the Vietnam Securities Depository (VSDC), in the first eight months of the year, domestic investors opened more than 1.41 million new securities accounts, 3.6 times higher than the total for 2023.

As a result, as of now, domestic investors hold nearly 8.66 million individual securities accounts (accounting for 99.8% of the total securities accounts).

Acknowledging the value of the research on the behavior of retail investors in the Chinese market, Ms. Phạm Thu Phương, Associate Professor of Finance at Curtin University, Australia, and Head of the Net Zero Task Force, Economic Startup – Economic Policy Network of AVSE Global, emphasized the need for in-depth research on investor behavior in Vietnam to formulate market development strategies.

“While recognizing the insights from the research on Chinese retail investor behavior, it’s important to understand that each market has unique characteristics, and investor behavior can vary significantly. Therefore, Vietnam needs to conduct comprehensive studies on this topic to develop tailored approaches for its market development,” she added.

According to Associate Professor Phương, attracting retail investors to the stock market is crucial for Vietnam to diversify capital mobilization channels for businesses.

While acknowledging the value of the Chinese market research, she emphasized the need for Vietnam to conduct its own comprehensive studies due to the unique characteristics of each market and the varying behaviors of individual investors.

“However, in Vietnam, data on individual investors is not comprehensive, even though they play a significant role in the market,” she stressed.

In theory, according to the representative from AVSE Global, individual investors in stock markets, including emerging or developed markets, are at a disadvantage compared to large or professional investors in terms of experience, governance, and capital. Therefore, measures to encourage individual investor participation while mitigating their risks should include transparent disclosure of transaction-related information such as gender, age, timing, and volume of transactions.

“Transparency and accurate information disclosure at the right time will be key to attracting more retail investors, both domestic and international, to actively participate in Vietnam’s market,” she emphasized.

The 3rd International Conference on Vietnam’s Startup, Finance, and Innovation (VSEFI 2024) was organized by the International School, Hanoi National University, in collaboration with the Global Vietnamese Scientists and Experts Association (AVSE Global), the School of Business and Law, Curtin University (Australia), EMLV Business School, and the University of Paris-Saclay (France). The event took place over two days, September 26 and 27.

The conference attracted more than 60 participants, both in-person and online, from 27 countries, including Vietnam, Australia, France, the USA, the Philippines, China, India, Brazil, Japan, Belgium, South Korea, Italy, Russia, Estonia, Romania, South Africa, Canada, Israel, Germany, and New Zealand.

VSEFI 2024 featured 41 selected research papers out of nearly 100 submissions, presented in 12 parallel sessions. The conference highlighted breakthrough research and innovative solutions in areas such as AI, Big Data, and Machine Learning in Finance, ESG, Asset Pricing, Family Businesses, Corporate Finance and Governance, Digital Finance and Banking, FinTech and Alternative Finance, Social and Sustainable Entrepreneurship, Climate Finance, and Household Finance.

This year, VSEFI 2024 stood out with three keynote speeches, one policy discussion panel, and one special discussion session, featuring renowned global experts in innovation and finance.

Optimizing the Securities Law: Further Tailoring the Corporate Bond Market?

The corporate bond market is undergoing a transformation to restore investor confidence after a series of setbacks. With impending revisions to the Securities Law, this market is expected to face further technical tightening measures.

Why the 2024 price hike is different from previous hikes: Company analysis reveals the reason

The analysts at CryptoQuant have commented on the recent surge in Bitcoin price and cryptocurrency market trends. They highlighted the potential factors contributing to the increase in prices and provided insights into the market sentiment. According to their analysis, the market is experiencing a bullish trend, driven by increasing institutional interest and positive market indicators. They also emphasized the importance of monitoring on-chain data and market liquidity in order to make informed investment decisions. Overall, CryptoQuant’s analysis offers valuable insights for investors and traders looking to navigate the dynamic cryptocurrency market.