Kido Sells Majority Stake in Kido Foods to Nutifood

In a notable move, Kido Corporation has agreed to sell a 51% stake in its cold industry subsidiary, Kido Foods (KDF), to Nutifood. This news has attracted attention as Kido, for years, has dominated the ice cream market with its two leading brands, Merino and Celano.

The decision to sell a significant portion of one of its prized assets comes at a time when Kido has ambitious plans for expansion into various sectors, including shopping malls, confectionery, and even spices and sauces.

While the specific financial details of the transaction have not been disclosed, based on Kido’s previous sale of a 24% stake in KDF in 2024 for VND 1,069 billion, the current valuation of KDF can be estimated at approximately VND 4,450 billion (USD 200 million). Kido retains a 49% stake in KDF following this deal.

Kido’s Dominance in the Ice Cream Market

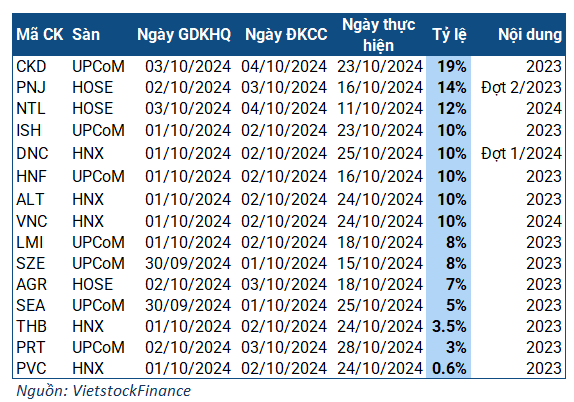

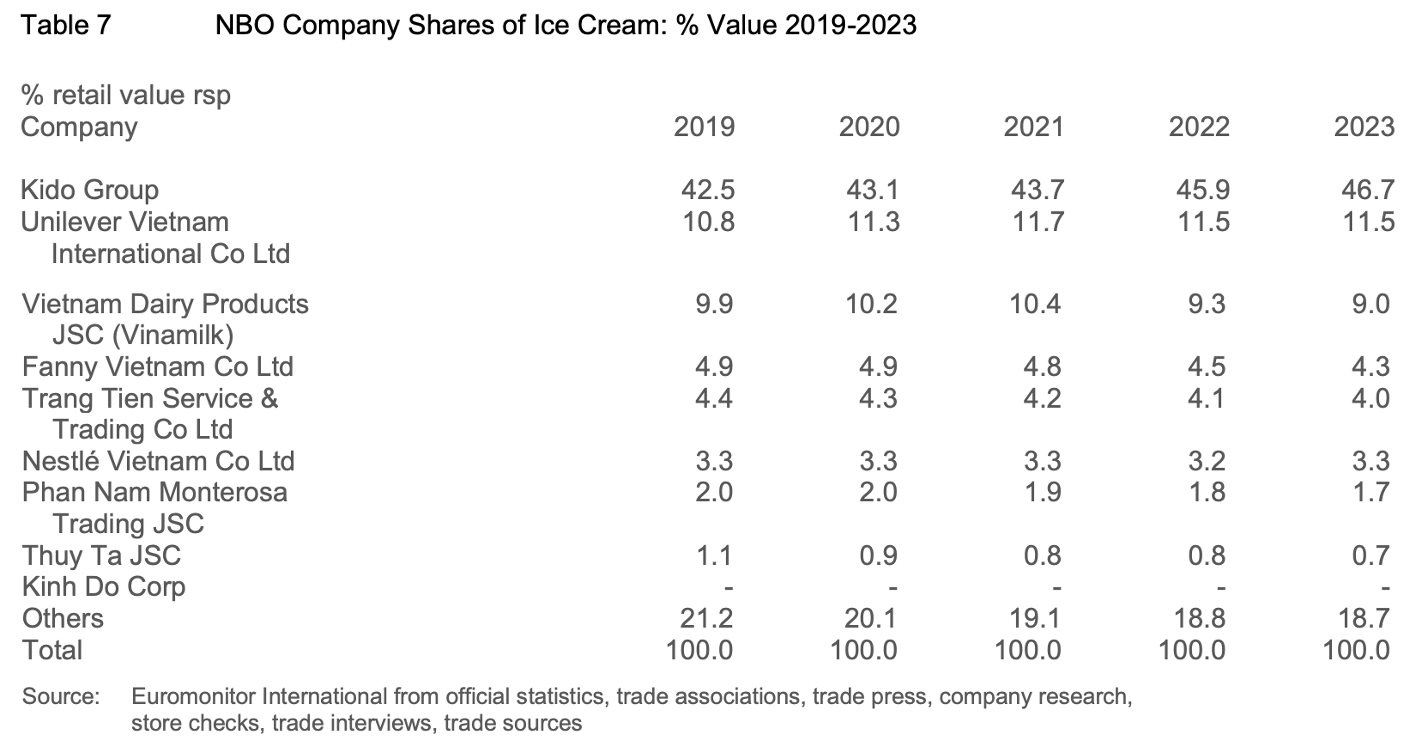

Prior to the Nutifood deal, Kido boasted a commanding presence in the ice cream market, capturing nearly 47% of the market share in 2023. According to Euromonitor, KDF’s sales have been consistently impressive, maintaining over 40% of the market share from 2019 to the present, despite intense competition from domestic and international giants.

Euromonitor’s data for 2023 further underscores KDF’s leadership in the industry, with the company capturing 47% of the market share. Notably, Merino and Celano, KDF’s flagship brands, independently accounted for 25.9% and 19.6% of the market share, respectively, outperforming their closest competitors.

Figure 1: Ice Cream Brand Market Share in 2023

KDF currently operates two processing plants in Cu Chi, Ho Chi Minh City, and VSIP, Bac Ninh.

Beyond distribution and promotions, one of the key factors attributed to KDF’s success is its ability to offer a diverse range of flavors that resonate with the market. For instance, KDF’s Merino Xplus ice cream combines red bean, white chocolate, and brown rice to create a unique crunchy texture. The company also excels at offering traditional flavors such as durian, taro, red bean, and mung bean.

“KDF has the advantage of owning its production facilities, which enables the company to shorten new product development time. This puts KDF ahead of its competitors in keeping up with consumer trends,” noted a 2023 Euromonitor report.

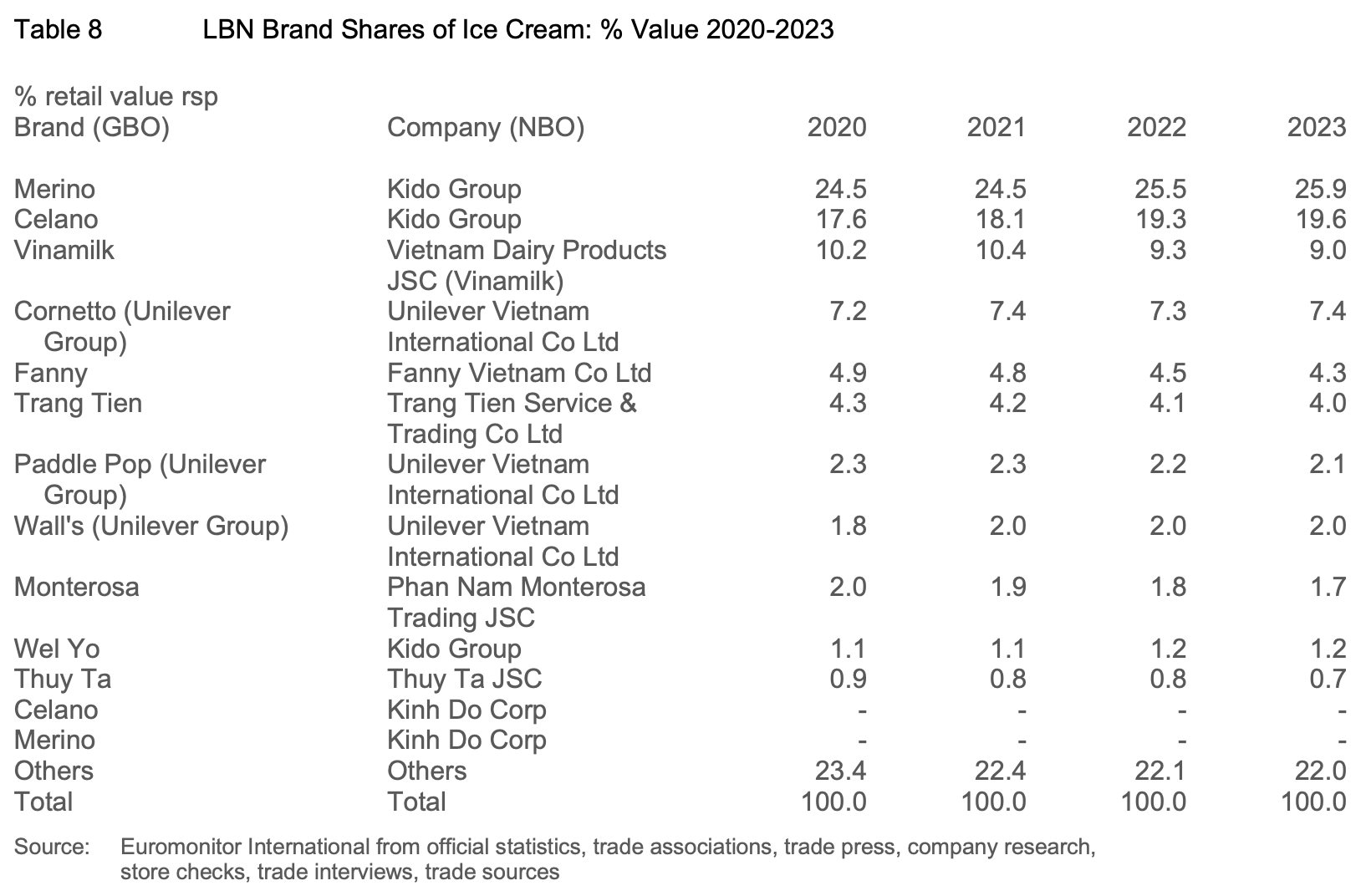

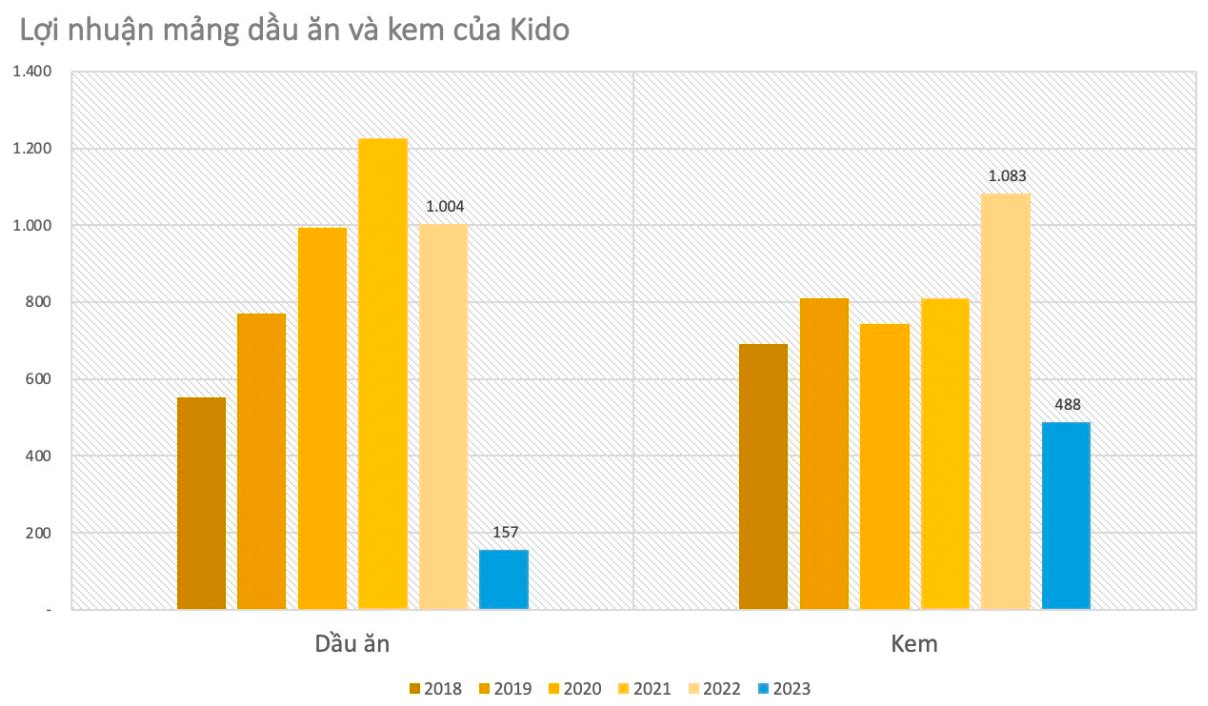

KDF: Kido’s Profitable Venture

KDF’s ice cream business has proven to be exceptionally profitable for Kido, generating impressive revenue and contributing significantly to the company’s overall earnings. Between 2018 and 2021, while the cold industry segment, including yogurt and ice cream, accounted for only 12-20% of Kido’s revenue, it contributed almost half of the company’s profits. The gross profit margin for the ice cream segment was an impressive 50%, far surpassing the 13-17% margin of the oil segment, which was the primary revenue driver.

In simpler terms, for every 10 units of revenue from oil, Kido earned less than 2 units in gross profit, whereas the ice cream segment yielded a gross profit of 5-6 units for every 10 units of revenue.

This trend continued in 2022, with the ice cream segment outperforming the oil segment in terms of profit contribution despite having only one-tenth of the oil segment’s revenue. In the first half of 2023, the ice cream business brought in more than 488 billion VND in profit, while the oil segment contributed just 157 billion VND.

Given the untapped potential in the ice cream market, Kido would have undoubtedly continued to benefit from substantial annual revenue and profit contributions from KDF had they not sold the majority stake.

Figure 2: Ice Cream Segment Profitability

Figure 3: Ice Cream Segment Profitability

A Competitive Landscape

The ice cream market in Vietnam is highly competitive, with established brands vying for market share. Kido leads the pack with a 47% market share, followed by Unilever at 11.5% and Vinamilk at 9%.

According to Euromonitor’s report, the ice cream market in Vietnam grew by 8% in 2023, reaching VND 4,900 billion. This was the second consecutive year of positive growth, albeit at a slower pace due to inflationary pressures on consumer spending. The reopening of international tourism to Vietnam contributed to a boost in foodservice sales, which had been impacted by COVID-19 restrictions in previous years.

Retail ice cream sales also increased by 9% to VND 1,500 billion, although this growth was slightly tempered compared to the previous year. The report suggests that as COVID-19 restrictions eased, consumer behavior shifted back to pre-pandemic patterns, with a preference for dining out. Additionally, growing health consciousness and concerns about the perceived high sugar and fat content of ice cream may have influenced purchasing decisions.

Looking ahead, the retail ice cream market is projected to grow at a CAGR of 10% from 2023 to 2027, reaching VND 7,800 billion.

Figure 4: Ice Cream Company Market Share in 2023

The ice cream industry in Vietnam is characterized by the presence of well-known and experienced brands. Following Kido, Unilever holds a significant market share of 11.5%, with Vinamilk close behind at 9%.

Nutifood’s Entry into the Ice Cream Market

Nutifood, a dairy company led by Mr. Tran Thanh Hai and his wife, has been expanding its portfolio in recent years, venturing into coffee and nutrition through various domestic and international collaborations. Prior to acquiring a controlling stake in KDF, Nutifood established the Ho Chi Minh City Nutrition Research Institute (NRI) and the Nutifood Research Institute of Sweden (NNRIS) to strengthen its focus on nutrition.

The acquisition of KDF, with its leading ice cream brands, Celano and Merino, represents a strategic move by Nutifood to rapidly expand its product ecosystem. By integrating KDF’s expertise and distribution network, Nutifood gains immediate access to a wide range of consumers through various channels, including traditional and modern retail outlets, as well as hospitality and entertainment venues across Vietnam.

Commenting on the investment in KDF, Mr. Tran Bao Minh, Vice Chairman of Nutifood’s Board of Directors, stated: “Investing in Kido Foods allows Nutifood to expand into the field of good-for-health nutrition. Additionally, this acquisition gives us control over a cold industry distribution system with hundreds of thousands of ice cream freezers covering the entire country. This foundation is essential for us to efficiently and effectively expand into the cold industry sector.”

The Digital Trade Link: Forging New Frontiers in Sino-Vietnamese Business Ventures

The digital commerce landscape is thriving amidst the Fourth Industrial Revolution, presenting a plethora of new opportunities for the Vietnam-China business community. This dynamic arena serves as a catalyst, fostering enhanced collaboration and ushering in a new era of cooperative potential.