Has the “turning point” arrived after a long streak of net selling?

According to trading statistics from September 23-27, foreign investors withdrew nearly VND 550 billion net from the Vietnamese stock market, with HOSE seeing nearly VND 530 billion in net selling. However, the actual foreign investors’ trading balance was influenced by a sudden negotiated sale of VIB shares during the September 24 session related to the divestment of Commonwealth Bank of Australia (CBA).

Excluding the exceptional case of VIB (-VND 2,665 billion), in fact, foreign capital has poured into the market more than VND 2,000 billion through order matching.

Meanwhile, observing the activities of foreign capital in the past two weeks, there have been 8 out of 10 sessions with the presence of foreign money. In total, during these two weeks, foreign investors net bought over VND 3,000 billion through order matching.

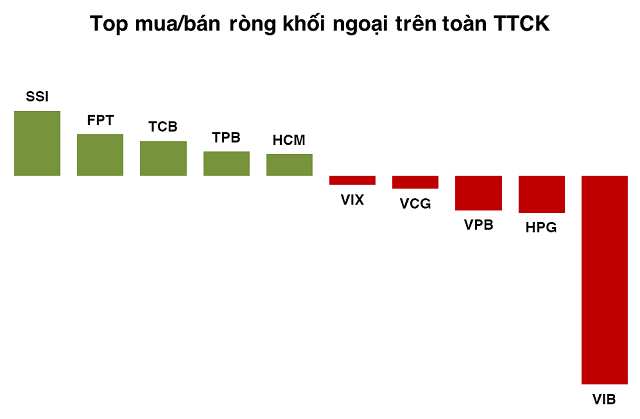

Delving deeper into the trading structure, the 5 stocks that foreign investors bought the most in the past two weeks were SSI (+VND 831 billion), FPT (+VND 532 billion), TCB (+ 448 billion), TPB (+309.7 billion), and HCM (+281 billion), all of which benefited to some extent. Notably, TPB surged 12% in the past two weeks, while SSI and TCB both climbed over 9%.

Top net buying and selling of foreign investors in the 2-week period from September 16-27.

|

On the other hand, the 5 stocks that were net sold were VIB (-VND 2,665 billion), HPG (-VND 474 billion), VPB (-VND 437.7 billion), VCG (-VND 164 billion), and VIX (-VND 115.4 billion). None of these stocks experienced unfavorable developments. In fact, VIB and VPB both gained over 7% in just two weeks of trading.

This indicates that domestic funds are no longer hesitant about stocks facing selling pressure from foreign funds. Meanwhile, the stocks in the positive territory are simultaneously benefiting from both domestic and foreign capital inflows.

With net buying in 8 out of the last 10 sessions, the market may be witnessing a “turning point” after the Fed officially reversed its tight monetary policy cycle.

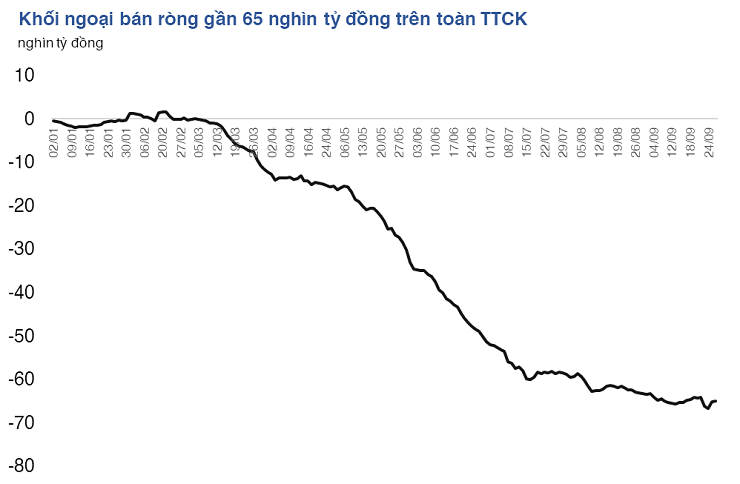

Foreign investors actually net bought in September 2024 if the negotiated trade of VIB is excluded.

|

The picture of foreign investors’ activities will likely become clearer from October 2024, as September 2024 marked the eighth consecutive month of net selling in the Vietnamese stock market. However, the intensity of net selling since the beginning of September 2024 has narrowed to a low level in the selling streak, at around VND 1,600 billion.

The story of market upgrade is regaining its relevance.

For capital flows from ETF funds as well as active funds, the Fed’s rate cut is considered a positive factor in reversing the trend of net capital outflows.

In fact, even before the Fed reversed its monetary policy, selling pressure from foreign investors had weakened significantly as speculative funds’ supply dried up.

Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Vietnam Securities Company, said that the Fed’s 0.5% rate cut has created many positive effects, such as easing exchange rate pressure, making Vietnamese stocks more attractive.

In particular, the issuance of Circular 68 by the Ministry of Finance will improve the trading frequency of foreign investors and will be the key to helping FTSE Russell upgrade Vietnam’s market to the Secondary Emerging Market group.

The effectiveness of the implementation for ETFs to officially add Vietnamese stocks to their portfolios can be seen in 2025. However, Mr. Minh believes that whether FTSE considers the upgrade in October 2024 or March 2025, it will have a positive impact on the market.

Investors expect the upgrade to the emerging market to attract about $1.5 billion in capital inflows from ETFs, excluding active funds.

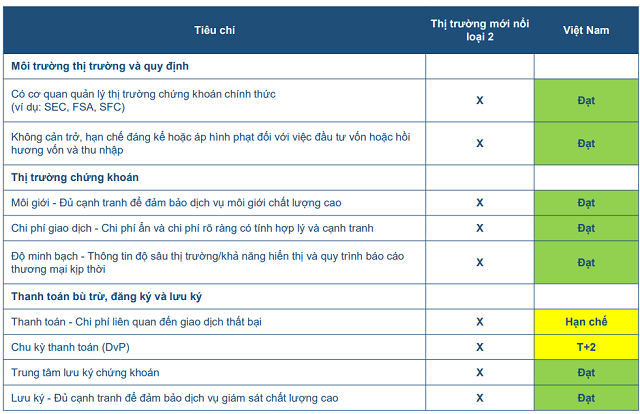

According to BVSC, the Vietnamese stock market will be considered for an upgrade as early as March 2025 – after the final assessments regarding the “Trading Failure Costs” criterion.

Source: BVSC.

|

Currently, 7 out of 9 groups of criteria for upgrading from a frontier market to a secondary emerging market by FTSE have been met. The two criteria that Vietnam has not yet met are:

✓ The “Settlement Cycle (DvP)” criterion is assessed as “restrictive” because, currently, market practice requires checking to ensure sufficient funds before executing a transaction.

✓ The criterion “Settlement – Costs related to failed transactions” is not assessed because, by default, the market does not experience failed transactions.

After the Ministry of Finance issued Circular 68, Vietnam has moved closer to meeting these two criteria set by FTSE. In the upcoming review on October 8, 2024, BVSC believes that FTSE will recognize the positive developments in Vietnam’s market upgrade process.