The State Securities Commission has issued an administrative sanction decision in the securities field to Nam Long Investment Joint Stock Company (code NLG).

Accordingly, a warning was issued per Point a, Clause 1, Article 42 of Decree No. 156/2020/ND-CP dated December 31, 2020, by the Government, stipulating administrative sanctions in the securities field and the securities market (Decree No. 156/2020/ND-CP) regarding the act of not issuing regulations on information disclosure.

In addition, Nam Long was also administratively fined a total of VND 500 million, specifically:

(1) Fine 100 million VND as prescribed at Point a, Clause 4, Article 42 of Decree No. 156/2020/ND-CP for the act of not disclosing information according to legal regulations (the company did not disclose information on the information disclosure system of the SSC and the website of HoSE documents: Explanation for the difference in business results in the 2021 Financial Statement compared to the 2020 Financial Statement, Explanation for the difference in business results in the 2022 Financial Statement compared to the 2021 Financial Statement, Explanation for the difference in business results in the 2023 Semi-annual Reviewed Financial Statement compared to the 2022 Semi-annual Reviewed Financial Statement,…)

(2) Fine 65 million VND as prescribed at Point a, Clause 3, Article 42 of Decree No. 156/2020/ND-CP for the act of disclosing information that is not fully content-regulated by law (In the Report on the situation of corporate governance for the first 6 months of 2022, the first 6 months of 2023, and the Report on the situation of corporate governance in 2022 and 2023, the Company disclosed information about transactions between the Company and related parties but did not announce the value of these transactions. In addition, the company did not mention information about many resolutions of the Board of Directors.

(3) Fine 137 , 5 million VND as prescribed at Point c, Clause 6, Article 15 of Decree No. 156/2020/ND-CP, amended and supplemented according to Clause 13, Article 1 of Decree No. 128/2021/ND-CP dated December 30, 2021, of the Government amending and supplementing a number of articles of Decree No. 156/2020/ND-CP (Decree No. 128/2021/ND-CP) for acts of violating regulations on transactions with shareholders, managers of the enterprise and related persons of these subjects.

(4) Fine 137 , 5 million VND as prescribed at Point d, Clause 6, Article 15 of Decree No. 156/2020/ND-CP, amended and supplemented according to Clause 13, Article 1 of Decree No. 128/2021/ND-CP for acts of not signing a written contract when transacting with related persons (According to the audited Financial Statements for 2022 and 2023 and the Q1/2024 Financial Statement, the Company has transactions with related organizations.

(5) Fine 65 million VND as prescribed at Point c, Clause 1, Article 8 of Decree No. 156/2020/ND-CP, amended and supplemented according to Point a, Clause 7, Article 1 of Decree No. 128/2021/ND-CP for acts of not disclosing the capital use report, the amount of money collected from the offering or issuance to implement the project has been audited by an approved auditing organization at the annual general meeting of shareholders or does not explain in detail the capital use, the amount of money collected from the offering or issuance to implement the project in the audited annual financial statements.

Nam Long Group is one of the leading real estate developers in Vietnam, with numerous integrated residential and urban projects, focusing on affordable and mid-range housing segments in the southern provinces, such as Mizuki Park, Akari City, and Waterpoint.

Regarding business performance in the first six months, Nam Long’s net revenue reached nearly VND 457 billion, and after-tax profit was nearly VND 95 billion, both down more than 60% over the same period last year. With these results, the company has only achieved 7% of its revenue target and 13.4% of its profit target.

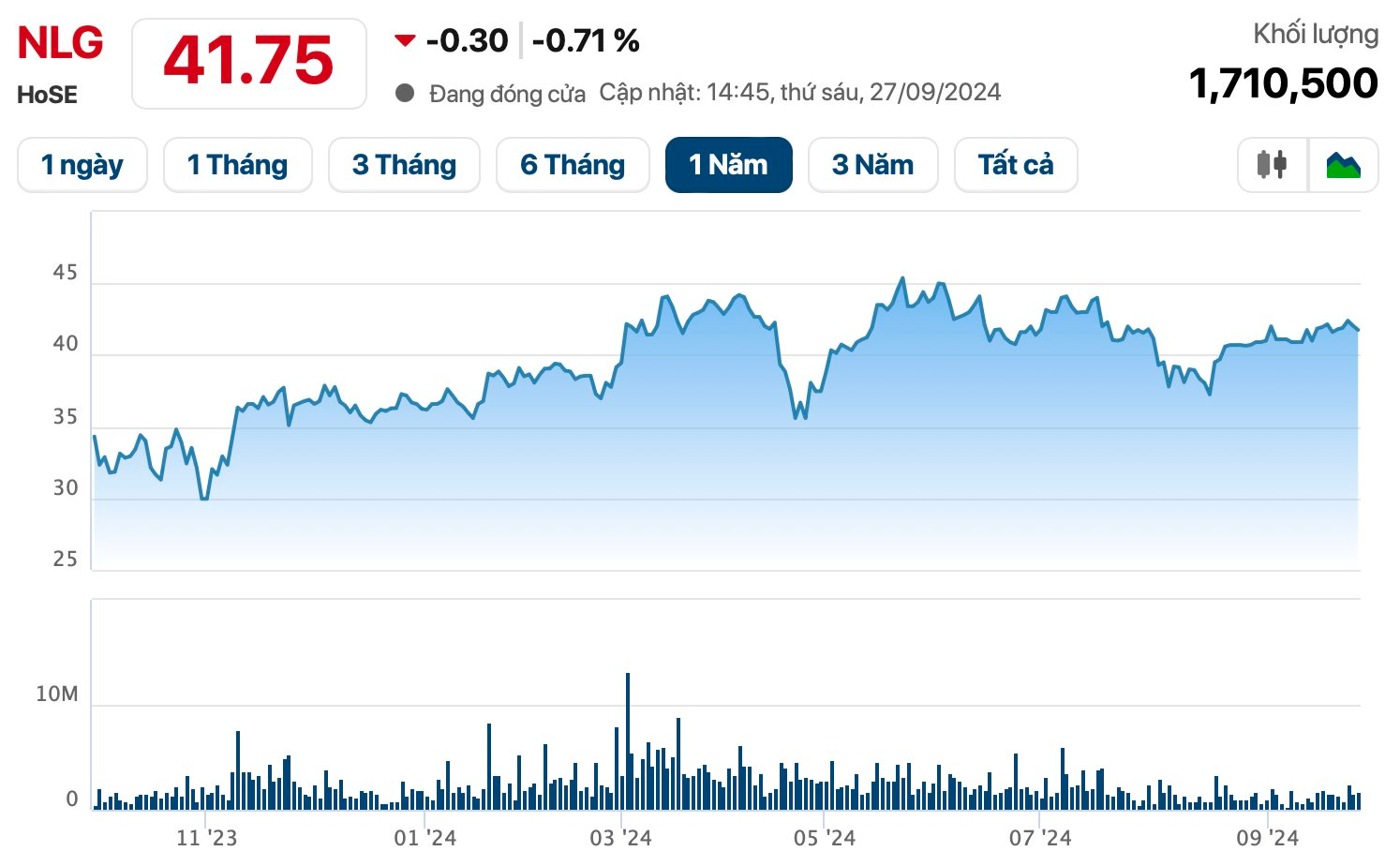

In the market, NLG shares are currently trading at VND 41,750 per share, up 15% since the beginning of the year. The corresponding market capitalization is over VND 16,000 billion.

“Proposed Higher Interest Rates for Second and Subsequent Home Buyers”

To curb speculative property investments, the Vietnam Real Estate Brokerage Association proposes an increase in interest rates for those purchasing their second or subsequent homes.

Vietnam Receives the Scepter to Host the 2025 FWC

At the FIATA World Congress (FWC) 2024, which recently took place in Panama City, Panama, the representative from Vietnam, the Vietnam Logistics Services Enterprises Association, proudly accepted the baton to host the FWC 2025 in Hanoi. The prestigious event will be held from October 6-10, 2025, and promises to be a showcase of Vietnam’s logistics industry and its integral role in global trade.