Record-High Deposits by Individuals in the Banking System

The State Bank of Vietnam (SBV) has just released data on deposits in the banking system. Specifically, as of the end of July 2024, deposits by enterprises and organizations in banks reached over VND 6,768 million billion, a slight decrease of 1.07% compared to the end of last year.

In contrast, deposits by individuals in the banking system reached VND 6,838 million billion, an increase of VND 305,672 billion, or 4.68%, compared to the end of 2023. This is a record high.

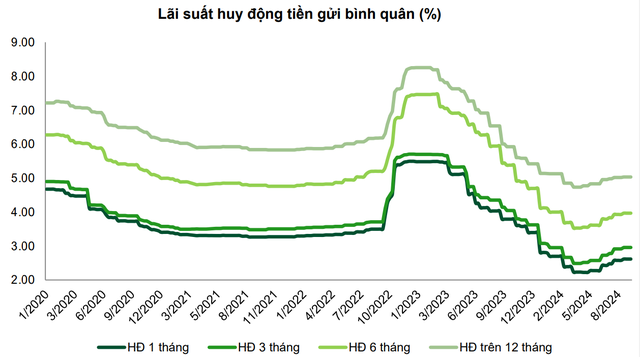

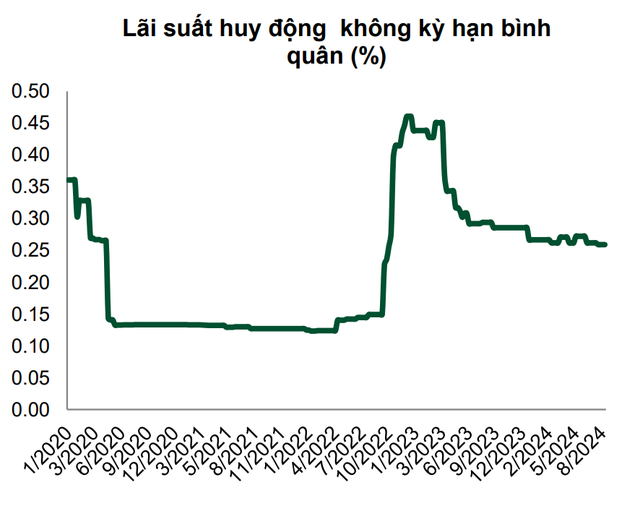

SBV’s data shows that in 2023, despite continuously decreasing interest rates, which hit record lows, deposits by individuals in banks increased consecutively for almost two years.

Explaining this phenomenon, some experts attribute it to the fact that the economy is still facing challenges, making it difficult to invest in production and business, while other investment channels such as securities and real estate entail high risks. As a result, people choose to save as a safe option during market fluctuations.

According to Business Magazine, Mr. Phan Le Thanh Long, CEO of AFA Group and co-founder of the Vietnam Wealth Advisors Community (VWA), stated: “In a period of uncertainty like the present, smart money chooses to return to the bank and wait. This is the reason for the peak in savings deposits.”

After a long period of sharp decreases, deposit interest rates at banks have shown signs of recovery since April this year, although they have not yet reached the golden days of the past.

Statistics from the Ho Chi Minh City Representative Office of the Vietnam Banks Association show that in the last three weeks of September 2024, 10 out of 36 banks slightly increased personal deposit interest rates, while only one bank slightly decreased them. Currently, most medium and small-sized banks offer an interest rate of 5%/year for a 12-month term.

What’s Next for Interest Rates?

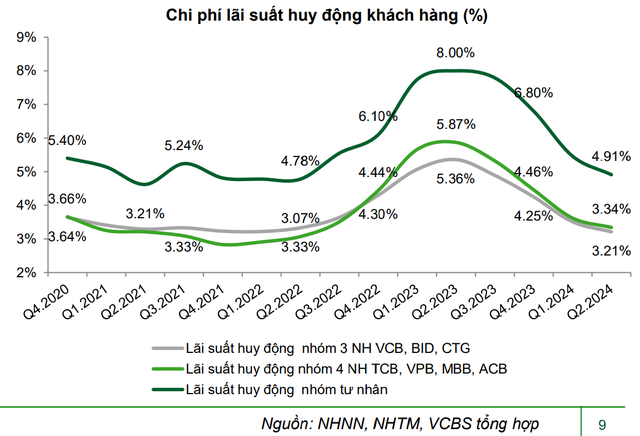

Regarding deposit interest rates, according to the Vietnam Industrial and Commercial Bank Securities Company’s (VCBS) analysis report on the banking sector, the trend of increasing deposit interest rates in the remaining months of 2024 is expected to be difficult to continue, and there will be a differentiation among banks.

Source: VCBS.

For the state-owned bank group, deposit interest rates are expected to remain stable at the current level and may be slightly reduced at the end of the year to support the economy, especially as it is affected by recent natural disasters.

For the private joint-stock commercial bank group, there is still pressure to slightly increase deposit interest rates to enhance capital mobilization and promote credit growth, especially for banks with a high dependence on customer deposits and inflexible capital mobilization structures.

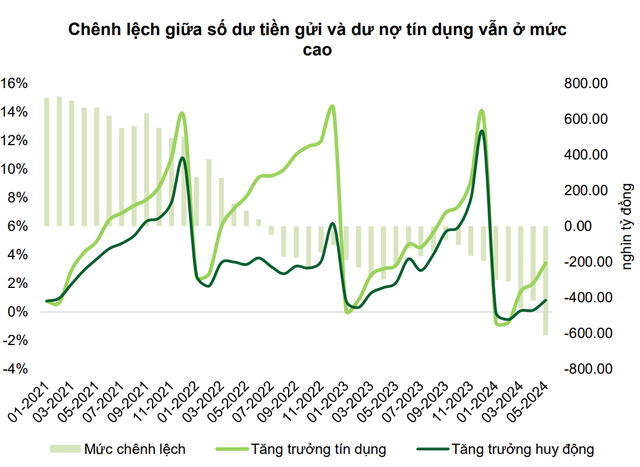

“However, we also note that there may be factors influencing the deposit interest rate level in the last months of 2024 when considering the difference between the deposit balance and credit balance of the whole system, which is still maintained at a high level. This could continue to put pressure on deposit interest rates in the coming time at some small-scale commercial joint-stock banks to increase the competitiveness of savings deposits compared to the investment yield of other investment channels in the market.

The demand for capital preparation to meet credit demand from production/business activities tends to increase in the last months of the year. Credit demand from real estate/construction business activities is expected to maintain a good growth momentum in the second half of 2024. Therefore, banks with a high proportion of lending to this sector need to have appropriate capital mobilization policies to ensure capital balance to serve credit growth,” VCBS stated.

Source: VCBS.

Along with the increase in deposit interest rates, according to the securities company’s assessment, lending rates will continue to be maintained at a low level to prioritize the goal of credit growth.

For the state-owned bank group, there is a tendency to continue reducing lending rates to support businesses following the Government’s and SBV’s directions and to reduce lending rates to support customers affected by Typhoon Yagi for existing and new loans until the end of this year.

In the private joint-stock commercial bank group, some banks have reduced lending rates to support customers affected by Typhoon Yagi. There is competitive pressure on lending rates to promote credit and attract quality customers, especially in small-scale banks. There is a trend of increasing the proportion of lending to corporate customers – a group with lower lending rates than individual customers, as lending to the individual customer group recovers slower than expected.

The Power of Persuasion: Crafting Compelling Copy for a Successful Business

“Ailing Power Company Raises $38 Million in ‘Triple No’ Bonds Despite $220 Million Losses”

Despite recording a post-tax loss of over VND 500 billion in the first half of this year, a power company has surprisingly raised nearly VND 900 billion in “three-no” bonds with a three-year maturity.