Credit growth has been a complex issue, with both positive and negative fluctuations.

Mr. Le Hoai An, CFA Founder IFSS, a banking training and consulting expert, shared his insights on the proposal to abolish credit room in Vietnam and its potential consequences. He also emphasized the need for aggressive actions to achieve the credit growth target for 2024.

Complex Dynamics of Credit Growth

How do you assess the actual credit growth situation in banks for the first three quarters of this year?

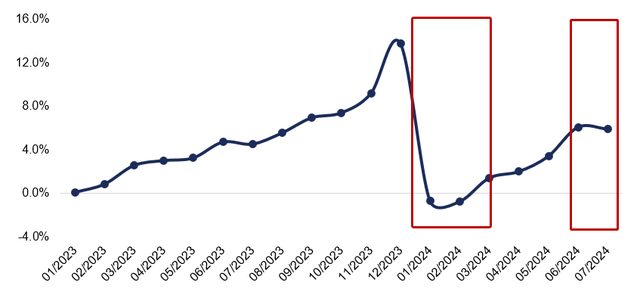

Credit growth in 2024 has exhibited complex dynamics, with both positive and negative fluctuations. The first two months witnessed negative growth, followed by a strong surge in June and a subsequent decline in July. The overall trend remains positive, but the growth process is interspersed with noise factors.

In the first three quarters of 2024, credit growth in Vietnamese banks generally fell short of expectations. By mid-September 2024, the industry-wide credit growth reached only 7.38%, despite completing three-quarters of the year. This figure represents approximately 50% of the initial target of 14-15% set at the beginning of the year.

Credit growth has been sluggish, falling short of the initial target.

Despite efforts to maintain low lending rates, the banking sector faces challenges due to weak demand from both businesses and individuals, as well as a rise in non-performing loans. Macroeconomic indicators clearly reflect this situation, with retail sales of goods and services stagnating at a range of 7-9% since the beginning of the year. Additionally, the PMI index for September was relatively pessimistic, falling below 50 points for the first time after eight months of stability.

In response to economic fluctuations, businesses are struggling with market consumption and are reluctant to expand their operations. Simultaneously, the rise in non-performing loans in certain sectors, such as real estate, has prompted banks to exercise caution in extending credit.

Can you provide a more detailed analysis of credit growth across different bank groups?

When categorizing banks based on their scale and nature of operations, a clear differentiation emerges in their credit growth rates:

For the group of state-owned banks (Vietcombank, BIDV, VietinBank, and Agribank), these institutions hold a significant share of the financial system and possess robust deposit-raising capabilities. However, their credit growth remains slow, mainly due to a focus on managing non-performing loans and risk control.

Turning to the large private bank group (Techcombank, VPBank, and ACB), they have achieved relatively good credit growth, surpassing 10% in the first three quarters. These banks concentrate on the small and medium-sized enterprise (SME) and retail segments. Notably, Techcombank, with its high CASA ratio, has maintained strong lending capacity and low-interest rates, enhancing the effectiveness of credit growth.

Mid-sized and small banks have been the most severely impacted by the economic situation. Their credit growth is extremely low, with some banks even falling below the 7% mark. They face challenges in capital mobilization and are burdened by high non-performing loan ratios, resulting in restricted lending capabilities.

Credit growth varies across different bank groups in 2024. Source: widata.vn.

To Room or Not to Room: The Credit Conundrum

The State Bank of Vietnam (SBV) has recently adjusted the credit room of some banks, providing additional room to those that had exhausted their previous allocation. Is this a necessary step to achieve the industry’s growth target for the year?

In 2023 and 2024, the SBV has repeatedly adjusted the credit room of banks to ensure that the banking system maintains a credit growth rate aligned with economic conditions. This approach stems from two primary objectives:

Firstly, inflation control. The SBV aims to tightly control the amount of money injected into the economy through credit extensions, preventing excessive money supply that could fuel inflationary pressures.

Secondly, credit quality assurance. Adjusting the credit room enables the SBV to oversee the credit quality of banks, mitigating the risk of rising non-performing loans. In the context of many banks grappling with non-performing loans, rapid credit growth could exacerbate financial system risks.

Given the current macroeconomic fluctuations, the SBV’s decision to adjust the credit room remains appropriate and, in my opinion, necessary. The credit room tool serves three crucial functions that I believe are well-suited to the economic recovery phase:

Firstly, it provides a stable growth incentive. Gradual allocation of the credit room helps large banks maintain stable growth without triggering overheating.

Secondly, it facilitates rational resource allocation among banks. Adjusting the credit room motivates well-performing banks to continue steering capital flows, supporting consistent liquidity for businesses and individuals in their commercial and consumer endeavors.

Thirdly, it enables risk management. By adjusting the credit room, the SBV can prevent banks from overextending into risky areas like real estate, thus curbing non-performing loans.

Amid the current context, some argue that the SBV should abolish the credit room policy to allow banks to boost capital injection into the economy and support growth recovery. What are your thoughts on this?

I believe that retaining the credit room is essential in the current scenario. While abolishing the credit room would grant banks more freedom in capital allocation, doing so could also entail greater risks. In Vietnam, financing heavily relies on the banking system.

Without the credit room mechanism, uncontrolled bank growth could lead to excessive money supply, exerting inflationary pressure on the Vietnamese economy. Moreover, as witnessed in the pre-2010 era, the absence of a control mechanism like the credit room encouraged banks to pursue profits aggressively, channeling credit into high-risk areas like real estate or funneling capital into “backyard” investments.

Lax lending practices and inadequate control will result in a surge of non-performing loans. This issue has already plagued the SBV in previous periods, specifically between 2010 and 2012, before the implementation of the credit room policy and stringent credit growth management.

However, I also suggest that the SBV consider relaxing the credit room for banks with robust liquidity and superior risk management. Institutions like Techcombank and Vietcombank have demonstrated effective credit management, maintaining low non-performing loan ratios and high profitability. Expanding the credit room for such banks could enhance capital access for the economy while upholding credit quality.

Exploring the Impact of Abolishing Credit Room

What would be the implications for the banking system and the economy if Vietnam were to abolish the credit room policy?

Abolishing the credit room policy in Vietnam would have significant ramifications for the banking system and the economy, presenting both benefits and risks. On the upside, such a decision would enable banks to expedite credit provision without being constrained by SBV regulations.

This could facilitate easier access to capital for businesses and individuals, thereby stimulating economic growth. For banks with strong management and ample liquidity, this scenario presents an opportunity to expand their market share.

However, as previously mentioned, without the credit room acting as a “growth ceiling,” inflationary pressures would likely intensify. Unchecked credit expansion would result in excessive money injection into the economy, potentially leading to inflation and wasteful capital allocation. The second adverse consequence is the risk of non-performing loans. With unrestricted credit provision, banks may embrace higher credit risks, particularly when extending credit to risky sectors like real estate.

From another perspective, the absence of credit limits could spark excessive competition among banks to attract customers, leading to relaxed lending standards or significantly reduced lending rates. This could erode banks’ profit margins, potentially destabilizing the financial system as institutions rush to lend without thoroughly assessing credit quality.

Ultimately, when these adverse consequences unfold, the SBV would lack a crucial tool for policy implementation. The credit room not only governs the annual credit disbursement but also empowers the SBV to regulate money supply in the economy and curb inflation.

Are there any other countries that still maintain a credit room policy?

Several countries continue to uphold a credit room policy or similar credit limit mechanisms, especially those with developing financial systems or those aiming to curb excessive credit growth. A notable example is China, a major economy that employs the credit room policy to rein in credit expansion.

In China, credit limits are used to prevent overheating in the real estate and stock markets. The Chinese government has restricted the amount of credit that banks can extend to real estate projects, curbing speculative investments and soaring property prices. This approach helps manage financial risks and prevents asset bubbles from bursting.

China also utilizes credit limits to control the debt levels of state-owned enterprises, particularly those in high-risk sectors. This strategy averts excessive borrowing, mitigates non-performing loans, and fortifies the financial system. A key takeaway from China is the ability to adjust the credit room dynamically based on economic conditions. During economic downturns, China tends to loosen the credit room to stimulate consumption and investment. Conversely, when the economy overheats, they tighten the reins to curb inflation and non-performing loans.

Vietnam can draw insights from China’s experience in employing the credit room policy with agility. Maintaining the credit room is essential to safeguard credit quality and prevent systemic risks. However, the SBV should also demonstrate flexibility in adjusting the credit room based on specific economic conditions, fostering sustainable growth in the banking system while preserving macroeconomic stability.

Mr. Le Hoai An, CFA Founder IFSS.

Catalyzing Factors for Achieving the 2024 Credit Growth Target

What is your forecast for the banking industry’s achievement of the credit growth target for 2024?

Despite the challenges, the credit growth target for the Vietnamese banking system in 2024 is projected to remain relatively optimistic, with the SBV aiming for 12-14%. In reality, the Vietnamese economy still requires substantial impetus from the consumer sector during this recovery phase. Additionally, our country has been ravaged by storms and floods, particularly in the northern region.

These natural disasters have not only inflicted damage on production and agriculture but have also impacted the banking system in managing loans for affected customers in these areas, prolonging the hardship.

Considering that we have passed three-quarters of the year and accomplished only half of the credit growth target, more aggressive actions are imperative. To attain the 2024 credit growth target, we must maintain low lending rates, relax the credit room for well-governed banks with low non-performing loan ratios, and enhance financial support for businesses affected by natural calamities. Specifically, commercial banks should introduce preferential credit packages for businesses and individuals severely impacted by natural disasters. These packages could offer low-interest rates or debt restructuring programs to aid them in weathering this difficult period.

– Thank you for your valuable insights!

Governor Nguyen Thi Hong: Handover Ceremony for Two Zero-Dollar Banks to Take Place

The Governor of the State Bank shared this information at the regular Government meeting today, October 7th.

The First 9 Months CPI Up 3.88%, Core Inflation Up 2.69%

The surge in food prices in provinces and cities directly impacted by storms and their aftermath, the implementation of increased tuition fees in some localities following Decree No. 97/2023/ND-CP, and rising rental costs were the primary drivers of the 0.29% month-over-month increase in the consumer price index (CPI) for September 2024. Compared to December 2023, September’s CPI rose 2.18%, and it increased 2.63% year-over-year.