The October 3rd trading session closed with the VN-Index down 9.74 points to 1,278.10, the HNX-Index down 1.7 points to 233.35, and the UPCoM down 0.59 points to 92.68. The market was dominated by red, with 526 stocks decreasing in price, more than double the 251 stocks that increased. Additionally, there were 829 stocks that remained unchanged.

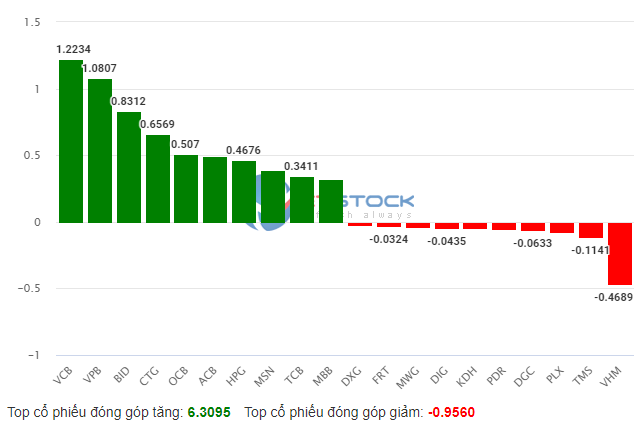

VHM was the stock that took the most points away from the VN-Index, with a loss of 1.84 points, far surpassing the other stocks in the negative impact ranking. VHM also represented the less-than-positive performance of the real estate group today.

On the other hand, the banking group still had quite a few names in the positive impact group, but their contribution decreased significantly compared to the morning session, and many stocks even turned red.

| Top stocks influencing the VN-Index on October 3rd |

The market’s liquidity for the session reached nearly VND 25,586 billion, with a strong increase towards the end of the afternoon session. This liquidity level was also higher than the average of the past month.

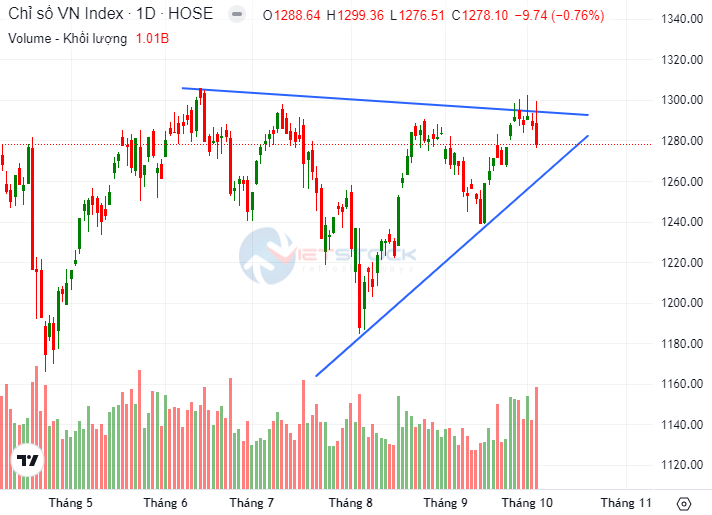

Looking at the technical charts, it can be seen that the index range is gradually narrowing, with the peaks getting lower while the troughs are being lifted. The narrowing range, coupled with increasing liquidity, led many investors to envision a scenario of an impending strong breakout.

|

VN-Index range is narrowing with increasing liquidity

Source: VietstockFinance

|

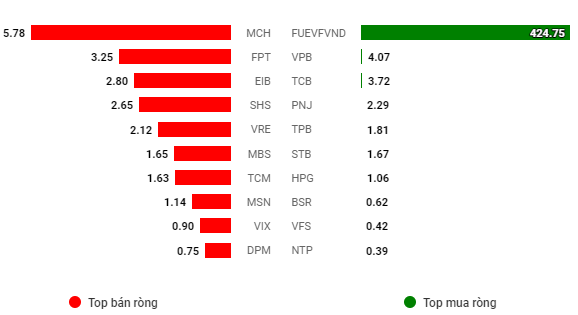

Foreign investors continued to demonstrate a reversal of behavior at the 1,300-point threshold, actively net buying instead of net selling as before. In today’s session, foreign investors net bought more than VND 411 billion, mainly contributed by net buying of FUEVFVND of more than VND 471 billion, far surpassing other stocks such as STB with a net buy of over VND 136 billion, and VHM with nearly VND 109 billion…

On the contrary, net selling was not strong, with the top stock, OCB, only net sold for less than VND 60 billion.

| Foreign investors have been actively net buying in the recent period |

| Net trading value by stock on October 3rd |

2:00 PM: Real estate stocks weigh down, market continues to adjust

The market continued to decline in the first half of the afternoon session. As of 1:55 PM, the VN-Index decreased by 4.84 points to 1,283 points, the HNX-Index decreased by 1.78 points to 233.27 points, and the UPCoM-Index decreased by 0.51 points to 92.77 points.

The number of declining stocks outnumbered the advancing ones, with 524 stocks decreasing while only 206 stocks increased. Considering industry groups, 20 out of 24 industries declined according to data from VS-SECTOR, led by automobiles & components (-3.23%), hardware (-3.13%), and real estate (-1.66%).

Financial stocks gradually lost their gains as many stocks officially turned red, typically TCB (-1%) and VIX (-2.06%). In addition, real estate stocks continued to sink deeper, with VHM (-3.46%), DXG (-3.77%), PDR (-2.83%), DIG (-2.9%), and VRE (-1.31%).

On the VN-Index, VHM was the stock that took away the most points, with a loss of 1.54 points, far surpassing the other stocks in the negative impact ranking. On the other hand, the banking group still had many names in the positive impact group, but their contribution decreased significantly compared to the morning session.

Morning Session: Continued adjustment at the 1,300-point threshold

Despite efforts from the banking group, red unexpectedly spread across the market, especially in the real estate sector, pulling the VN-Index down and temporarily moving away from the 1,300-point threshold.

Source: VietstockFinance

|

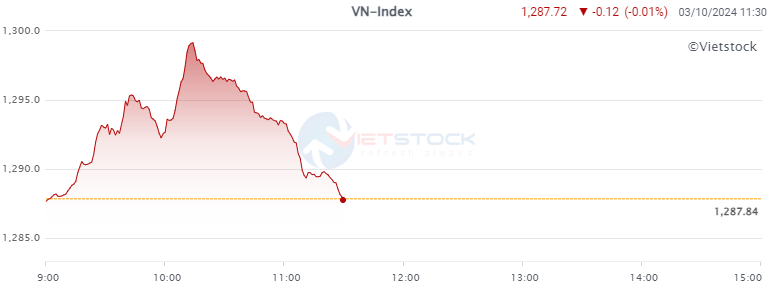

At the end of the morning session, the VN-Index decreased by 0.12 points to 1,287.72, despite briefly approaching the 1,300-point threshold. Meanwhile, the HNX-Index decreased by 0.3 points to 234.75, and the UPCoM-Index decreased by 0.08 points to 93.19.

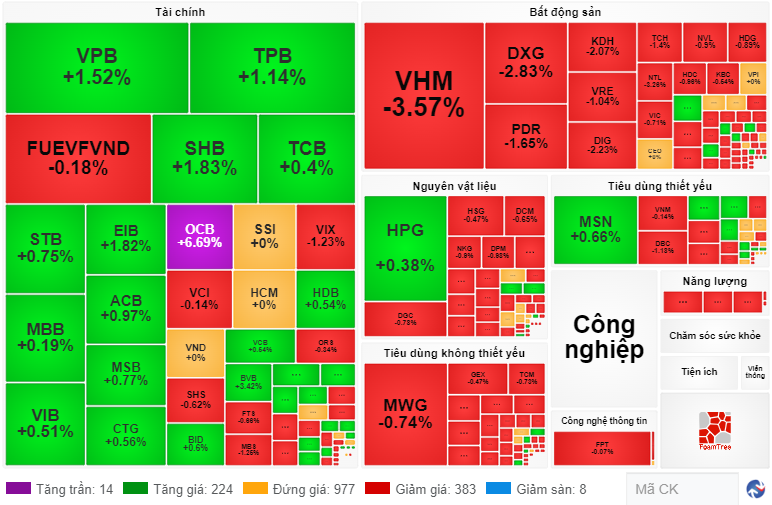

The market heat map underwent a noticeable shift, with 391 declining stocks, including 8 at the floor price, while only 238 stocks increased, including 14 at the ceiling price. The remaining 977 stocks were unchanged. Overall, red dominated in terms of quantity, a stark contrast to the morning session’s early trading.

One of the main factors driving the market adjustment was the impact of the real estate group, with the main culprits being VHM (-3.57%), DXG (-2.83%), PDR (-1.65%), DIG (-2.23%), KDH (-2.07%), and VRE (-1.04%). In this list, VHM alone took away nearly 1.6 points from the VN-Index.

Banking stocks maintained their green status but narrowed their gains significantly. Notable performers in this group during the morning session included OCB at the ceiling price, SHB (+1.83%), VPB (+1.52%), and TPB (+1.14%).

|

The market heat map gradually turned red

Source: VietstockFinance

|

Foreign investors’ actions were not particularly noteworthy after a strong start with net buying of nearly VND 425 billion in the FUEVFVND fund. At the end of the morning session, foreign investors were net buying nearly VND 486 billion.

The behavior of foreign investors has gradually changed recently, with consistent net buying whenever the market touches the 1,300-point threshold, which is a complete contrast to their previous net selling behavior whenever the market tested this psychological level.

10:40 AM: Banks create waves, VN-Index continues to test the 1,300-point threshold

Following the upward momentum from the early morning session, the VN-Index continued to accelerate and briefly surpassed the 1,300-point threshold, driven mainly by banking stocks. As of 10:30 AM, the VN-Index increased by 8.65 points to 1,296.49, the HNX-Index increased by 0.48 points to 235.53, and the UPCoM-Index increased by 0.28 points to 93.56.

|

Numerous bank stocks rose

Source: VietstockFinance

|

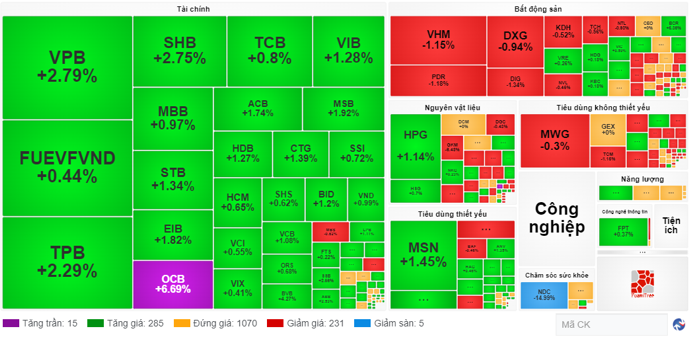

As usual, banking stocks continued to be the focus during the tests of the 1,300-point threshold. Green dominated the banking sector, with notable gainers including VPB (+2.79%), SHB (+2.75%), TPB (+2.29%), MSB (+1.92%), STB (+1.34%), and VIB (+1.28%). The most prominent performer was OCB at the ceiling price.

In addition to banking stocks, many other large-cap stocks also contributed positively to the market’s rise, such as MSN (+1.45%) and HPG (+1.14%)…

|

Banking stocks contributed significantly to the index’s gain

Source: VietstockFinance

|

The 1,300-point threshold remains challenging, as the index continues to approach and then adjust. This is considered a reasonable development as 1,300 points is a strong psychological level that has been tested and failed multiple times in recent months.

Opening: Mild consensus, FUEVFVND net bought for over VND 424 billion

After the first 25 minutes of trading, Vietnam’s stock market indices recorded slight increases, with the VN-Index up 3.95 points to 1,291.79, the HNX-Index up 0.18 points to 235.23, and the UPCoM-Index up 0.13 points to 93.41.

The market’s focus was on the FUEVFVND fund (Dragon Capital’s VNDiamond ETF), which saw a matched order purchase of approximately 12.5 million fund certificates worth nearly VND 425 billion by foreign investors, thus contributing significantly to the net buy value of over VND 424 billion in the early morning session.

|

FUEVFVND was heavily net bought in the early morning session

Source: VietstockFinance

|

Green spread across the banking sector, supporting the index’s gain, with notable gainers including TPB (+2%), MSB (+1.15%), and VPB (+1.02%). At the same time, green also appeared in the materials sector, such as HPG and HSG…

In Asian markets, indices opened mixed, with the Nikkei 225 up 2.36% and the Singapore Straits Times up 0.11%. In contrast, the Kospi decreased by 1.22%, the Hang Seng decreased by 3.26%, and the FTSE China 50 decreased by 3.36%.

On Wednesday (October 2nd), Wall Street’s major indices were mostly flat as escalating tensions in the Middle East weighed on the market.

At the close of the trading session on October 2nd, the S&P 500 rose 0.01% to 5,709.54 points, while the Nasdaq Composite added 0.08% to 17,925.12 points. The Dow Jones index advanced 39.55 points (equivalent to 0.09%) to 42,196.52 points.

Market Beat: Financials Drag VN-Index into the Red

The market ended the session on a negative note, with the VN-Index shedding 7.5 points (-0.59%) to close at 1,270.6. The HNX-Index followed suit, losing 0.68 points (-0.29%), settling at 232.67. Bears dominated the broader market, with 448 decliners outweighing 249 advancers. The large-cap VN30-Index painted a mixed picture, as 22 stocks fell, 5 rose, and 3 remained unchanged, resulting in a sea of red and green.

Can MWG Make a Comeback to the VNDiamond Basket in October?

BSC Research, the analytics arm of BIDV Securities, predicts that 26 million MWG shares could be added to the VNDiamond Index-referencing ETFs during the upcoming October review.

What Will Fuel the VN-Index’s Growth in the Coming Period?

“A robust economy is the fundamental driver of a thriving stock market, and that’s precisely what we’re seeing. With impressive economic growth rates, Vietnam is poised for success. The government forecasts a remarkable 7% growth rate for this year, while VinaCapital predicts a still-healthy 6.5%. This bodes well for the stock market and investors alike.”

The Ultimate Guide to Technical Analysis: Uncovering Market Sentiment

The VN-Index and HNX-Index both witnessed declines, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.