Market liquidity decreased compared to the previous trading session, with the matching trading volume of VN-Index reaching more than 677 million shares, equivalent to a value of more than 14.9 trillion VND; HNX-Index reached more than 53.6 million shares, equivalent to a value of more than 1,052 billion VND.

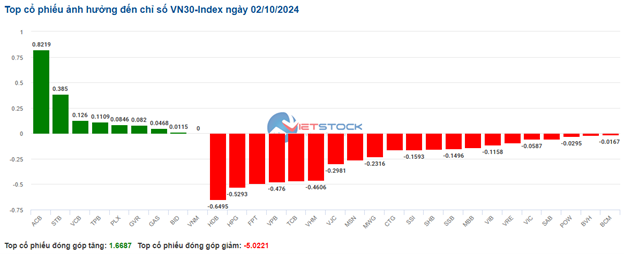

VN-Index opened the afternoon session on a dull note as selling pressure continued to dominate, despite the return of buying interest, which only led to a stalemate around the reference level until the end of the session, with the index closing in the red. In terms of impact, HPG, CTG, VPB, and HDB were the most negative stocks, taking away more than 2 points from the index. On the other hand, VCB, TCB, TPB, and GVR were the most positive stocks, contributing more than 1.8 points to the index.

| Top 10 stocks impacting the VN-Index on 02/10/2024 |

Similarly, HNX-Index also witnessed a lackluster performance, with the index being negatively impacted by CEO (-2.48%), NTP (-2.31%), BAB (-1.63%), and VCS (-1.24%)…

|

Source: VietstockFinance

|

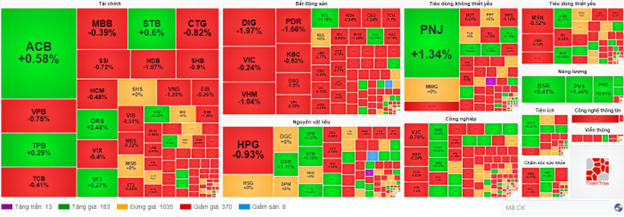

The telecommunications sector recorded the sharpest decline in the market at -1.53%, mainly due to VGI (-1.82%), ELC (-0.59%), FOC (-2.67%), and FOX (-1.35%). This was followed by the real estate and industrial sectors, which fell by 0.92% and 0.73%, respectively. In contrast, the energy sector witnessed the strongest recovery in the market, rising by 0.48% with green signals from BSR (+0.41%), PVS (+0.99%), PVD (+0.55%), and PVC (+2.31%).

In terms of foreign trading, they continued to net buy more than 211 billion VND on the HOSE exchange, focusing on TCB (258.75 billion), PNJ (161.03 billion), FPT (66.77 billion), and VCB (45.69 billion). On the HNX exchange, foreign investors net sold more than 40 million VND, focusing on IDC (11.2 billion), TNG (3.68 billion), TIG (2.05 billion), and CEO (1.86 billion).

| Foreign Trading Activity |

Morning Session: Red Dominates

Caution prevailed amid the volatile global financial market due to escalating tensions in the Middle East. At the midday break, VN-Index lost 2.82 points, or 0.22%, to 1,289.38 points; HNX-Index fell 0.46% to 234.96 points. Sellers dominated with 404 declining stocks versus 216 gainers.

The matching trading volume of VN-Index in the morning session reached more than 320 million units, equivalent to a value of over 7 trillion VND. HNX-Index recorded a matching volume of nearly 26 million units, with a value of nearly 490 billion VND.

Red dominated most industry groups, with telecommunications temporarily at the bottom with a decline of 1.81%. This was mainly due to stocks like VGI (-2.28%), VNZ (-0.65%), and FOX (-0.9%). Following closely was the real estate group, which also exerted significant pressure on the overall market, falling by 0.7%. Red dominated the sector, with notable selling pressure on stocks such as LDG (-4.11%), DIG (-3.06%), DXG (-2.99%), IDJ (-2.94%), PDR (-2.45%), and CEO (-1.86%)…

The financial group exhibited mixed performance. Some bank stocks attempted to buoy the index, notably TCB (+1.22%), BID (+0.4%), ACB (+0.97%), STB (+0.45%), TPB (+0.58%), and SSB (+0.86%). Conversely, most securities and insurance stocks declined, including SSI (-0.54%), HCM (-0.81%), VND (-1.29%), DSC (-2.53%); BMI (-1.04%), and PTI (-3.75%)…

On the flip side, the energy group was the brightest spot in the market this morning. Green signals were observed in many large-cap stocks within the sector, including BSR (+0.41%), PVS (+1.24%), PVD (+0.91%), PVC (+1.54%), and PVB (+1.34%).

Foreigners net sold nearly 46 billion VND on the HOSE exchange this morning. Notably, in terms of negotiated trading, foreigners net bought PNJ by more than 160 billion VND from domestic sellers. Currently, PNJ stock is witnessing a solid gain (+1.44%) along with proactive buying and increased liquidity, as today is the ex-dividend date for this stock.

Additionally, foreign trading activity was vibrant in the banking group. TCB and TPB were the two stocks with the highest net buying value, at 140.15 billion and 40.73 billion VND, respectively. Conversely, the three most net sold stocks this morning were VPB, HDB, and CTG.

10:35 am: Still grappling with selling pressure

Sellers continued to dominate the market, causing the main indices to fluctuate below the reference level, while liquidity in the morning session decreased compared to the previous session, reflecting caution ahead of the crucial resistance level. As of 10:30 am, VN-Index dipped 3.13 points, hovering around 1,289 points. HNX-Index shed 0.91 points, trading around 235 points.

Stocks like HDB, HPG, FPT, and VPB faced intense selling pressure, erasing 0.65 points, 0.53 points, 0.49 points, and 0.47 points from the VN30-Index, respectively. Conversely, bank stocks such as ACB, STB, VCB, and TPB maintained their recovery momentum, contributing over 1.4 points to the index.

Source: VietstockFinance

|

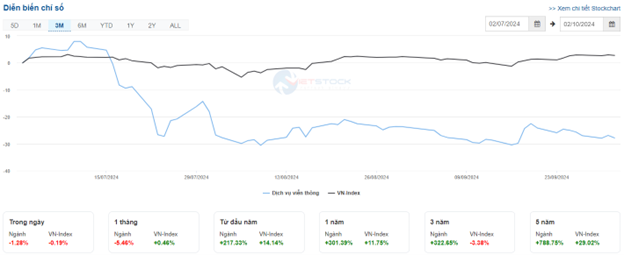

Selling pressure persisted in the telecommunications sector, which recorded the largest decline in the market at 1.28%. Specifically, VGI fell by 1.67%, ELC by 0.79%, FOX by 0.68%, and YEG by 0.44%… Additionally, over the past three months, this sector has continued to underperform the broader VN-Index.

Telecommunications sector price movement. Source: VietstockFinance

|

Following closely, the real estate sector also witnessed a decline, with red dominating most stocks. Specifically, DIG fell by 1.53%, VHM by 0.92%, PDR by 1.34%, and DXG by 1.8%. Conversely, only a handful of stocks, such as NTL (+1.78%), HDC (+0.19%), and NLG (+0.36%), managed to stay in the green, but their positive impact was negligible.

On the flip side, the energy sector staged a solid recovery, with buying interest concentrated in the large-cap oil and gas stocks. Specifically, BSR rose by 0.41%, PVS by 1.24%, PVD by 0.73%, PVC by 1.54%, and PVB by 1.68%. Moreover, global oil prices continued to surge after the attack on October 1, as Iran launched a barrage of ballistic missiles at Israel, marking a new escalation in the Middle East conflict.

Compared to the opening, the market remained range-bound, with over 1,000 stocks trading around the reference level, while selling pressure prevailed. Specifically, there were 370 declining stocks versus 183 advancing stocks.

Source: VietstockFinance

|

Opening: Caution from the Start

At the start of the October 2 session, as of 9:30 am, VN-Index edged lower amid a cautious mood. However, the index received positive contributions from the energy and utilities sectors.

Large-cap stocks like GAS, VCB, and GVR led the market higher, adding nearly 1 point to the index. Conversely, stocks like TCB, VHM, and CTG dragged the market lower, collectively erasing over 1 point from the index.

As of 9:30 am, several energy stocks started the day on a positive note, including BSR (+1.24%), PVS (+1.73%), PVD (+1.28%), PVC (+2.31%), PVB (+2.01%), and PSB (+1.54%)…

Market Beat: Another Setback at the 1,300 Threshold

Similar to the script of the recent sessions, the VN-Index once again failed to conquer the psychological mark of 1,300 points, with the red even dominating towards the end of the afternoon session, causing the index to fall below the 1,280-point mark.

Market Beat: Financials Drag VN-Index into the Red

The market ended the session on a negative note, with the VN-Index shedding 7.5 points (-0.59%) to close at 1,270.6. The HNX-Index followed suit, losing 0.68 points (-0.29%), settling at 232.67. Bears dominated the broader market, with 448 decliners outweighing 249 advancers. The large-cap VN30-Index painted a mixed picture, as 22 stocks fell, 5 rose, and 3 remained unchanged, resulting in a sea of red and green.

What Will Fuel the VN-Index’s Growth in the Coming Period?

“A robust economy is the fundamental driver of a thriving stock market, and that’s precisely what we’re seeing. With impressive economic growth rates, Vietnam is poised for success. The government forecasts a remarkable 7% growth rate for this year, while VinaCapital predicts a still-healthy 6.5%. This bodes well for the stock market and investors alike.”

Technical Analysis for the Session Ending 07/10: Indecision Plaguing the Markets

The VN-Index and HNX-Index rose in tandem, while trading volume plummeted in the morning session, indicating a cautious sentiment among investors.