The buyers’ risk appetite has significantly increased, immediately changing the way orders are placed and the selected price range. Today’s market still saw many swinging patterns, but they remained in the green zone and became more exuberant towards the end.

After a session of touching the bottom with a “wicked candle” and a session of tug-of-war balance, the market began to accelerate upward. The most obvious change was from passively waiting for prices to actively blocking around reference prices, and today is about pushing prices up. This dynamic is essentially a change in the perception of risk: when afraid of further price drops, one either doesn’t buy or waits for very low prices, and it’s okay if there’s no match. When less afraid, one buys tentatively during price dips within the session. When the fear of missing out kicks in, one buys by straight matching, and finally, when worried that others might seize the opportunity, one engages in price competition.

Today’s liquidity was maintained quite well, with a matching order volume of about 16.9k billion on the two exchanges, showing a gradual increase. The new information is that the Vietnamese market has not been considered for a change in ranking, which, in theory, is not positive, but the way the market responded shows that the information itself is not inherently good or bad. When the psychology is exuberant, supply and demand become the deciding factors.

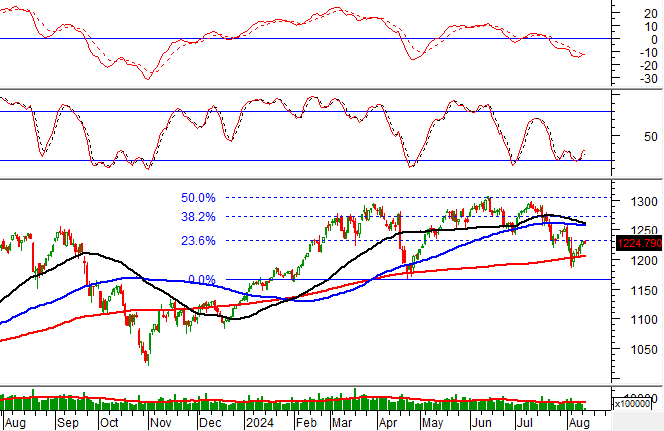

The VN30 blue-chip group today led the strong rise at the end, and the representative index of this basket also performed the best. In recent sessions, capital has been focusing clearly on this group, with a high weight of over 50% on the HSX floor. In fact, if we look at the index, the VNI failed to break the 1300 peak at the end of September and early October, but the VN30 has already broken through, and the recent retreat was just a retest of the old resistance zone. The wave on VN30 is much clearer, both in momentum and liquidity.

Today’s market also widely disseminated forecasts of Q3/2024 financial results. In fact, this information is old news, but the interesting thing is that when the psychology needs to find a foothold, whether the news is old or new doesn’t matter; what matters is whether it meets the needs or not. Everywhere, people start talking about how this stock will increase profits well, and that stock will surge, which no one cared about yesterday or at the beginning of the week. Such psychological dynamics always repeat themselves and remain effective.

There is now a growing acceptance of chasing higher prices, so the opportunity to buy at lower prices is diminishing. This is not necessarily a disadvantage because the purchases made during the dips already have a low-cost base. There will always be intraday fluctuations even when the market is exuberant. Consensus has not yet been fully achieved.

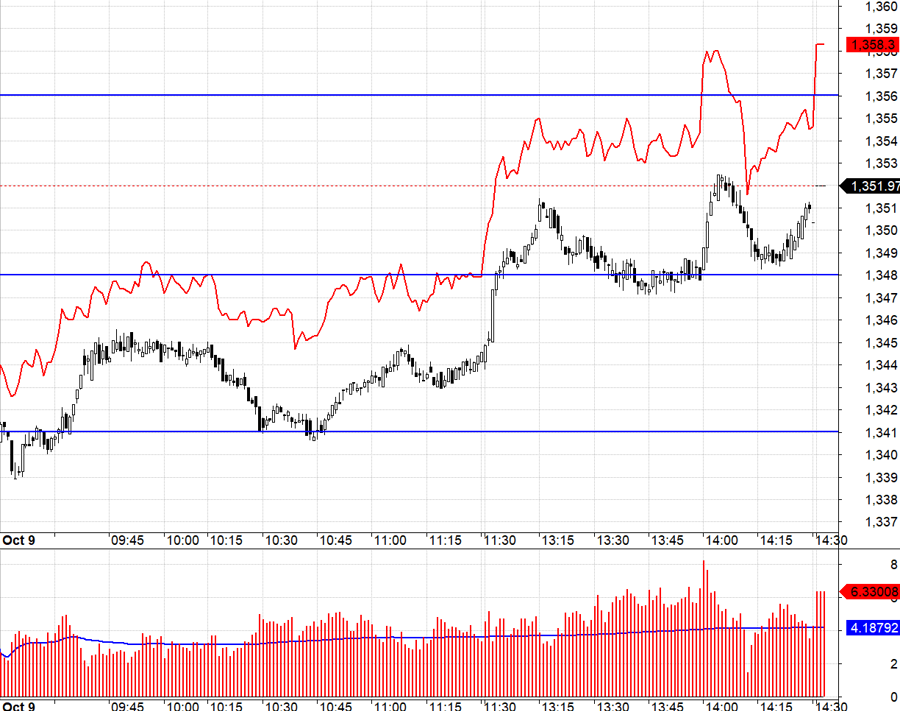

Today, the derivatives market continued to maintain a wide basis difference. In the last 2.5 sessions, this signal has shown that expectations are in line with the underlying market. Although a wide positive basis is a disadvantage for Long, when the market has strengthened, there is no other way, and Short is even riskier. In fact, even during intraday dips, F1 adjusted very little.

The threshold of 1341.xx for VN30 provided strong support for the index, serving as a good entry point for Long positions with a stop loss when VN30 falls below this level. VN30 broke through 1348.xx but failed to reach 1356.xx, however, the basis widened even more advantageously.

Today’s strong rise is a signal of greater consensus from the sell-off signals and the changing will to place orders by the buyers. The market has established a short-term bottom for this correction phase, and this is just a typical corrective pattern. The strategy remains to look for buying opportunities, Long/Short flexibility with derivatives, and a preference for Long.

VN30 closed today at 1351.97. Tomorrow’s nearest resistance levels are 1357; 1367; 1376; 1380; 1388; 1397. Supports are at 1348; 1341; 1333; 1325.

“Stock Blog” is a personal column and does not represent the opinion of VnEconomy. The views and assessments are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment views and recommendations posted.