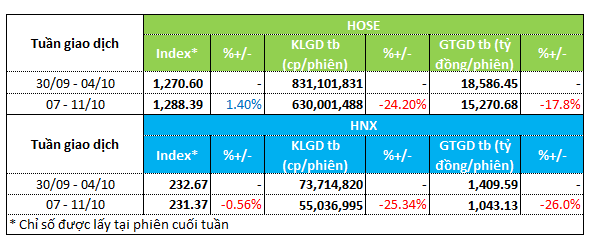

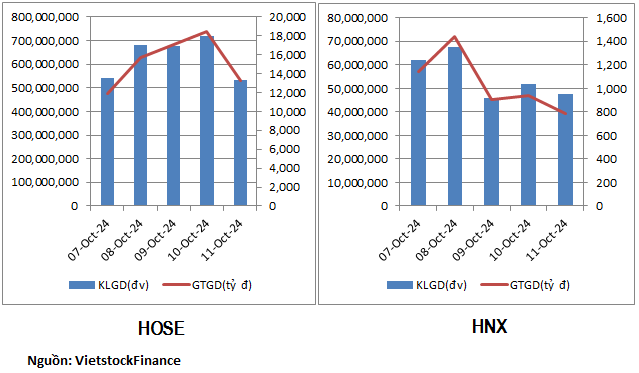

The stock market traded quietly again during the week of October 7-11. Liquidity fell on both the HOSE and HNX exchanges. Specifically, the trading volume on the HOSE floor decreased by 24%, to 630 million units/session. Trading value decreased by 18%, to VND 15.2 trillion/session.

Meanwhile, the HNX floor’s liquidity decreased by about 26% compared to the previous week. Trading volume and value were at 55 million units/session and VND 1 trillion/session, respectively.

|

Liquidity Overview for the Week of October 7-11

|

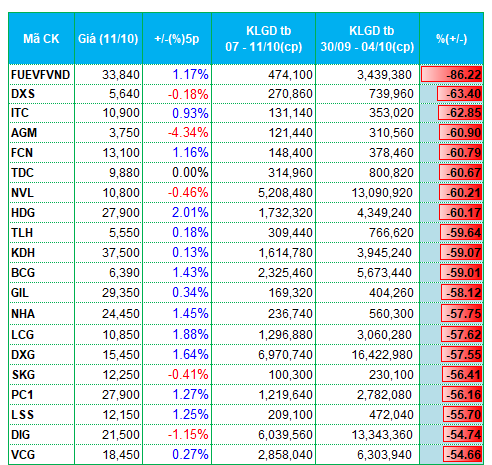

Cash flow weakened significantly in the real estate stock group. A series of codes recorded a decrease in trading value compared to the previous week. Notable mentions include DXS, ITC, NVL, and HDG, with liquidity declines of over 60%.

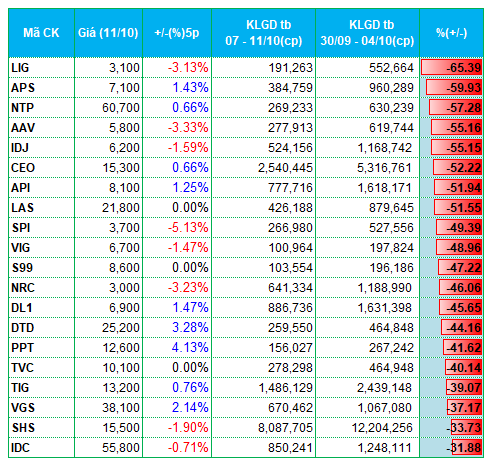

Other codes such as KDH, BCG, NHA, DXG, DIG, AAV, IDJ, CEO, API, NRC, and TIG were among the top codes with significant liquidity declines on the two listed exchanges.

In addition to real estate, cash flow in the construction group also weakened considerably. Construction codes including FCN, TCD, LCG, PC1, VCG, LIG, and S99 recorded trading volume decreases ranging from 45% to 65%.

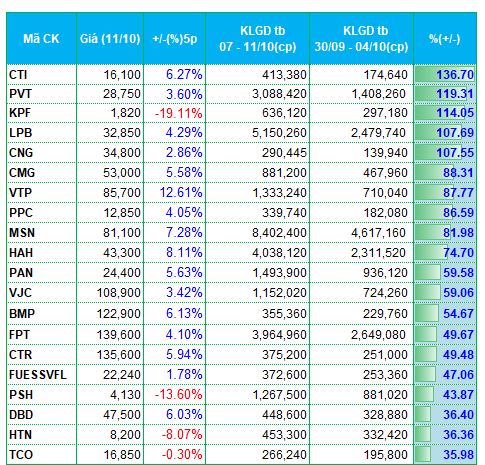

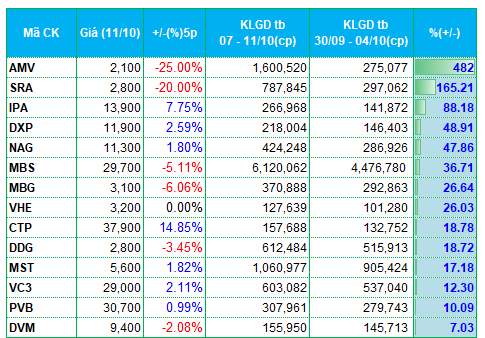

Despite the lackluster liquidity, there were still stock groups that attracted money. One such group was transportation, with contributions from codes like PVT, VTP, HAH, TCO, and DXP. Notably, PVT achieved a trading volume of over 3 million shares/session during the week, more than doubling the previous week’s volume.

The information technology group, represented by FPT, CMG, and CTR, was among the top gainers in liquidity for the week, with increases ranging from 50% to 90%.

|

Top 20 Codes with the Highest Liquidity Increase/Decrease on the HOSE Floor

|

|

Top 20 Codes with the Highest Liquidity Increase/Decrease on the HNX Floor

|

The list of codes with the highest increases and decreases in liquidity is based on an average trading volume of over 100,000 units/session.

Will VN-Index Break Through the 1,300-Point Resistance in October?

The TPS Research securities analysis center is bullish on the VN-Index surpassing the 1,300-point mark, heralding a new upward trend in October. This presents a prime opportunity for investors to capitalize on the potential influx of funds into the banking and securities sectors.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.

The Golden Conundrum: Where Will Money Flow as Property Prices Rise, Stocks Fluctuate, and Gold Soars?

According to economic experts, the real estate market remains an attractive investment avenue, despite a lack of significant momentum at present. This prediction stands in contrast to the potential decline in gold prices expected later this year.