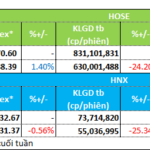

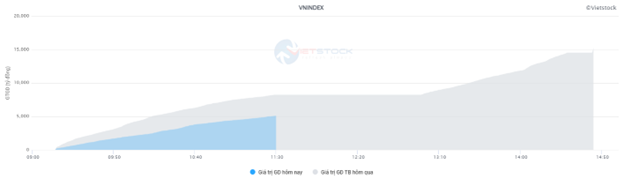

Market liquidity decreased compared to the previous trading session, with the matching trading volume of the VN-Index reaching over 482 million shares, equivalent to a value of more than 11.8 trillion dong; HNX-Index reached over 33.5 million shares, equivalent to a value of more than 602 billion dong.

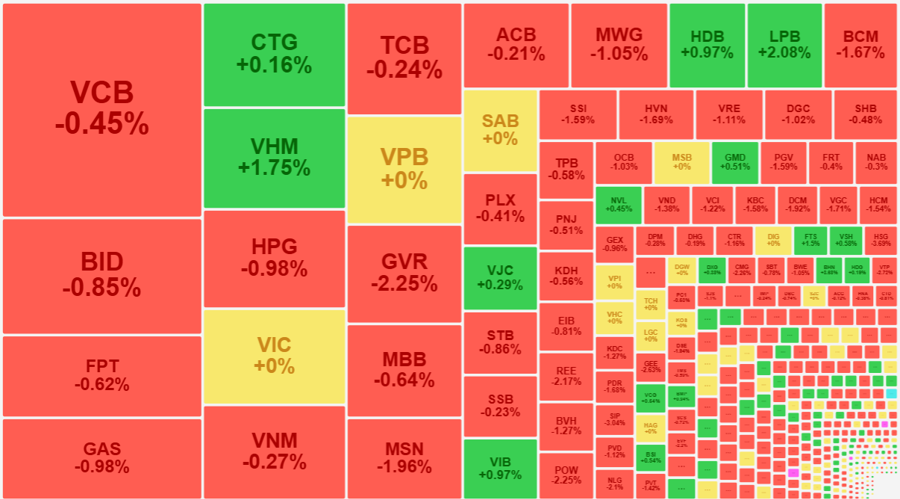

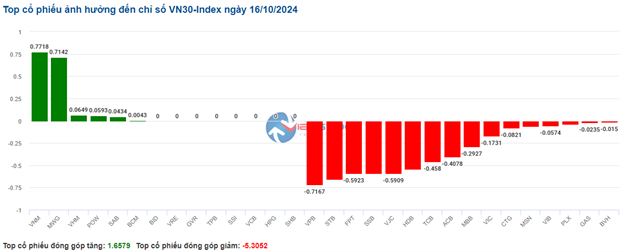

VN-Index opened the afternoon session with selling pressure continuing to dominate, although buying demand emerged, it was not enough to turn the tide, causing the index to fluctuate strongly and close in the red. In terms of impact, SSB, GAS, PLX, and LPB were the most negative stocks, taking away more than 1.4 points from the index. On the other hand, MWG, VHM, VNM, and GVR were the most positive stocks, with an impact of more than 1.4 points on the index.

| Top 10 stocks with the strongest impact on the VN-Index on October 16, 2024 |

Similarly, the HNX-Index also had a rather pessimistic development, with the index negatively impacted by the stocks BAB (-1.67%), SHS (-1.3%), PVS (-0.76%), and CEO (-1.36%)…

|

Source: VietstockFinance

|

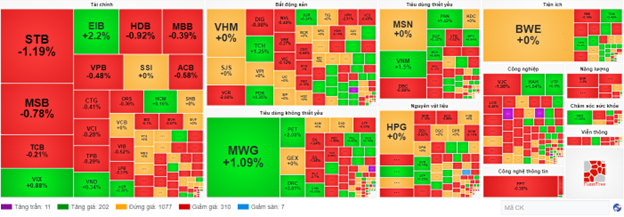

The telecommunications industry had the largest decrease in the market at -1.65%, mainly due to the decline in the VGI (-1.76%), FOX (-1.86%), VNZ (+2.97%), and SGT (-2.6%) stocks. This was followed by the energy and information technology sectors, with decreases of 1.1% and 0.49%, respectively. On the other hand, the essential consumer goods industry had the best recovery in the market, reaching 1.47% with green signals from VNM (+1.05%), PAN (+0.2%), VHC (+1.94%), and SAB (+1.23%).

In terms of foreign trading, they continued to net sell more than 354 billion dong on the HOSE exchange, focusing on the stocks of FPT (69.9 billion), HDB (54.06 billion), VHM (48.77 billion), and DBC (45.79 billion). On the HNX exchange, foreigners net sold more than 29 billion dong, focusing on the SHS (25.2 billion), PVS (17.76 billion), TNG (5.84 billion), and MBS (940 million) stocks.

| Foreigners’ buying and selling dynamics |

Morning session: Maintaining a tug-of-war

The tug-of-war situation in a narrow range with low liquidity continued until the end of the morning session. At the midday break, the VN-Index paused slightly below the reference level, reaching 1,281.36 points; the HNX-Index also paused at 228.89 points. The market was mixed, with 282 declining stocks and 253 advancing stocks at the end of the morning session.

The matching trading volume of the VN-Index this morning reached nearly 207 million units, equivalent to a value of more than 5 trillion dong, a decrease of more than 38% compared to the previous morning. Liquidity on the HNX exchange also decreased by more than 43%, with a matching volume of over 15 million units, with a value of just over 269 billion dong.

Source: VietstockFinance

|

VNM, MWG, and HPG were the most positive influences on the index, contributing more than 1 point to the VN-Index. On the contrary, the most negative stocks were SSB, PLX, and HDB, but the impact was not significant.

The industry groups were mixed. On the rising side, the green signals of the stocks MCH (+5.59%), SAB (+0.88%), and VNM (+1.5%) helped the essential consumer goods group lead the market, increasing by 1.5% at the end of the morning session. This was followed by the non-essential consumer goods group, which also attracted quite positive buying demand, typically MWG (+1.71%), PET (+4.54%), DGW (+1.11%), and DRC (+3.63%).

The telecommunications group, with pressure mainly from VGI (-2.06%), FOX (-1.32%), and FOC (-1.56%), was the industry with the largest decrease this morning. The remaining groups were also dominated by red signals, including energy, healthcare, information technology, finance, and industry.

The net selling pressure of foreign investors gradually increased towards the end of the morning session, with a net selling value of nearly 112 billion dong on the HOSE exchange this morning. VCB and FPT were the two stocks that were net sold the most, while foreign demand focused on the MSN stock. On the HNX exchange, foreigners net sold nearly 16 billion dong at the end of the morning session, with the strongest selling in the SHS and PVS stocks.

10:30 am: Selling pressure persists amid lackluster liquidity

Investors’ cautious sentiment continued to prevail, causing the main indices to fluctuate around the reference level. As of 10:30 am, the VN-Index decreased by 1.06 points, trading around 1,279 points. The HNX-Index decreased by 0.25 points, trading around 228 points.

The breadth of the stocks in the VN30 basket was still tilted towards the sell side, with most stocks declining, such as VPB, STB, FPT, and SSB, which negatively impacted the VN30-Index, taking away 0.72 points, 0.66 points, 0.59 points, and 0.59 points from the overall index, respectively. In contrast, VNM, MWG, VHM, and POW maintained their gains, helping the overall index hold on to more than 1.5 points.

Source: VietstockFinance

|

Overall, the industries were mostly mixed. Among them, the telecommunications group faced the strongest selling pressure in the market, with a decrease of 1.33%. The selling pressure was concentrated mainly in large-cap stocks such as VGI, which fell by 1.62%, FOX by 1.32%, ELC by 0.41%, and MFS by 0.69%…

Notably, the financial and real estate sectors also had a lackluster performance, with decreases of 0.23% and 0.13%, respectively. In the financial sector, the red signals were mainly in the banking group, with STB falling by 1.48%, MBB by 0.58%, HDB by 1.1%, and MSB by 1.57%… On the other hand, a few stocks still managed to stay in the green, such as VIX, which increased by 0.44%, HCM by 0.33%, and FTS by 0.11%…

Additionally, the EIB stock rebounded after two consecutive declining sessions as the Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) recently issued a statement regarding the circulation of unverified documents on social media related to the bank’s operations.

In the real estate sector, the selling pressure was slightly stronger, with stocks such as VHM falling by 0.11%, DIG by 0.74%, VIC by 0.12%, and NVL by 0.96%…

On a more positive note, the essential consumer goods sector continued to support the overall index with a modest recovery of 0.54%. Specifically, MSN increased by 0.12%, VNM by 1.5%, PAN by 1.22%, and MCH by 5.34%… However, the red signals persisted in some stocks, such as DBC, which fell by 0.99%, HAG by 1.36%, CTP by 3.52%, and QNS by 0.41%…

Compared to the beginning of the session, the number of reference stocks still maintained a higher proportion of over 1,000 stocks, and the sell side continued to dominate. There were 310 declining stocks and 202 advancing stocks.

Source: VietstockFinance

|

Opening: A cautious sentiment prevails

After the decline in the previous session, the VN-Index opened this morning’s session fluctuating around the reference level, indicating that a cautious sentiment still prevailed.

On October 15, in Can Tho, Prime Minister Pham Minh Chinh chaired a conference on the implementation of the Project “Sustainable development of one million hectares of specialized and high-quality rice production associated with the new rural model in the Mekong Delta by 2030.”

Prime Minister Pham Minh Chinh outlined five major orientations and 11 specific tasks and solutions, emphasizing that we must “cherish the rice plant as we cherish our own lives” to “breathe life into the rice plant,” bringing new vitality to the rice industry, the rice value chain, and the development of the Mekong Delta region.

As of 9:30 am, the telecommunications services sector led the declining groups, with most stocks falling from the beginning of the session. Notably, stocks such as VGI decreased by 1.91%, FOX by 1.43%, SGT by 5.84%, and FOC by 1.8%…

The energy sector followed suit, with stocks falling from the beginning of the session, such as BSR, which decreased by 0.87%, PVD by 0.19%, and CST by 0.4%…, while the remaining stocks remained unchanged or slightly increased.

The Real Estate and Construction Cash Crunch

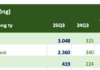

Equity Liquidity Weakens for the Week of October 7–11, with Real Estate and Construction Sectors Witnessing Significant Outflows.

The Market Beat: A Tale of Diverging Fortunes, VN-Index Falters at the 1,295 Mark

The market ended the session in negative territory, with the VN-Index down 2.05 points (-0.16%) to close at 1,286.34. The HNX-Index followed suit, falling 0.65 points (-0.28%) to 230.72. It was a sea of red across the broader market, as sellers dominated with 395 declining stocks compared to 294 gainers. The large-cap VN30-Index also painted a similar picture, with 19 stocks in the red, 8 in the green, and 3 unchanged.

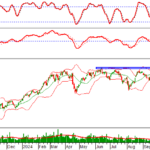

Technical Analysis for October 15: A Creeping Pessimism

The VN-Index and HNX-Index both witnessed declines, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.