Vietnam Electricity (EVN) has issued Decision No. 1046/QD-EVN dated October 11, 2024, on adjusting the average retail electricity price, accordingly, the average retail electricity price is 2,103.1159 VND/kWh (excluding value-added tax) from October 11, 2024. Equivalent to an increase of 4.8% compared to the current average electricity price.

For large electricity-consuming enterprises, a 4.8% increase in electricity prices will certainly increase costs.

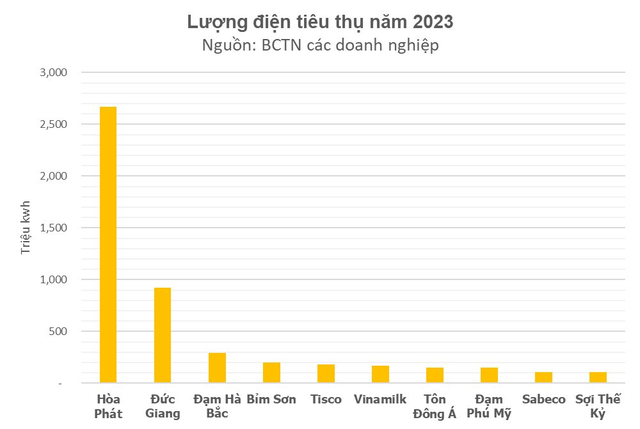

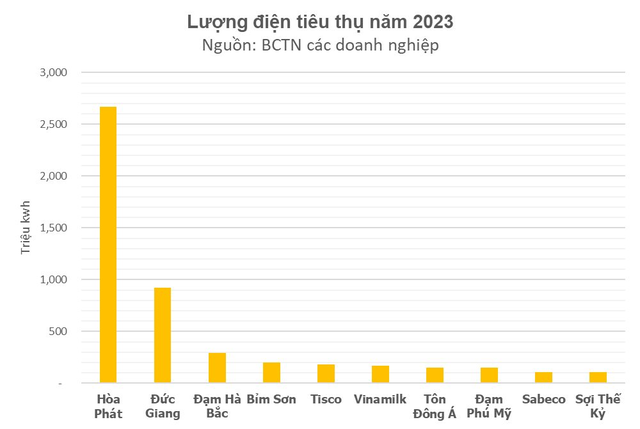

According to our data, Hoa Phat Group (HPG) consumed up to 2.67 billion kWh of electricity in 2023. However, Hoa Phat has self-supplied about 90% of its electricity for production, reaching 2.4 billion kWh.

With an increase of about 100 VND, Hoa Phat will only spend about 26-30 billion VND more on electricity at these complexes.

In 2025, with the operation of the Dung Quat 2 project, Hoa Phat’s electricity consumption will increase sharply, but this enterprise still has a cost advantage thanks to the recycling technology that helps to self-supply 90% of its electricity as mentioned above.

Another enterprise with very large electricity consumption is Duc Giang Chemical Group (DGC) with electricity consumption in 2023 of 922 million kWh.

With the increase in electricity prices, Duc Giang will incur additional electricity costs of nearly 90 billion VND. This number is insignificant compared to the net revenue in 2023 of VND 9,748 billion or cost of goods sold of VND 6,308 billion.

Other enterprises with the highest electricity consumption such as Ton Dong A, Phuc My Fertilizer (DPM), Habeco Fertilizer (DHB), Century Fiber (STK), Vinamilk (VNM), Sabeco (SAB)… range from 100 to 300 million kWh/year. The increased electricity cost for these enterprises is about 10 billion to 30 billion VND.

Thus, the impact of the electricity price increase exists but is not significant thanks to the small increase in electricity costs and many enterprises saving a considerable amount of money thanks to investing in solar power.

Previously, in 2023, retail electricity prices were adjusted twice (3% in May 2023 and 4.5% in November 2023)

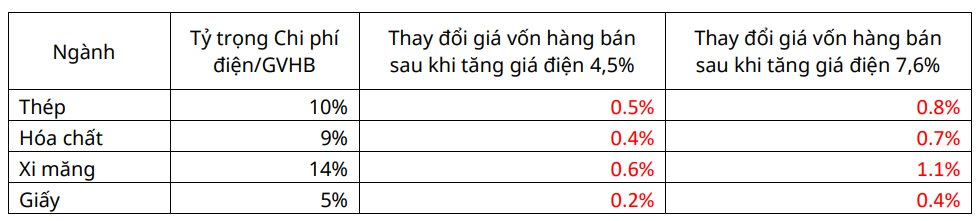

According to Mirae Asset’s assessment, after each electricity price increase, the increase in retail electricity prices will negatively affect some electricity-intensive manufacturing industries, with a sharp increase in cost of goods sold, typically cement, chemicals, steel, and paper.

Specifically, according to Mirae Asset’s estimates, electricity costs account for about 9-10% of the cost of goods sold for steel manufacturing enterprises, this rate is also equivalent to enterprises in the chemical industry.

Particularly in the cement industry, it accounts for about 14-15% of the cost of goods sold, except for large enterprises with cement rotary kilns, where electricity costs account for about 9-10% of the cost of goods sold.

For paper manufacturing enterprises, it is estimated that electricity costs account for a lower proportion than some other industries, averaging 4-5% of sales expenses and management expenses.

Mirae Asset believes that if electricity costs increase, enterprises cannot pass this on to consumers. It is estimated that a 4.5% increase in electricity costs will lead to an increase in the cost of goods sold, which could reduce the total pre-tax profit of each industry by up to: pre-tax profit of the steel industry decreases by 23%, pre-tax profit of the paper industry decreases by 2%, pre-tax profit of the cement industry decreases by 21%, and pre-tax profit of the chemical industry decreases by 1%.

However, if enterprises can pass on the increased electricity costs by raising selling prices to consumers, the impact of higher input costs can be mitigated.

In 2023, EVN’s commercial electricity output was 253.05 billion kWh, and commercial electricity revenue was VND 494,359 billion.

Thus, with an estimated commercial electricity output equivalent to that of 2023, with a 4.8% increase in the retail electricity price, EVN’s revenue will increase by about VND 23,700 billion.